Answered step by step

Verified Expert Solution

Question

1 Approved Answer

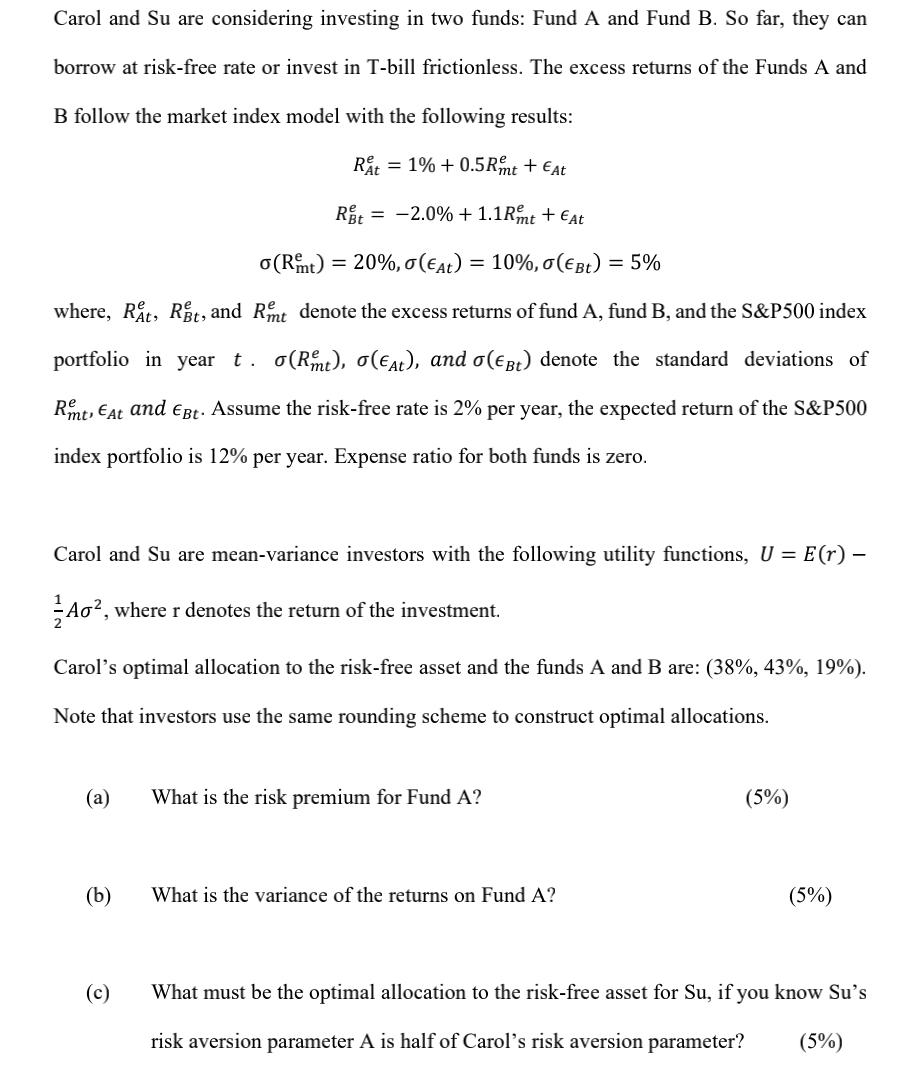

Carol and Su are considering investing in two funds: Fund A and Fund B. So far, they can borrow at risk-free rate or invest

Carol and Su are considering investing in two funds: Fund A and Fund B. So far, they can borrow at risk-free rate or invest in T-bill frictionless. The excess returns of the Funds A and B follow the market index model with the following results: Rt = 1% +0.5Rmt + At Ret=-2.0%+ 1.1Rmt + At o(Remt) = 20%, (At) = 10%, o (EBt) = 5% where, Rt, Rt, and Rt denote the excess returns of fund A, fund B, and the S&P500 index portfolio in year t. o(Rt), o(at), and (EBt) denote the standard deviations of Rent, At and EBt. Assume the risk-free rate is 2% per year, the expected return of the S&P500 index portfolio is 12% per year. Expense ratio for both funds is zero. Carol and Su are mean-variance investors with the following utility functions, U = E(r) Ao, where r denotes the return of the investment. Carol's optimal allocation to the risk-free asset and the funds A and B are: (38%, 43%, 19%). Note that investors use the same rounding scheme to construct optimal allocations. (a) (b) (c) What is the risk premium for Fund A? What is the variance of the returns on Fund A? (5%) (5%) What must be the optimal allocation to the risk-free asset for Su, if you know Su's risk aversion parameter A is half of Carol's risk aversion parameter? (5%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the risk premium for Fund A we need to find the difference between the expected return of Fund A and the riskfree rate Given Riskfree r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started