Question: Hello, this is an academic assignment. According to the text, answer the question between 250 and 300 words. Question: Evaluate the post-acquisition integration methods that

Hello, this is an academic assignment. According to the text, answer the question between 250 and 300 words.

Question:

Evaluate the post-acquisition integration methods that CVS uses to create an integrated offering?

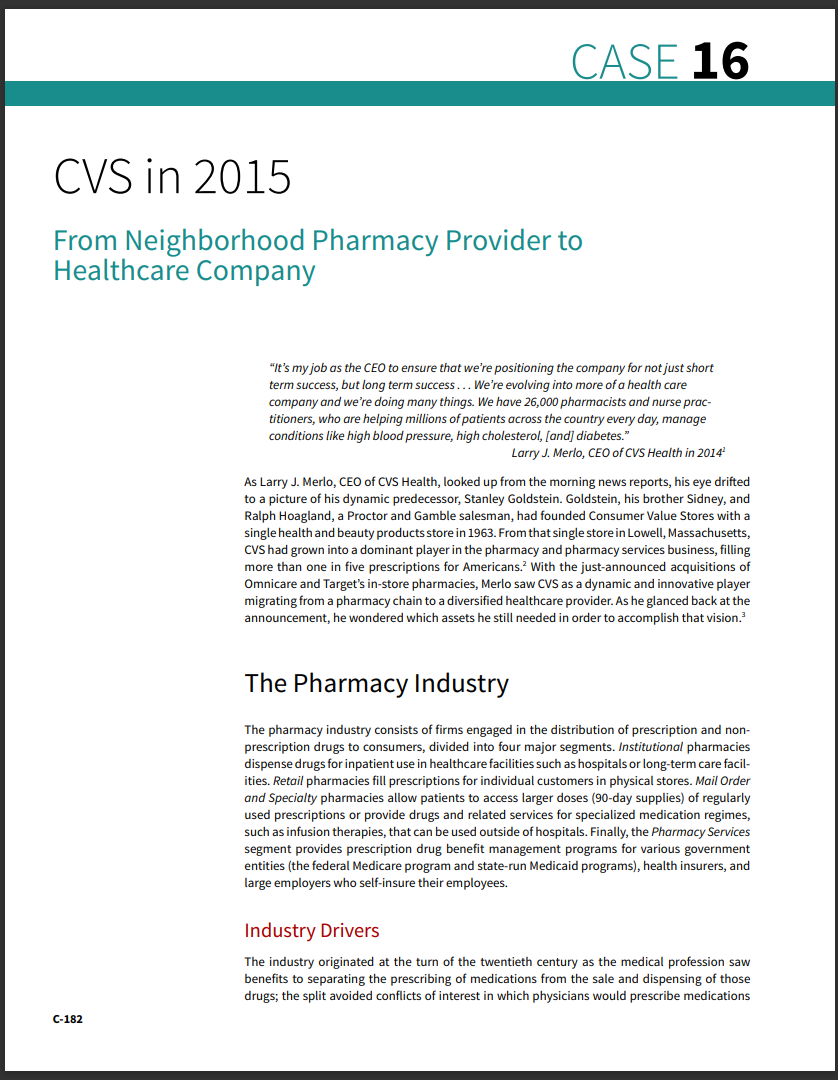

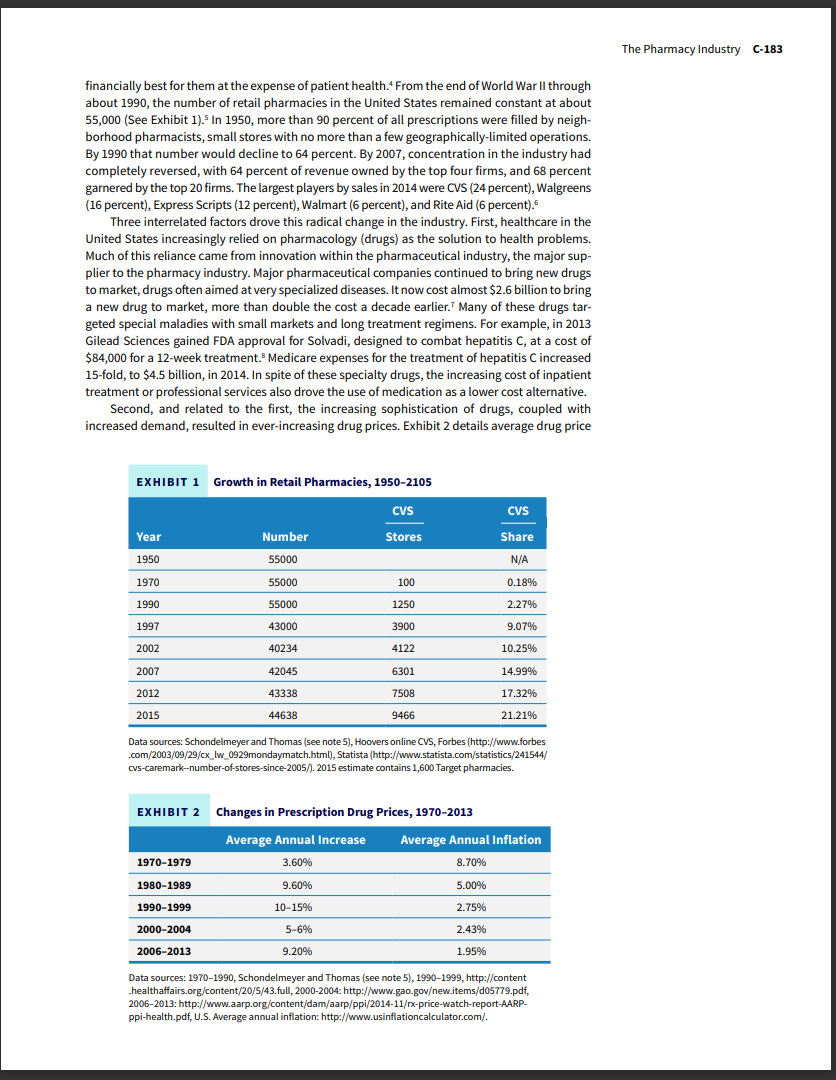

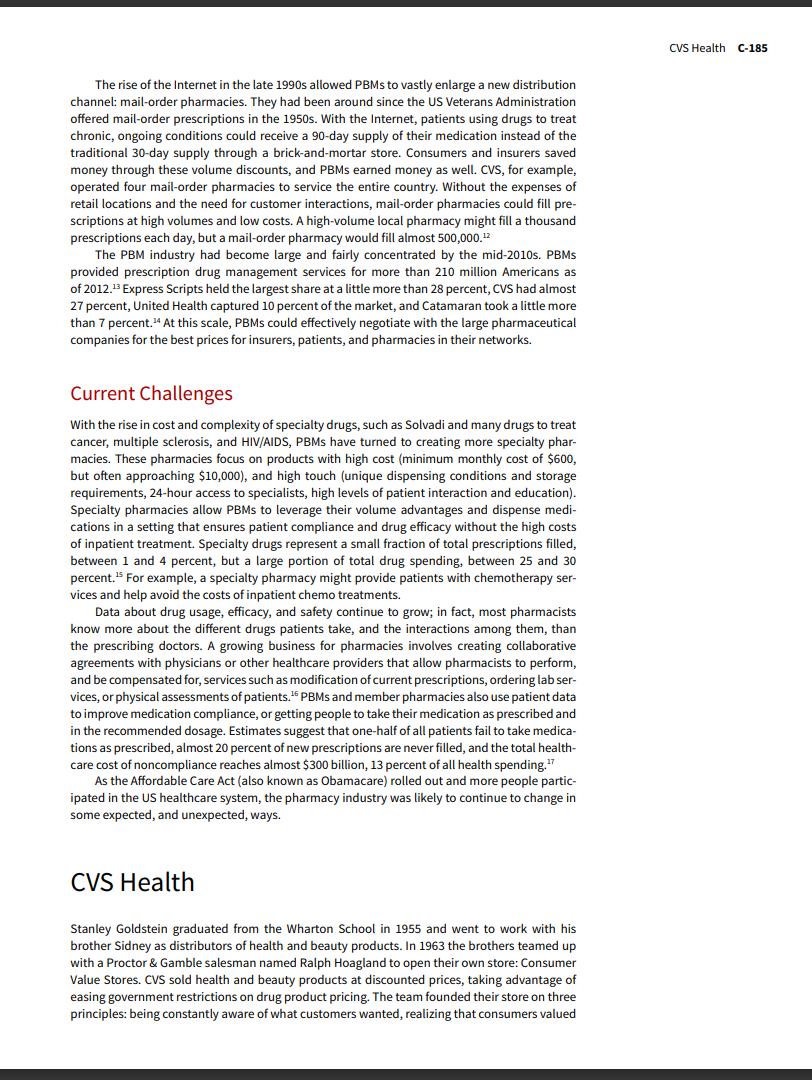

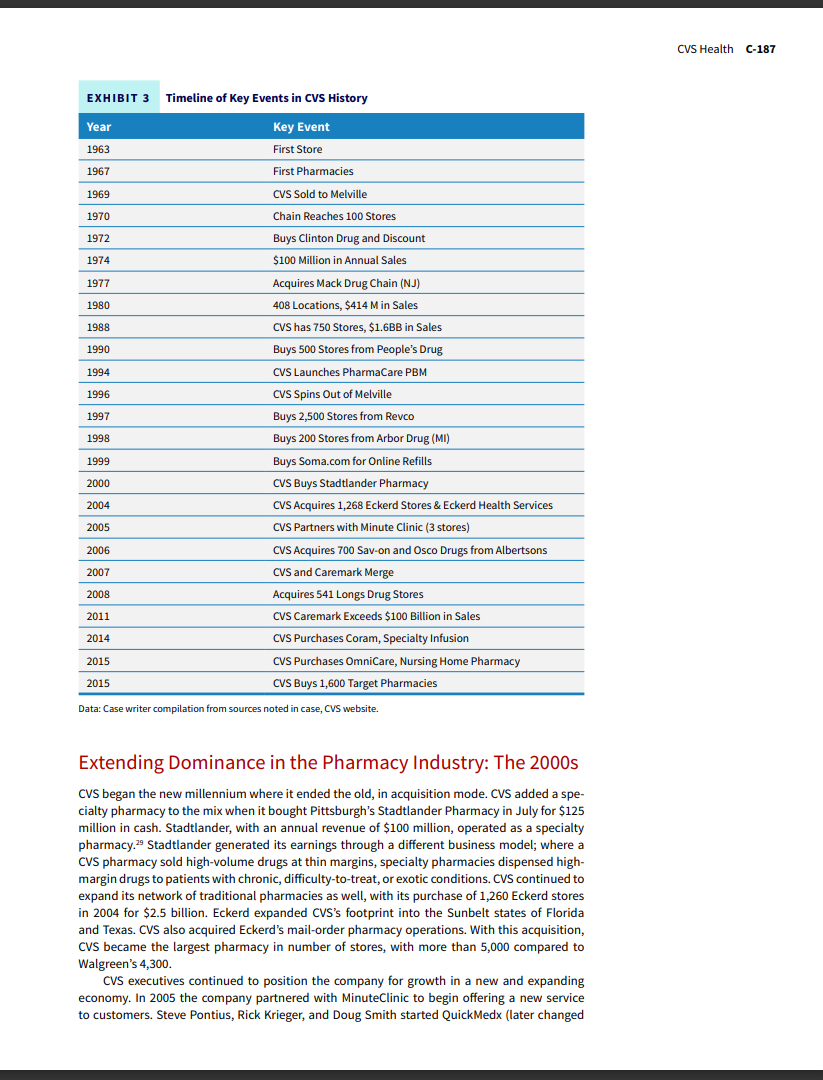

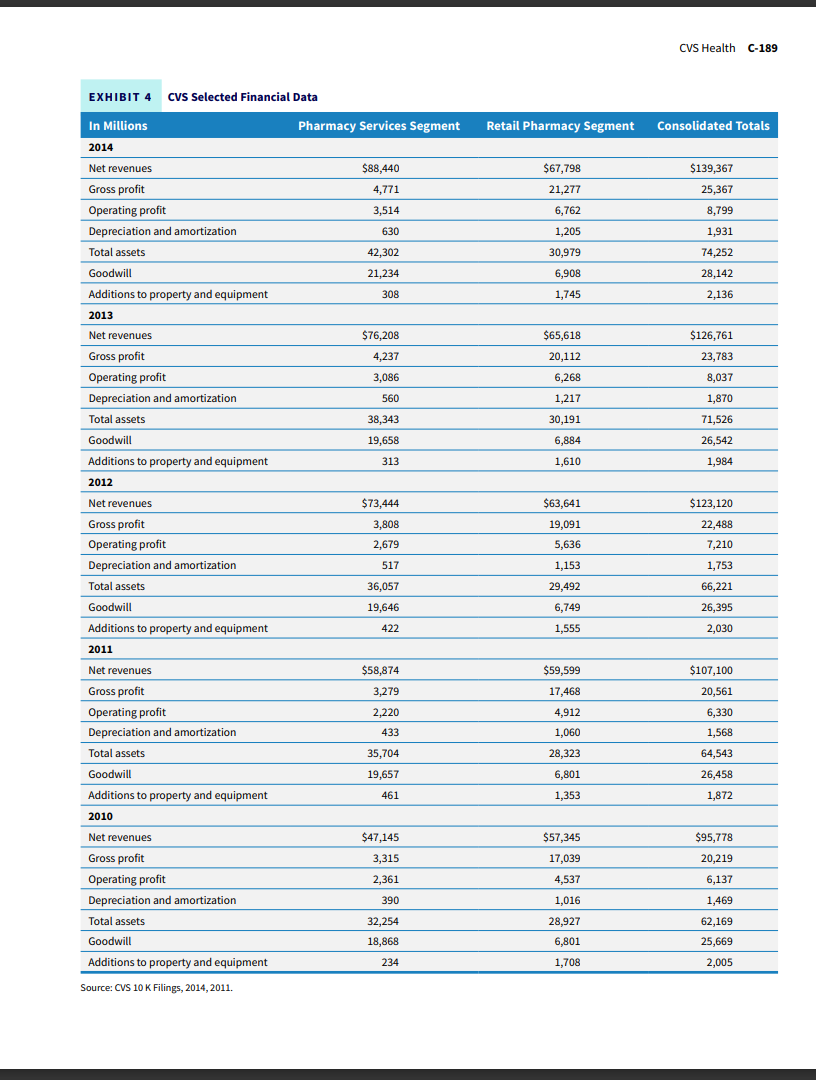

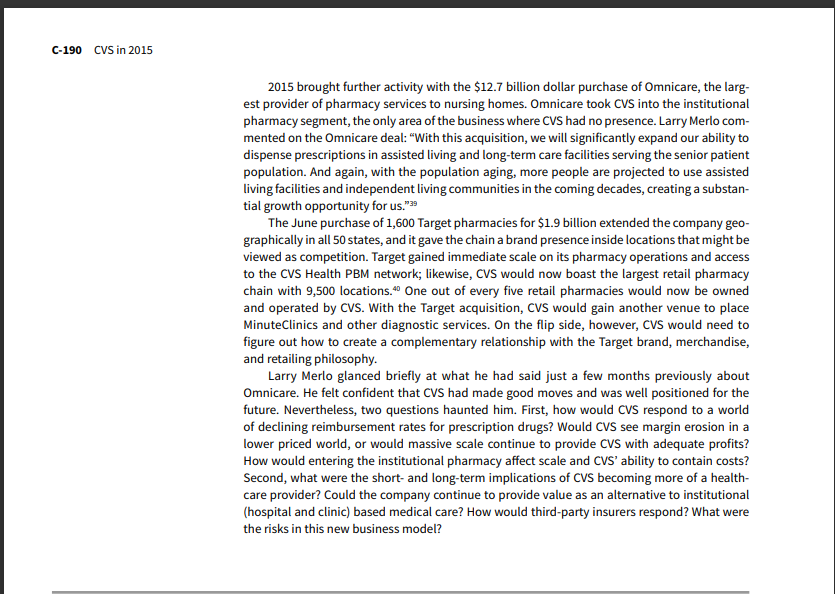

From Neighborhood Pharmacy Provider to Healthcare Company "It's my job as the CEO to ensure that we're positioning the company for not just short term success, but long term success... We're evolving into more of a health care company and we're doing many things. We have 26,000 pharmacists and nurse practitioners, who are helping millions of patients across the country every day, manage conditions like high blood pressure, high cholesterol, [and] diabetes." Larry J. Merlo, CEO of CVS Health in 20142 As Larry J. Merlo, CEO of CVS Health, looked up from the morning news reports, his eye drifted to a picture of his dynamic predecessor, Stanley Goldstein. Goldstein, his brother Sidney, and Ralph Hoagland, a Proctor and Gamble salesman, had founded Consumer Value Stores with a single health and beauty products store in 1963. From that single store in Lowell, Massachusetts, CVS had grown into a dominant player in the pharmacy and pharmacy services business, filling more than one in five prescriptions for Americans. 2 With the just-announced acquisitions of Omnicare and Target's in-store pharmacies, Merlo saw CVS as a dynamic and innovative player migrating from a pharmacy chain to a diversified healthcare provider. As he glanced back at the announcement, he wondered which assets he still needed in order to accomplish that vision. 3 The Pharmacy Industry The pharmacy industry consists of firms engaged in the distribution of prescription and nonprescription drugs to consumers, divided into four major segments. Institutional pharmacies dispense drugs for inpatient use in healthcare facilities such as hospitals or long-term care facilities. Retail pharmacies fill prescriptions for individual customers in physical stores. Mail Order and Specialty pharmacies allow patients to access larger doses (90-day supplies) of regularly used prescriptions or provide drugs and related services for specialized medication regimes, such as infusion therapies, that can be