Question

Calculating Present Values Imprudential, Inc., has an unfunded pension liability of $645 million that must be paid in 25 years. To assess the value

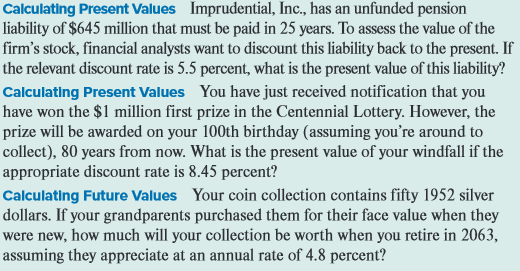

Calculating Present Values Imprudential, Inc., has an unfunded pension liability of $645 million that must be paid in 25 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 5.5 percent, what is the present value of this liability? Calculating Present Values You have just received notification that you have won the $1 million first prize in the Centennial Lottery. However, the prize will be awarded on your 100th birthday (assuming you're around to collect), 80 years from now. What is the present value of your windfall if the appropriate discount rate is 8.45 percent? Calculating Future Values Your coin collection contains fifty 1952 silver dollars. If your grandparents purchased them for their face value when they were new, how much will your collection be worth when you retire in 2063, assuming they appreciate at an annual rate of 4.8 percent?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Present Value of Unfunded Pension Liability To calculate the present value of the unfunded pension ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started