Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Connors Corporation acquired manufacturing equipment for use in its assembly line. Below are four independent situations relating to the acquisition of the equipment. 1.

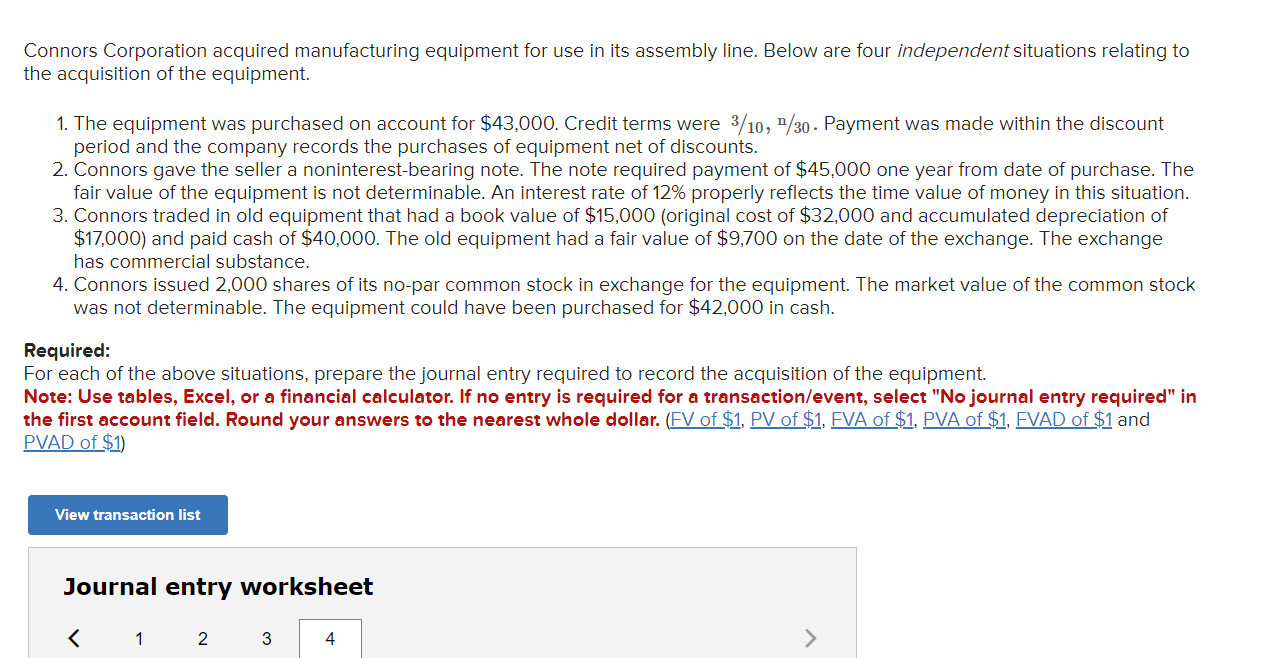

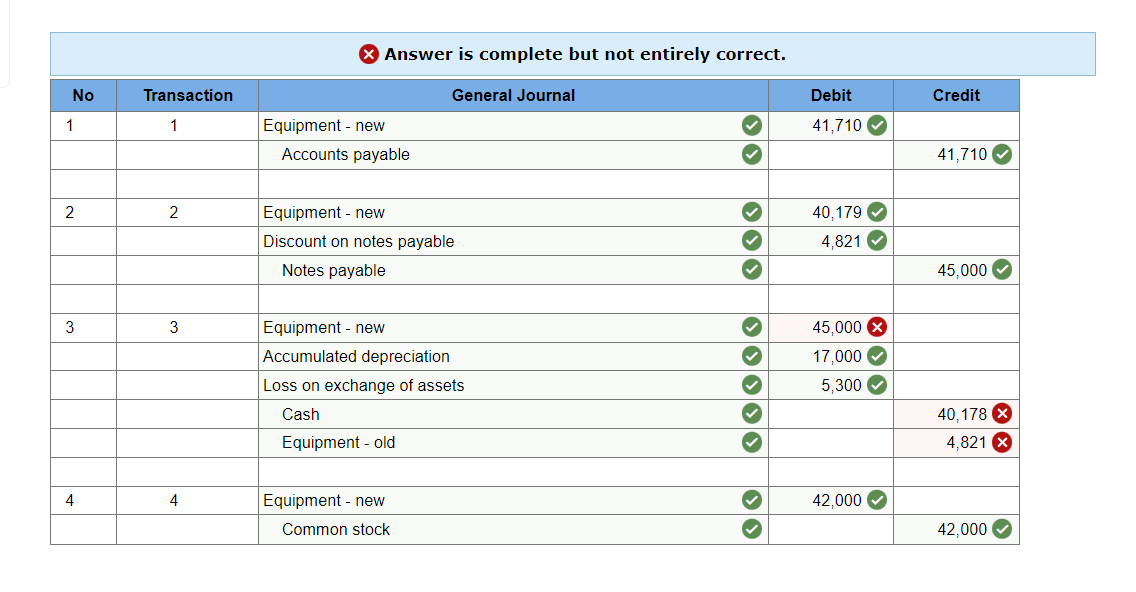

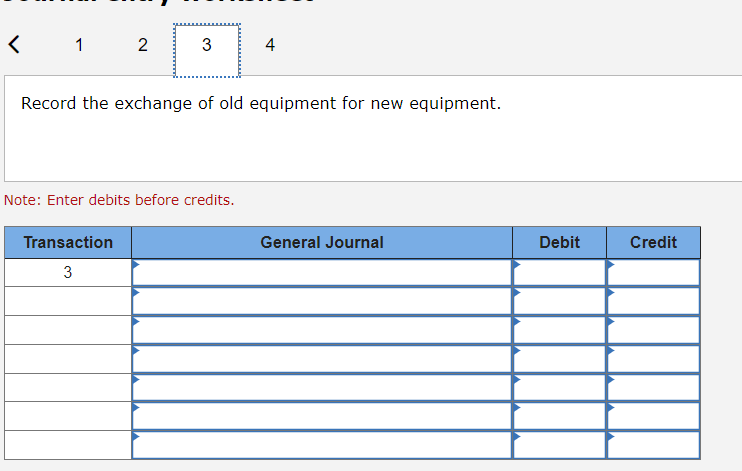

Connors Corporation acquired manufacturing equipment for use in its assembly line. Below are four independent situations relating to the acquisition of the equipment. 1. The equipment was purchased on account for $43,000. Credit terms were 3/10, 1/30. Payment was made within the discount period and the company records the purchases of equipment net of discounts. 2. Connors gave the seller a noninterest-bearing note. The note required payment of $45,000 one year from date of purchase. The fair value of the equipment is not determinable. An interest rate of 12% properly reflects the time value of money in this situation. 3. Connors traded in old equipment that had a book value of $15,000 (original cost of $32,000 and accumulated depreciation of $17,000) and paid cash of $40,000. The old equipment had a fair value of $9,700 on the date of the exchange. The exchange has commercial substance. 4. Connors issued 2,000 shares of its no-par common stock in exchange for the equipment. The market value of the common stock was not determinable. The equipment could have been purchased for $42,000 in cash. Required: For each of the above situations, prepare the journal entry required to record the acquisition of the equipment. Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) View transaction list Journal entry worksheet < 1 2 3 4 1 No > Answer is complete but not entirely correct. Transaction 1 Equipment - new Accounts payable 2 2 Equipment - new Discount on notes payable Notes payable General Journal 3 3 Equipment - new Accumulated depreciation Loss on exchange of assets Cash Equipment - old 4 4 Equipment - new Common stock Debit Credit 41,710 41,710 40,179 4,821 45,000 45,000 17,000 5,300 40,178 x 4,821 x 42,000 42,000 < 1 2 3 4 Record the exchange of old equipment for new equipment. Note: Enter debits before credits. Transaction 3 General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started