used outside of hospitals. Finally, the Pharmacy Services segment provides prescription drug benefit management programs for various government entities (the federal Medicare program and state-run Medicaid programs), health insurers, and large employers who self-insure their employees. Industry Drivers The industry originated at the turn of the twentieth century as the medical profession saw benefits to separating the prescribing of medications from the sale and dispensing of those drugs; the split avoided conflicts of interest in which physicians would prescribe medications C-182 financially best for them at the expense of patient health. 4 From the end of World War II through about 1990, the number of retail pharmacies in the United States remained constant at about 55,000 (See Exhibit 1). 5ln1950, more than 90 percent of all prescriptions were filled by neighborhood pharmacists, small stores with no more than a few geographically-limited operations. By 1990 that number would decline to 64 percent. By 2007, concentration in the industry had completely reversed, with 64 percent of revenue owned by the top four firms, and 68 percent garnered by the top 20 firms. The largest players by sales in 2014 were CVS ( 24 percent), Walgreens ( 16 percent), Express Scripts ( 12 percent), Walmart ( 6 percent), and Rite Aid ( 6 percent). 6 Three interrelated factors drove this radical change in the industry. First, healthcare in the United States increasingly relied on pharmacology (drugs) as the solution to health problems. Much of this reliance came from innovation within the pharmaceutical industry, the major supplier to the pharmacy industry. Major pharmaceutical companies continued to bring new drugs to market, drugs often aimed at very specialized diseases. It now cost almost $2.6 billion to bring a new drug to market, more than double the cost a decade earlier. 7 Many of these drugs targeted special maladies with small markets and long treatment regimens. For example, in 2013 Gilead Sciences gained FDA approval for Solvadi, designed to combat hepatitis C, at a cost of $84,000 for a 12-week treatment. 8 Medicare expenses for the treatment of hepatitis C increased 15-fold, to $4.5 billion, in 2014. In spite of these specialty drugs, the increasing cost of inpatient treatment or professional services also drove the use of medication as a lower cost alternative. Second, and related to the first, the increasing sophistication of drugs, coupled with increased demand, resulted in ever-increasing drug prices. Exhibit 2 details average drug price Growth in Retail Pharmacies, 1950-2105 Data sources: Schondelmeyer and Thomas (see note 5), Hoovers online CVS, Forbes (http://www.forbes .com/2003/09/29/cx_lw_0929mondaymatch.html), Statista (http://www.statista.com/statistics/241544/ cvs-caremark-number-of-stores-since-2005/). 