Question

(I) A fitness company is considering building an additional sports complex in a new location now or wait for one year. Use equations (1) to

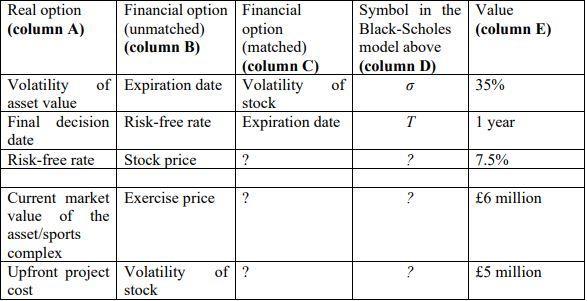

(I) A fitness company is considering building an additional sports complex in a new location now or wait for one year. Use equations (1) to (3) to find the value of the timing option, if you are provided with the following information: The current market value of the complex is £6 million; the upfront project/asset cost is £5 million; the volatility of the asset value is 35%, the risk-free rate is 7.5% (annualised); and, the final decision date is 1 year from today. Hint: First, complete the following table by reinterpreting/matching the financial option parameters in column B with the real option parameters in column A. Write down the correct match in column C and the corresponding symbol in the Black-Scholes formula in column D. The first two rows are done for you as examples. Provide the answers to the cells with question mark.

(ii) Is it optimal to wait if the NPV of investing immediately is £2.75 million?

(iii) Calculate the value of the PUT option using the PUT-CALL parity.

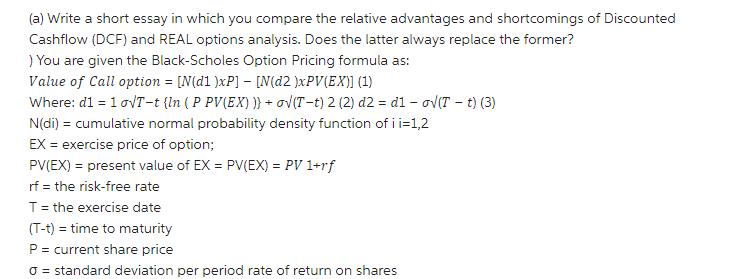

(a) Write a short essay in which you compare the relative advantages and shortcomings of Discounted Cashflow (DCF) and REAL options analysis. Does the latter always replace the former? ) You are given the Black-Scholes Option Pricing formula as: Value of Call option = [N(d1 )xP] [N(d2 )xPV(EX)] (1) Where: d1 = 1 oVT-t {In ( P PV(EX) )} + ov(T-t) 2 (2) d2 = d1 - ov(T - t) (3) N(di) = cumulative normal probability density function of ii=1,2 EX = exercise price of option; PV(EX) = present value of EX = PV(EX) = PV 1+rf rf = the risk-free rate T= the exercise date (T-t) = time to maturity P = current share price O = standard deviation per period rate of return on shares

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

i ii Using Black Scholes modelwe have d1 lnSK r 22TT05 ln65 750 3522135105 09102 d2 d1 T05 09102 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started