Question

Crane Company Bramble Company 2025 2024 2025 2024 Net sales $1,877,000 $587,000 Cost of goods sold 1,076,000 298,000 Operating expenses 261,000 83,000 Interest expense

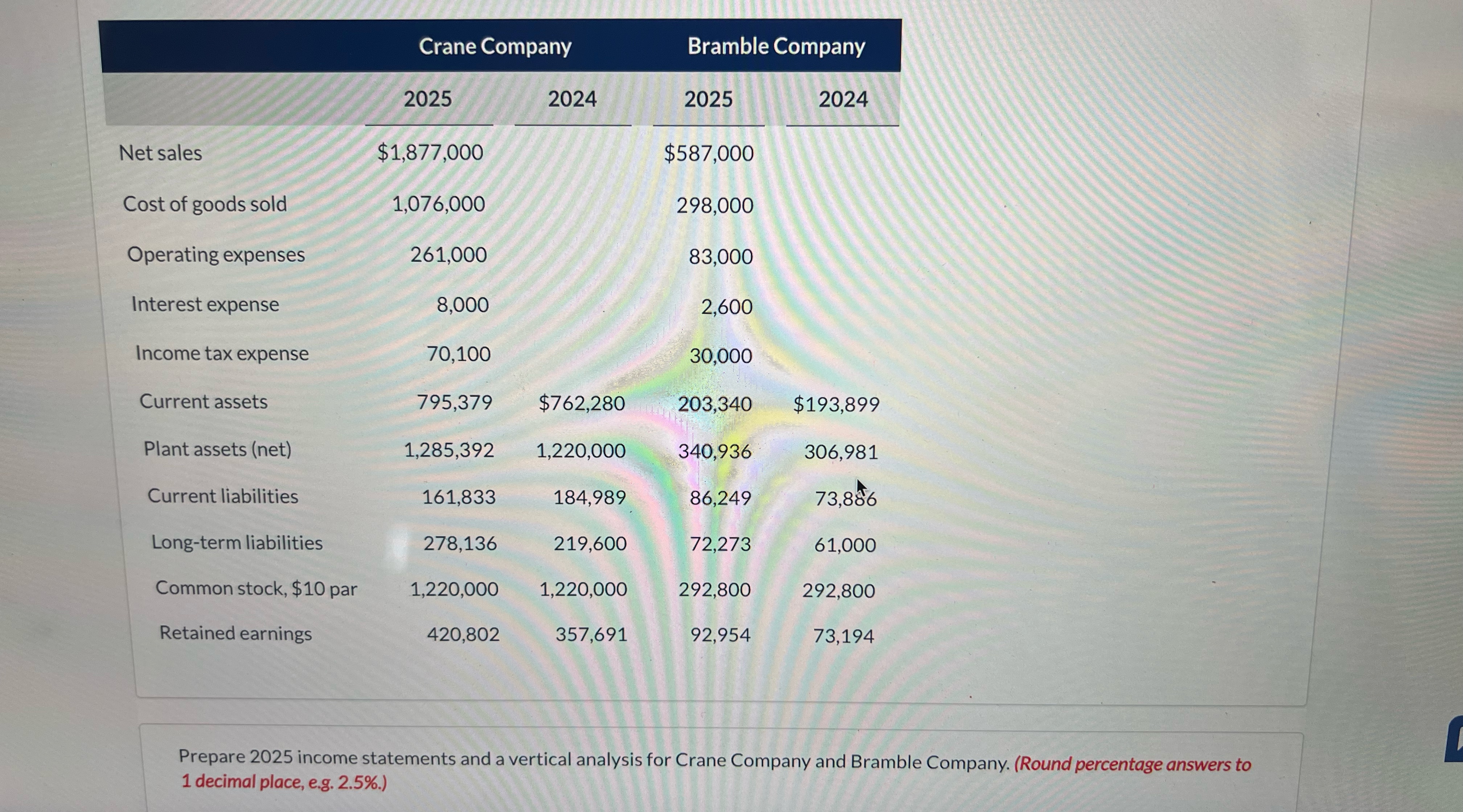

Crane Company Bramble Company 2025 2024 2025 2024 Net sales $1,877,000 $587,000 Cost of goods sold 1,076,000 298,000 Operating expenses 261,000 83,000 Interest expense 8,000 2,600 Income tax expense 70,100 30,000 Current assets 795,379 $762,280 203,340 $193,899 Plant assets (net) 1,285,392 1,220,000 340,936 306,981 Current liabilities 161,833 184,989 86,249 73,886 Long-term liabilities 278,136 219,600 72,273 61,000 Common stock, $10 par 1,220,000 1,220,000 292,800 292,800 Retained earnings 420,802 357,691 92,954 73,194 Prepare 2025 income statements and a vertical analysis for Crane Company and Bramble Company. (Round percentage answers to 1 decimal place, e.g. 2.5%.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Income Statement for Crane Company 2025 Net Sales 1877000 Cost of Goods Sold 107600...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Kemp, Jeffrey Waybright

4th edition

978-0134125053, 9780134114781, 134125053, 134114787, 978-0134436111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App