2015 estimate contains 1,600 Target pharmacies. Changes in Prescription Drug Prices, 1970-2013 Data sources: 1970-1990, Schondelmeyer and Thomas (see note 5), 1990-1999, http://content .healthaffairs.org/content/20/5/43.full, 2000-2004: http://www.gao-govew.items/d05779.pdf, 2006-2013: http://www.aarp.org/content/dam/aarp/ppi/2014-11//x-price-watch-report-AARPppi-health.pdf, U.S. Average annual inflation: http://www.usinflationcalculator.com/. increases in the United States during the last 45 years. The hyperinflation decade of the 1970 s represents the only decade where consumer prices outpaced prescription drug price increases; since 2006 drug prices had outpaced core inflation by a factor of 4 . Drug pricing increased from 5.5 percent of total healthcare spending in 1990 to 15 percent of private health insurance spending in 2014.9 The market for prescription drugs featured two buyers, often with differing objectives. Patients who took the drugs wanted whatever medication would solve their particular problem. Insurers, private insurance companies, large employer self-insurance plans, and Medicare and Medicaid providers looked to find the lowest cost drug with the highest probability of solving a patient's medical issues. These third-party payers worked to align their incentives with patients, usually through the practice of co-pays and deductibles that shared costs with patients. In 2015, 25 percent of third-party payers offered only "high deductible" plans where patients incurred greater out-of-pocket expenses, nearly double the 13 percent only three years previously. 10 Both buyer groups were becoming more price sensitive. Finally, the rise of prescription drug and healthcare costs in general, and the importance of healthcare to a full life, led to high levels of federal and state government regulation of the pharmacy industry. On the supply side, the FDA regulated pharmaceutical companies, and states all had their own licensing requirements for professional pharmacists. Since the introduction of Medicare and Medicaid in the 1960s, the federal government set reimbursement rates for most medical services for those covered by its plans. Private insurers often used these "shadow prices" to benchmark their own reimbursement rates. In 2003 George W. Bush signed the Medicare Prescription Drug, Improvement, and Modernization Act (MMA) into law and created Medicare Part D. Part