Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Specify the composition of a portfolio consisting of the CAC 40 and the risk-free asset that will produce an expected return of 10%. Contrast

2. Specify the composition of a portfolio consisting of the CAC 40 and the risk-free asset that will produce an expected return of 10%. Contrast the risk on this portfolio with the risk of Renault.

2. Specify the composition of a portfolio consisting of the CAC 40 and the risk-free asset that will produce an expected return of 10%. Contrast the risk on this portfolio with the risk of Renault.

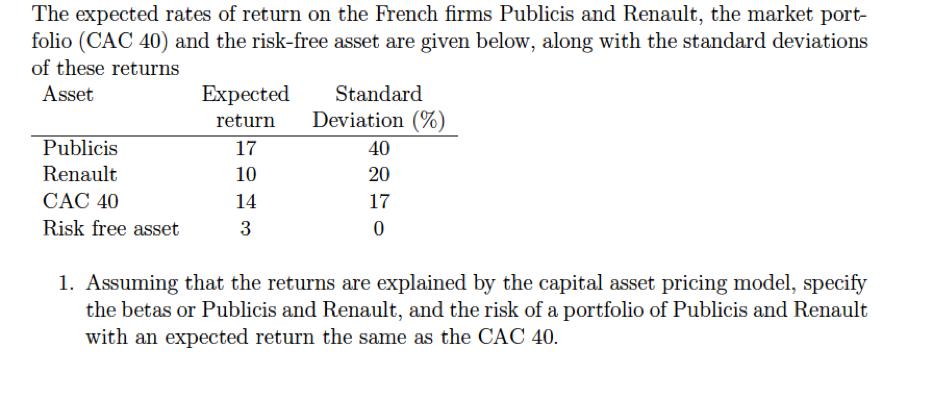

The expected rates of return on the French firms Publicis and Renault, the market port- folio (CAC 40) and the risk-free asset are given below, along with the standard deviations of these returns Asset Expected return Standard Deviation (%) Publicis 17 40 Renault 10 20 CC 40 14 17 Risk free asset 3 0 1. Assuming that the returns are explained by the capital asset pricing model, specify the betas or Publicis and Renault, and the risk of a portfolio of Publicis and Renault with an expected return the same as the CAC 40.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Quiz 1 The expected rates of return on the French firms Publicis and Renault the market portfolio CA...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started