Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Conversion costs are the combination of direct labor and factory overhead. Assume the conversion costs (see attached) consists of 45% direct labor and the remainder

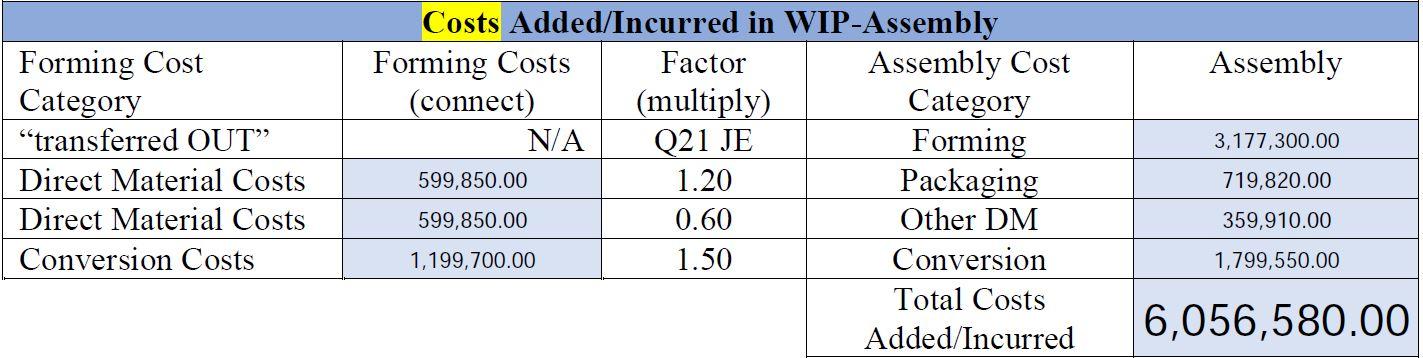

Conversion costs are the combination of direct labor and factory overhead. Assume the conversion costs (see attached) consists of 45% direct labor and the remainder is factory overhead. There is no indirect labor for Tamar Co. What would be the journal entry to record the direct labor incurred (charged/added) to BOTH departments in May?

Costs Added/Incurred in WIP-Assembly Assembly Cost Category Forming Packaging Forming Cost Category Forming Costs (connect) Factor Assembly (multiply) Q21 JE "transferred OUT" N/A 3,177,300.00 Direct Material Costs 599,850.00 1.20 719,820.00 Direct Material Costs 599,850.00 0.60 Other DM 359,910.00 Conversion Costs 1,199,700.00 1.50 Conversion 1,799,550.00 Total Costs 6,056,580.00 Added/Incurred

Step by Step Solution

★★★★★

3.50 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Forming Work in process Direct Labor 539865 Salary Payable 539865 Assembly Work in process Direct La...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started