D allowed retirees to purchase a private insurance supplement to their Medicare coverage that offset the cost of prescription drugs. Understanding and managing Part D expenses became an important part of succeeding as a pharmacy. Industry Evolution The pharmacy industry sits in the middle of a value chain that connects patients, third-party payers, and the larger pharmaceutical companies. By the late 1960 s, the pharmacy services segment began to emerge. With close to 90 percent of prescriptions still filled by local "mom and pop" pharmacies in small dollar amounts, an increasing number of prescriptions created an immense paperwork burden on insurers and employers who covered the costs of prescriptions. Pharmacy benefit management (PBM) companies offloaded this burden from third-party payers by using sophisticated computing resources and standardizing key elements of the process. Small pharmacies joined a PBM network, and the network handled the tasks of transaction processing. 11 Two decades later, PBMs had grown in size and sophistication. PBMs were an early developer and user of "big data," gathering data about what drugs were prescribed, drug interactions, and drug efficacy. As drug prices continued to rise in the late 1980s and 1990s, PBMs shifted their focus from being efficient providers of transaction and financial services into organizations focused on controlling drug cost increases. Using their massive databases about drug safety, interactions, and efficacy, PBMs developed drug formularies or lists that identified the most effective medications for different ailments. Formularies often recommended a generic drug instead of a higher priced, name brand drug. PBMs entered the arena of drug plan design and administration as third-party payers used formularies to control which drugs their plans would cover. PBMs earned money in one of, or a combination of, three ways. PBMs could arbitrage the negotiated price spread between suppliers and buyers. For example, CVS might negotiate a 20 percent discount for a medication, but pass only 19 percent on to network members. A PBM might choose to pass on all the discount, but charge a fee, either on each claim or a fee per member (capitation). PBMs also earned money by keeping volume-based rebates from pharmaceutical companies as a source of profit. By the end of the 1990s, PBMs had continued to expand their offerings into efforts to change patient behaviors, such as encouraging the use of generics or lower cost alternatives, using their massive data volume to help control prescription drug fraud and abuse, and continuing to refine formularies