Answered step by step

Verified Expert Solution

Question

1 Approved Answer

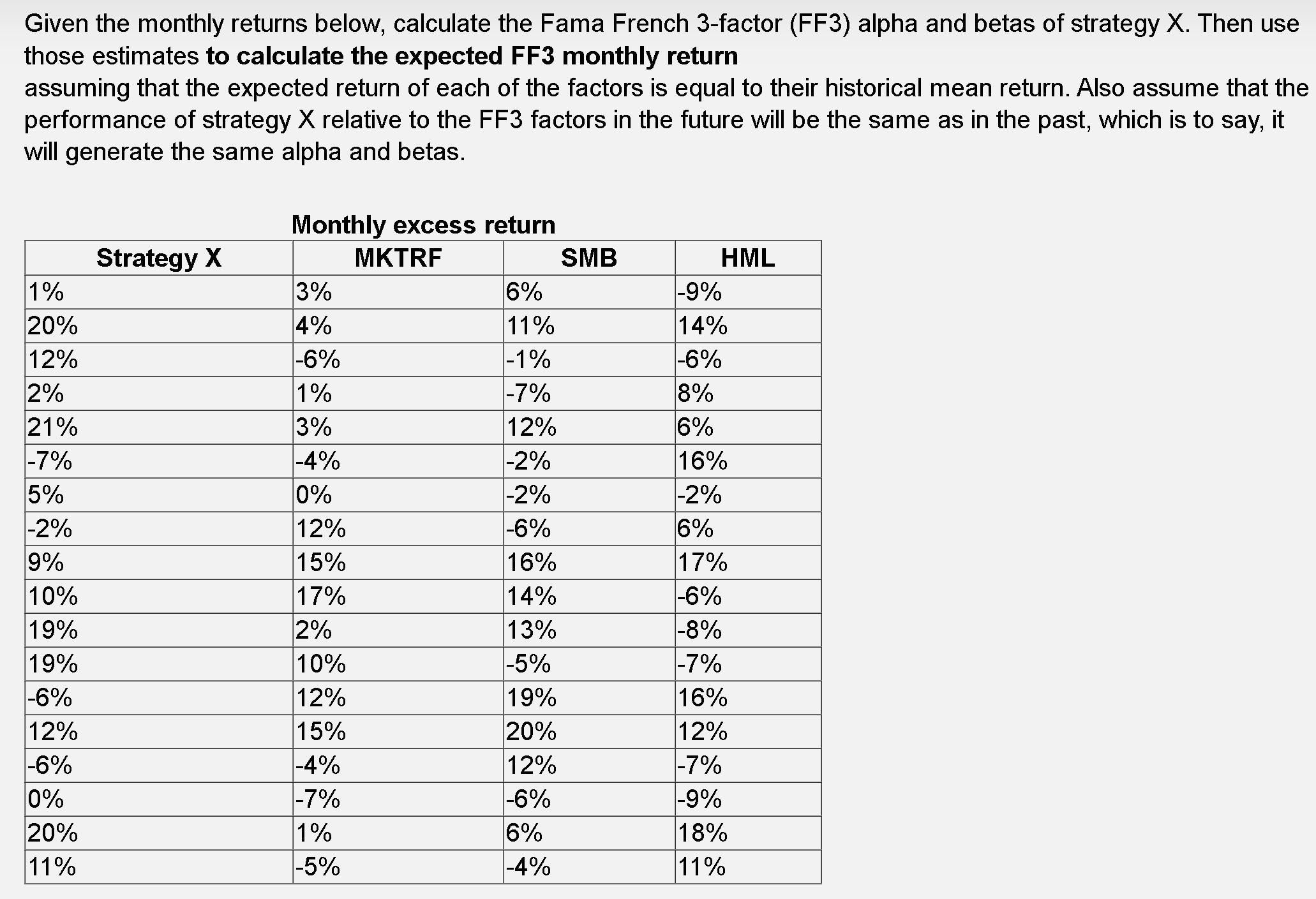

Given the monthly returns below, calculate the Fama French 3-factor (FF3) alpha and betas of strategy X. Then use those estimates to calculate the

Given the monthly returns below, calculate the Fama French 3-factor (FF3) alpha and betas of strategy X. Then use those estimates to calculate the expected FF3 monthly return assuming that the expected return of each of the factors is equal to their historical mean return. Also assume that the performance of strategy X relative to the FF3 factors in the future will be the same as in the past, which is to say, it will generate the same alpha and betas. 1% 20% 12% 2% 21% -7% 5% -2% 9% 10% 19% 19% -6% 12% -6% 0% 20% 11% Strategy X Monthly excess return MKTRF 3% 4% |-6% 1% 3% -4% 0% 12% 15% 17% 2% 10% 12% 15% |-4% -7% 1% -5% 6% 11% -1% -7% 12% -2% -2% -6% 16% 14% 13% -5% 19% 20% 12% -6% 6% -4% SMB HML -9% 14% -6% 8% 6% 16% -2% 6% 17% -6% -8% -7% 16% 12% -7% -9% 18% 11%

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Fama French 3factor FF3 alpha and betas of strategy X manually we can use the follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started