Question

Correct previous answers if wrong and fill in the rest with an explanation of where the numbers came from. Time Value of Money, Part 2

Correct previous answers if wrong and fill in the rest with an explanation of where the numbers came from.

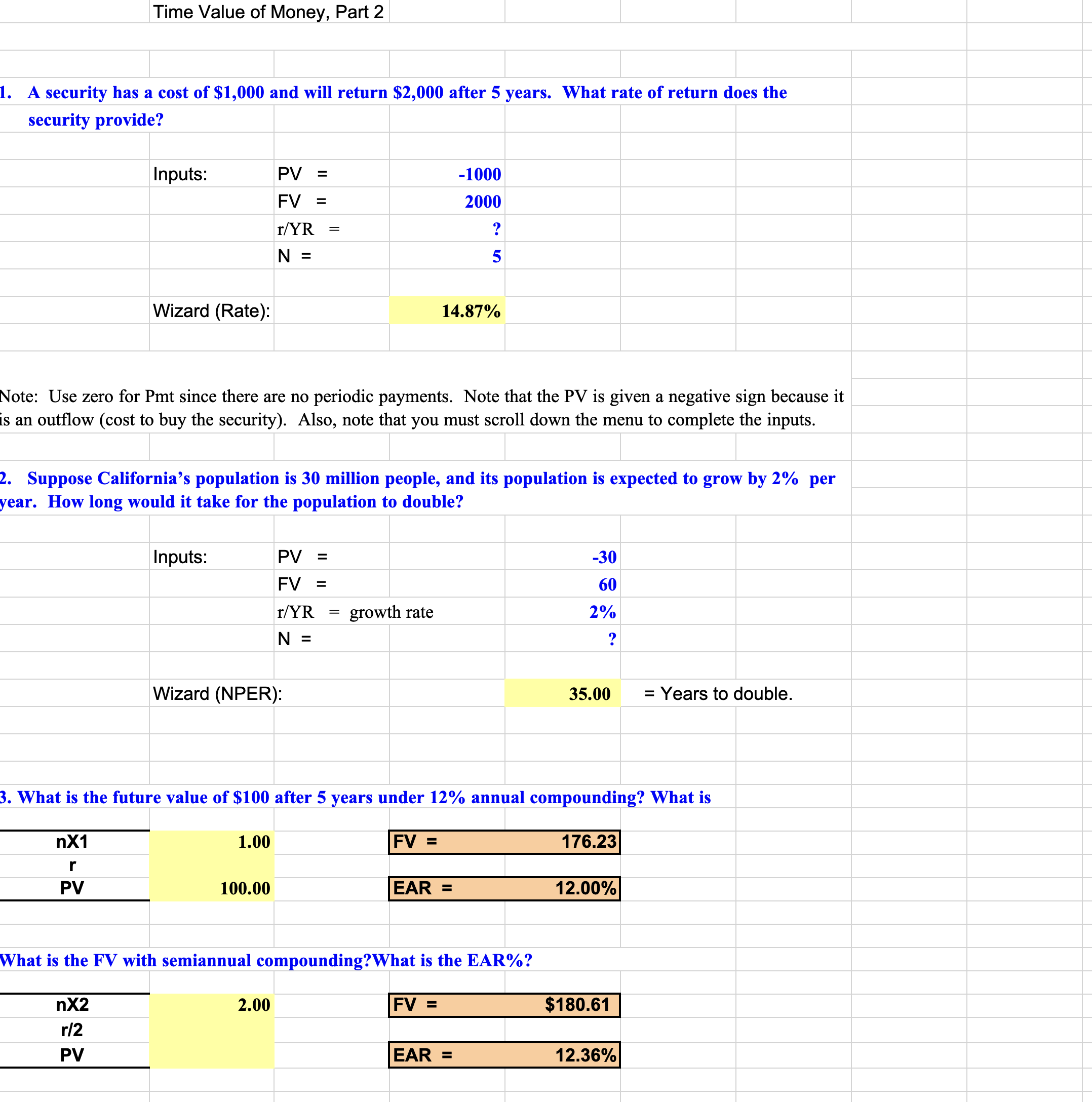

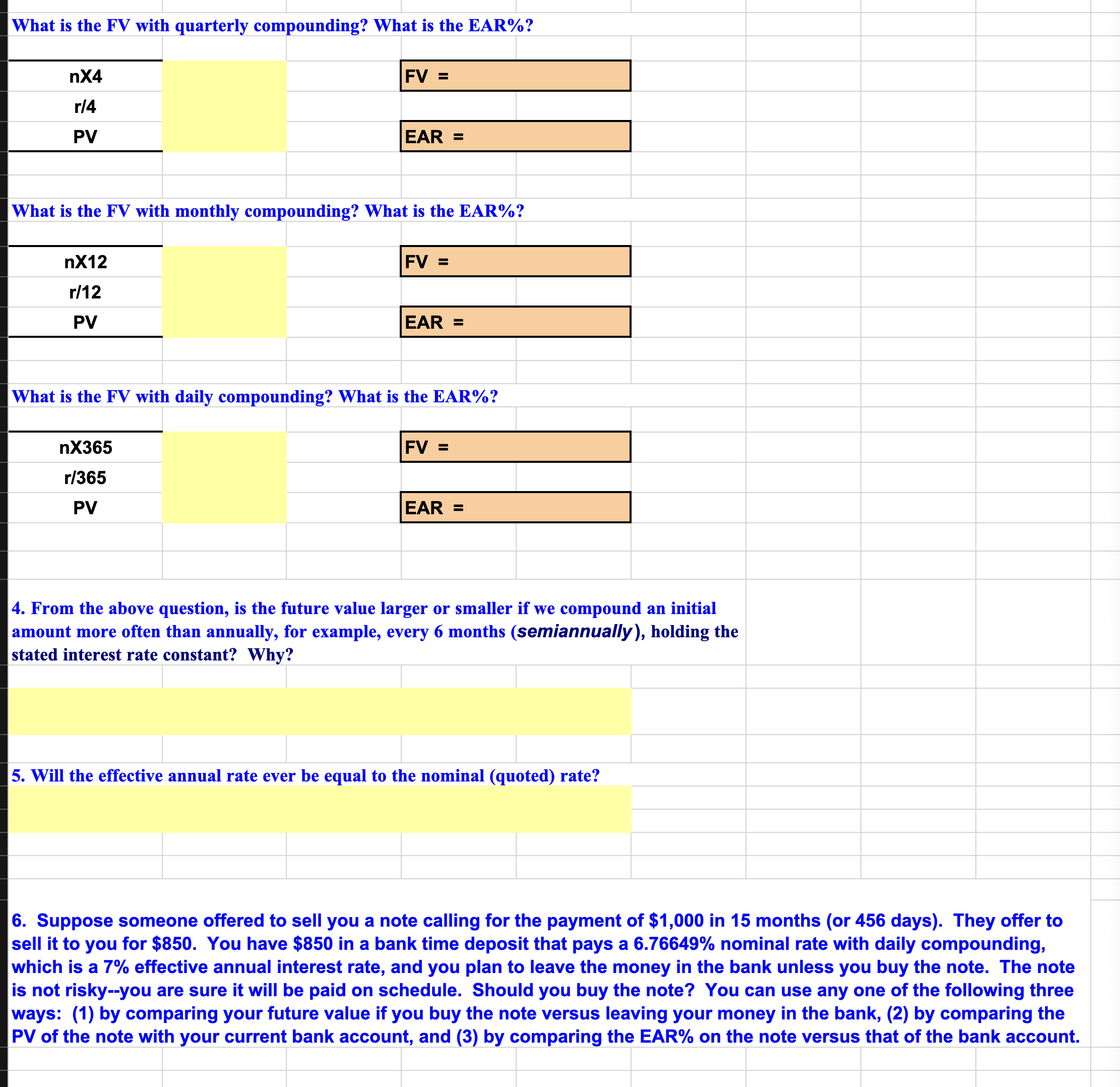

Time Value of Money, Part 2 1. A security has a cost of $1,000 and will return $2,000 after 5 years. What rate of return does the security provide? Inputs: Wizard (Rate): nX2 r/2 PV Inputs: PV = FV = r/YR N = Note: Use zero for Pmt since there are no periodic payments. Note that the PV is given a negative sign because it is an outflow (cost to buy the security). Also, note that you must scroll down the menu to complete the inputs. 2. Suppose California's population is 30 million people, and its population is expected to grow by 2% per year. How long would it take for the population to double? Wizard (NPER): 1.00 100.00 = PV = FV = r/YR N = 2.00 = growth rate FV = -1000 2000 14.87% 3. What is the future value of $100 after 5 years under 12% annual compounding? What is 176.23 nX1 r PV ? 5 EAR = What is the FV with semiannual compounding?What is the EAR%? FV = EAR = -30 60 2% ? 35.00 12.00% $180.61 = Years to double. 12.36%

Step by Step Solution

3.32 Rating (125 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Part 2 1 The rate of return on the security is 1487 which means that the security provides ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started