Answered step by step

Verified Expert Solution

Question

1 Approved Answer

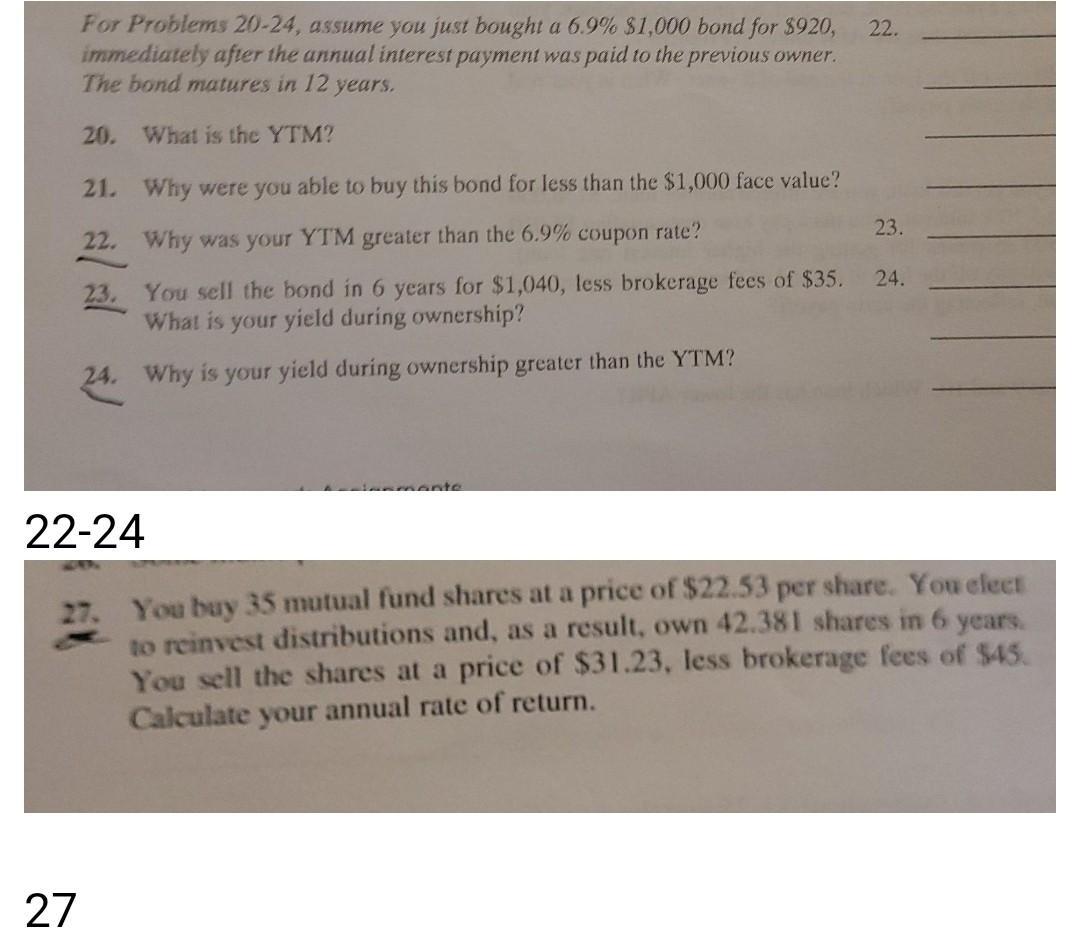

For Problems 20-24, assume you just bought a 6.9% $1,000 bond for $920, 22. immediately after the annual interest payment was paid to the

For Problems 20-24, assume you just bought a 6.9% $1,000 bond for $920, 22. immediately after the annual interest payment was paid to the previous owner. The bond matures in 12 years. 20. What is the YTM? 21. Why were you able to buy this bond for less than the $1,000 face value? 22. Why was your YTM greater than the 6.9% coupon rate? 23. You sell the bond in 6 years for $1,040, less brokerage fees of $35. What is your yield during ownership? 24. Why is your yield during ownership greater than the YTM? 27 23. 24. 22-24 27. You buy 35 mutual fund shares at a price of $22.53 per share. You elect to reinvest distributions and, as a result, own 42.381 shares in 6 years. You sell the shares at a price of $31.23, less brokerage fees of $45. Calculate your annual rate of return.

Step by Step Solution

★★★★★

3.44 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions we need to calculate various values related to the bond and the mutual fund investment Lets go step by step To find the Yield to Maturity YTM of the bond we can use the formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started