Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compare your current car (or any imaginary car) with a new car to be purchased and same car to be leased. Project is 5

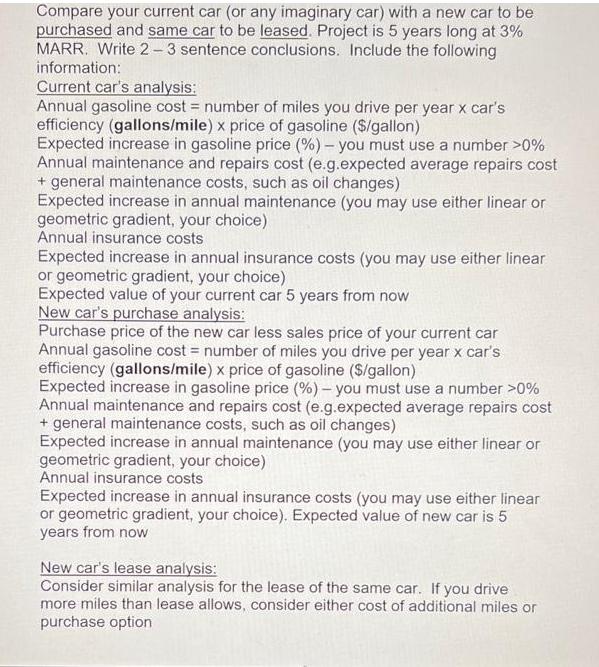

Compare your current car (or any imaginary car) with a new car to be purchased and same car to be leased. Project is 5 years long at 3% MARR. Write 2-3 sentence conclusions. Include the following information: Current car's analysis: Annual gasoline cost = number of miles you drive per year x car's efficiency (gallons/mile) x price of gasoline ($/gallon) Expected increase in gasoline price (%) - you must use a number >0% Annual maintenance and repairs cost (e.g.expected average repairs cost + general maintenance costs, such as oil changes) Expected increase in annual maintenance (you may use either linear or geometric gradient, your choice) Annual insurance costs Expected increase in annual insurance costs (you may use either linear or geometric gradient, your choice) Expected value of your current car 5 years from now New car's purchase analysis: Purchase price of the new car less sales price of your current car Annual gasoline cost = number of miles you drive per year x car's efficiency (gallons/mile) x price of gasoline ($/gallon) Expected increase in gasoline price (%) - you must use a number >0% Annual maintenance and repairs cost (e.g.expected average repairs cost + general maintenance costs, such as oil changes) Expected increase in annual maintenance (you may use either linear or geometric gradient, your choice) Annual insurance costs Expected increase in annual insurance costs (you may use either linear or geometric gradient, your choice). Expected value of new car is 5 years from now New car's lease analysis: Consider similar analysis for the lease of the same car. If you drive more miles than lease allows, consider either cost of additional miles or purchase option

Step by Step Solution

★★★★★

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Answer After analyzing the costs associated with the current car new car purchase and new ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started