Answered step by step

Verified Expert Solution

Question

1 Approved Answer

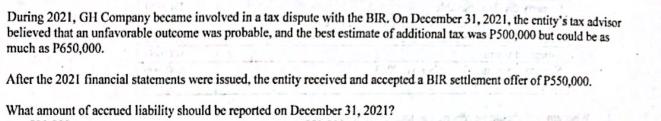

During 2021, GH Company became involved in a tax dispute with the BIR. On December 31, 2021, the entity's tax advisor believed that an

During 2021, GH Company became involved in a tax dispute with the BIR. On December 31, 2021, the entity's tax advisor believed that an unfavorable outcome was probable, and the best estimate of additional tax was P500,000 but could be as much as P650,000. After the 2021 financial statements were issued, the entity received and accepted a BIR settlement offer of P550,000. What amount of accrued liability should be reported on December 31, 2021?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided the amount of accrued liability that should be reported on Decembe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e5cb530fd0_957524.pdf

180 KBs PDF File

663e5cb530fd0_957524.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started