to create effective disease management protocols. The rise of the Internet in the late 1990 s allowed PBMs to vastly enlarge a new distribution channel: mail-order pharmacies. They had been around since the US Veterans Administration offered mail-order prescriptions in the 1950s. With the Internet, patients using drugs to treat chronic, ongoing conditions could receive a 90-day supply of their medication instead of the traditional 30-day supply through a brick-and-mortar store. Consumers and insurers saved money through these volume discounts, and PBMs earned money as well. CVS, for example, operated four mail-order pharmacies to service the entire country. Without the expenses of retail locations and the need for customer interactions, mail-order pharmacies could fill prescriptions at high volumes and low costs. A high-volume local pharmacy might fill a thousand prescriptions each day, but a mail-order pharmacy would fill almost 500,000.12 The PBM industry had become large and fairly concentrated by the mid-2010s. PBMs provided prescription drug management services for more than 210 million Americans as of 2012.13 Express Scripts held the largest share at a little more than 28 percent, CVS had almost 27 percent, United Health captured 10 percent of the market, and Catamaran took a little more than 7 percent. 14 At this scale, PBMs could effectively negotiate with the large pharmaceutical companies for the best prices for insurers, patients, and pharmacies in their networks. Current Challenges With the rise in cost and complexity of specialty drugs, such as Solvadi and many drugs to treat cancer, multiple sclerosis, and HIV/AIDS, PBMs have turned to creating more specialty pharmacies. These pharmacies focus on products with high cost (minimum monthly cost of $600, but often approaching $10,000 ), and high touch (unique dispensing conditions and storage requirements, 24-hour access to specialists, high levels of patient interaction and education). Specialty pharmacies allow PBMs to leverage their volume advantages and dispense medications in a setting that ensures patient compliance and drug efficacy without the high costs of inpatient treatment. Specialty drugs represent a small fraction of total prescriptions filled, between 1 and 4 percent, but a large portion of total drug spending, between 25 and 30 percent. 