Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DAIRY DEN (Pty) Ltd was established in 2015 by Mr. Kane. The company produces and sells stuffed donut stacks. The company has a 30

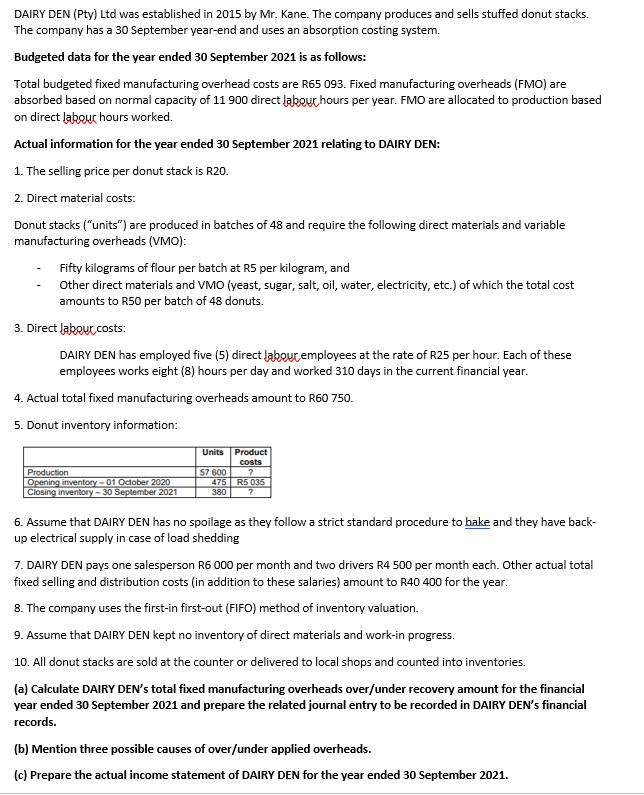

DAIRY DEN (Pty) Ltd was established in 2015 by Mr. Kane. The company produces and sells stuffed donut stacks. The company has a 30 September year-end and uses an absorption costing system. Budgeted data for the year ended 30 September 2021 is as follows: Total budgeted fixed manufacturing overhead costs are R65 093. Fixed manufacturing overheads (FMO) are absorbed based on normal capacity of 11 900 direct labour hours per year. FMO are allocated to production based on direct labour hours worked. Actual information for the year ended 30 September 2021 relating to DAIRY DEN: 1. The selling price per donut stack is R20. 2. Direct material costs: Donut stacks ("units") are produced in batches of 48 and require the following direct materials and variable manufacturing overheads (VMO): Fifty kilograms of flour per batch at R5 per kilogram, and Other direct materials and VMO (yeast, sugar, salt, oil, water, electricity, etc.) of which the total cost amounts to R50 per batch of 48 donuts. 3. Direct labour costs: DAIRY DEN has employed five (5) direct labour employees at the rate of R25 per hour. Each of these employees works eight (8) hours per day and worked 310 days in the current financial year. 4. Actual total fixed manufacturing overheads amount to R60 750. 5. Donut inventory information: Production Opening inventory-01 October 2020 Closing inventory-30 September 2021 Units Product costs ? R5 035 ? 57 600 475 380 6. Assume that DAIRY DEN has no spoilage as they follow a strict standard procedure to bake and they have back- up electrical supply in case of load shedding 7. DAIRY DEN pays one salesperson R6 000 per month and two drivers R4 500 per month each. Other actual total fixed selling and distribution costs (in addition to these salaries) amount to R40 400 for the year. 8. The company uses the first-in first-out (FIFO) method of inventory valuation. 9. Assume that DAIRY DEN kept no inventory of direct materials and work-in progress. 10. All donut stacks are sold at the counter or delivered to local shops and counted into inventories. (a) Calculate DAIRY DEN's total fixed manufacturing overheads over/under recovery amount for the financial year ended 30 September 2021 and prepare the related journal entry to be recorded in DAIRY DEN's financial records. (b) Mention three possible causes of over/under applied overheads. (c) Prepare the actual income statement of DAIRY DEN for the year ended 30 September 2021.

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer is as follow Answer Calculations are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started