Question

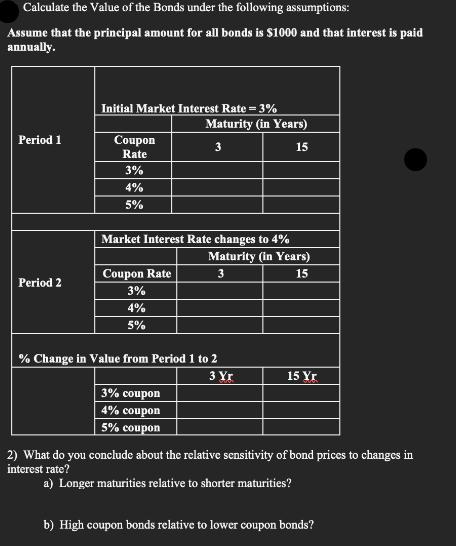

Calculate the Value of the Bonds under the following assumptions: Assume that the principal amount for all bonds is $1000 and that interest is

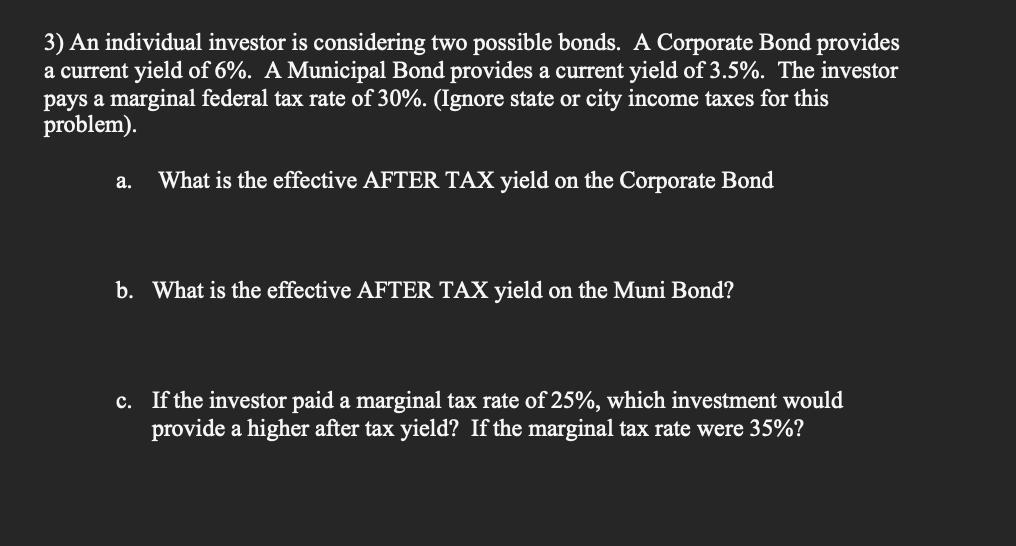

Calculate the Value of the Bonds under the following assumptions: Assume that the principal amount for all bonds is $1000 and that interest is paid annually. Period 1 Period 2 Initial Market Interest Rate = 3% Coupon Rate 3% 4% 5% Market Interest Rate changes to 4% Coupon Rate 3% 4% 5% Maturity (in Years) 3 15 3% coupon 4% coupon 5% coupon Maturity (in Years) 3 15 % Change in Value from Period 1 to 2 3 Yr 15 Yr 2) What do you conclude about the relative sensitivity of bond prices to changes in interest rate? a) Longer maturities relative to shorter maturities? b) High coupon bonds relative to lower coupon bonds? 3) An individual investor is considering two possible bonds. A Corporate Bond provides a current yield of 6%. A Municipal Bond provides a current yield of 3.5%. The investor pays a marginal federal tax rate of 30%. (Ignore state or city income taxes for this problem). a. What is the effective AFTER TAX yield on the Corporate Bond b. What is the effective AFTER TAX yield on the Muni Bond? c. If the investor paid a marginal tax rate of 25%, which investment would provide a higher after tax yield? If the marginal tax rate were 35%?

Step by Step Solution

3.29 Rating (117 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the bonds under the given assumptions we will use the present value formula for bond valuation PV C 1 1 rn r M 1 rn where PV ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started