15 For example, a specialty pharmacy might provide patients with chemotherapy services and help avoid the costs of inpatient chemo treatments. Data about drug usage, efficacy, and safety continue to grow; in fact, most pharmacists know more about the different drugs patients take, and the interactions among them, than the prescribing doctors. A growing business for pharmacies involves creating collaborative agreements with physicians or other healthcare providers that allow pharmacists to perform, and be compensated for, services such as modification of current prescriptions, ordering lab services, or physical assessments of patients. 16PBMs and member pharmacies also use patient data to improve medication compliance, or getting people to take their medication as prescribed and in the recommended dosage. Estimates suggest that one-half of all patients fail to take medications as prescribed, almost 20 percent of new prescriptions are never filled, and the total healthcare cost of noncompliance reaches almost $300 billion, 13 percent of all health spending. 17 As the Affordable Care Act (also known as Obamacare) rolled out and more people participated in the US healthcare system, the pharmacy industry was likely to continue to change in some expected, and unexpected, ways. CVS Health Stanley Goldstein graduated from the Wharton School in 1955 and went to work with his brother Sidney as distributors of health and beauty products. In 1963 the brothers teamed up with a Proctor \& Gamble salesman named Ralph Hoagland to open their own store: Consumer Value Stores. CVS sold health and beauty products at discounted prices, taking advantage of easing government restrictions on drug product pricing. The team founded their store on three principles: being constantly aware of what customers wanted, realizing that consumers valued convenience as much as price, and providing employees with a great work environment. CVS paid workers more than competitors, offered health insurance benefits, and provided legendary holiday parties. 18 Those three principles built a business. Within a year, the chain had expanded to 17 stores, and by 1967 had expanded from a provider of health and beauty products into the retail pharmacy space. Pharmacy sales effectively doubled in-store revenue. 19 The Melville Era: Growth in the 1970s and 1980s In 1969 the chain was purchased by Melville Corporation, a retail conglomerate with a stable of brands that included mall stores such as shoe retailers Thom McAn and Footaction, and specialty retailers such as Kay-Bee Toys and Linens 'n Things. 20 The company migrated into standalone general retail with the CVS acquisition, and eventually added the Marshalls brand. Melville, originally a shoe manufacturing company, had diversified into the larger specialty retail segment in order to accelerate growth. Melville acted as a holding company and provided its brands with rigid reporting discipline of key metrics for specialty retail success, active monitoring and oversight, and the use of corporate capital to invest in promising new brands. 