Answered step by step

Verified Expert Solution

Question

1 Approved Answer

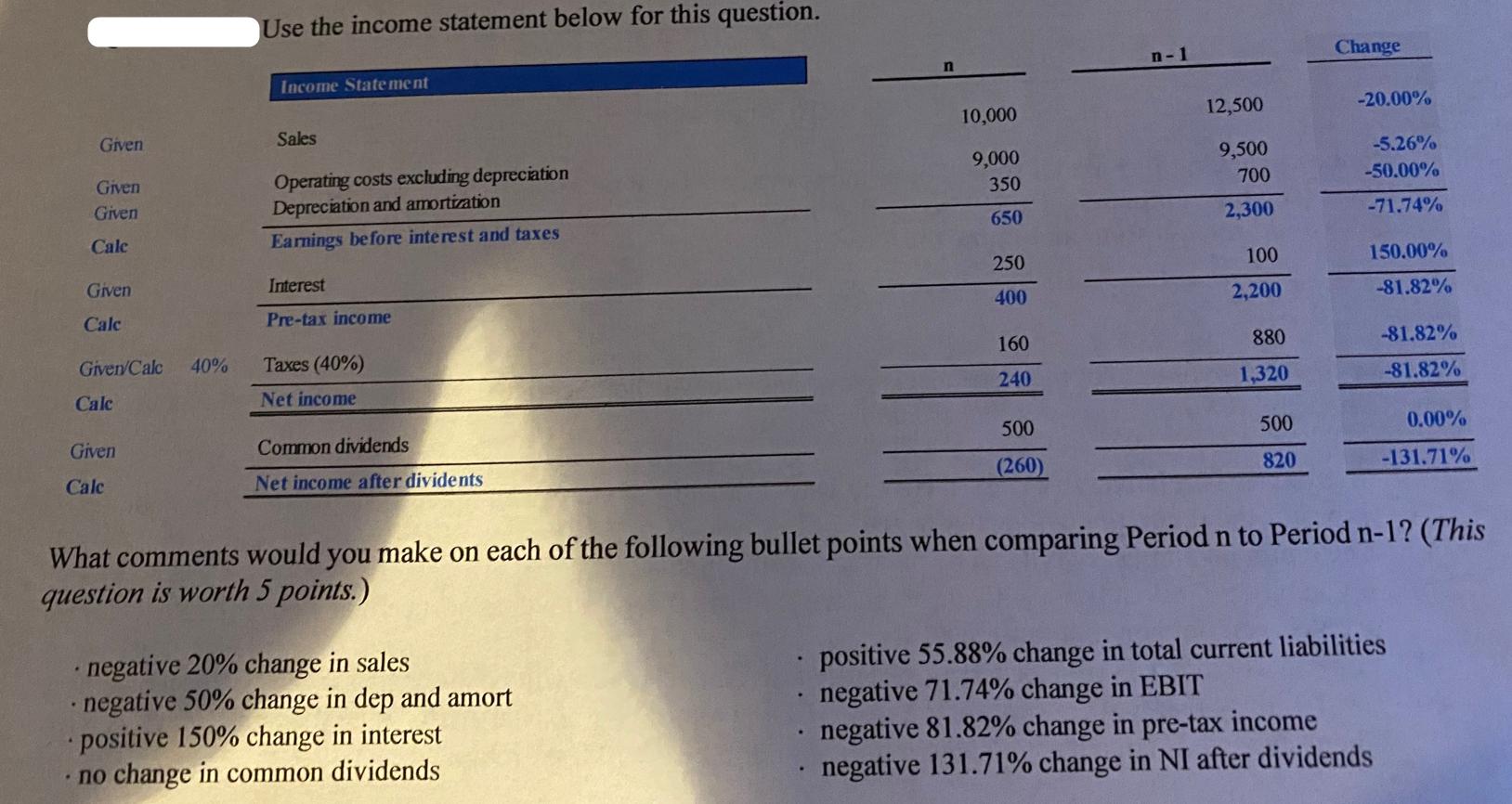

Given Given Given Calc Given Calc Given/Calc Calc Given Calc 40% Use the income statement below for this question. Income Statement Sales Operating costs

Given Given Given Calc Given Calc Given/Calc Calc Given Calc 40% Use the income statement below for this question. Income Statement Sales Operating costs excluding depreciation Depreciation and amortization Earnings before interest and taxes Interest Pre-tax income Taxes (40%) Net income Common dividends Net income after dividents n negative 20% change in sales - negative 50% change in dep and amort positive 150% change in interest no change in common dividends 10,000 9,000 350 650 250 400 160 240 500 (260) n-1 12,500 9,500 700 2,300 100 2,200 880 1,320 500 820 Change -20.00% -5.26% -50.00% -71.74% 150.00% -81.82% -81.82% -81.82% 0.00% -131.71% What comments would you make on each of the following bullet points when comparing Period n to Period n-1? (This question is worth 5 points.) positive 55.88% change in total current liabilities negative 71.74% change in EBIT negative 81.82% change in pre-tax income negative 131.71% change in NI after dividends

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The image seems to show an income statement with comparative figures for Period n and Period n1 including the percentage changes between these periods Below the income statement there are several bull...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started