21 With a lean staff, Melville had made a series of smart acquisitions that contributed to 15 percent compounded earnings growth throughout the 1970 s and 1980 s. 22 CVS contributed to Melville's growth through a smart acquisition strategy that consistently grew the number of locations. The company bought 84 Clinton Drug and Discount stores in 1972, which deepened its presence in the Northeast but also provided a presence in the Midwest. 23 In 1977 CVS purchased the Mack Drug chain's 36 New Jersey stores; with these acquisitions and organic store growth, CVS ended the 1970 s with more than 400 stores and $400 million in annual revenue. By 1990, CVS had tripled in size to more than 1,250 stores, fueled in large measure by its acquisition of 500 Peoples Drug Stores that year. During the 1980 s, Melville's sales and earnings had increased 300 percent. 24 Focused and Strategic Expansion: The 1990s and 2000s The 1990 s brought hard times for the Melville Corporation. While CVS accounted for 28 percent of the corporation's revenue and operated in markets across the nation, other specialty retail brands suffered flagging sales growth amid the deep recession of 1991-1992. Big-box retailers such as Walmart began to offer branded merchandise at lower prices, and new specialty formats such as TheGap plied customers with in-house brands. Stanley Goldstein, nowCEO and chairman of Melville, shuttered stores and ultimately broke up the business by selling Marshalls to rival TJX for $600 million and Kay-Bee Toys for $315 million. Wilsons Leather and This End Up generated additional cash through management-led buyouts. The Melville transformation was completed in 1996 as the company became CVS Corporation and completed the divestiture of its last other brand, Linens ' n Things, by 1997. CVS' 1996 sales grew 10 percent to $4.3 billion, and profits shot up 16 percent. 25 In the midst of the 1990 s restructuring, CVS quietly created its own PBM, PharmaCare, providing drug management services for about one million Americans. 26 By 1997 , flush with cash from its divestitures and strategically focused on the pharmacy segment, a streamlined CVS moved quickly to expand its position with the purchase of Revco, an Ohio-based drug store chain active in 17 Midwestern, Southern, and Eastern states. With 2,500 new stores, CVS had again tripled its size. With the acquisition of 200 Arbor Drug stores in Michigan in 1998, CVS had 4,100 stores in 24 states, a dominant presence in the Detroit market, and revenues a little more than $15 billion. 27 CVS closed out the decade with one final acquisition, designed to give CVS a leg up in the new millennium: for $30 million in stock, the company purchased Soma.com, an online pharmacy. CEO Tom Ryan noted, "It's all about making life easier for the customer and giving them what they want." Tom Pigott, CEO and founder of Soma.com, realized the potential for CVS to grow: "They're going to start putting a dot-com on the bottom of three-quarters of a billion bags. How are you going to compete against that?"218 Exhibit 3 provides a summary of key events in CVS history. EXHIBIT 3 Timeline of Key Events in CVS History Extending Dominance in the Pharmacy Industry: The 2000s CVS began the new millennium where it ended the old, in acquisition mode. CVS added a specialty pharmacy to the mix when it bought Pittsburgh's Stadtlander Pharmacy in July for $125 million in cash. Stadtlander, with an annual revenue of $100 million, operated as a specialty pharmacy. 29 Stadtlander generated its earnings through a different business model; where a CVS pharmacy sold high-volume drugs at thin margins, specialty pharmacies dispensed highmargin drugs to patients with chronic, difficulty-to-treat, or exotic conditions. CVS continued to expand its network of traditional pharmacies as well, with its purchase of 1,260 Eckerd stores in 2004 for $2.5 billion. Eckerd expanded CVS's footprint into the Sunbelt states of Florida and Texas. CVS also acquired Eckerd's mail-order pharmacy operations. With this acquisition, CVS became the largest pharmacy in number of stores, with more than 5,000 compared to Walgreen's 4,300. CVS executives continued to position the company for growth in a new and expanding economy. In 2005 the company partnered with MinuteClinic to begin offering a new service to customers. Steve Pontius, Rick Krieger, and Doug Smith started QuickMedx (later changed to MinuteClinic) as a kiosk in a Minneapolis Cub Foods grocery store in 2000. QuickMedx used nurse practitioners and physicians' assistants to diagnose and treat common ailments such as strep throat, pink eye, and ear or sinus infections, and to do early pregnancy testing. The company marketed itself with the slogan "You're sick, we're quick," and offered consumers convenient and fast care for a flat fee of $35.30CVS hoped to establish MinuteClinics in a number of its traditional pharmacies. MinuteClinic would move CVS from a pharmacy provider to an overall healthcare provider, with the possibility of third-party reimbursement for clinical, as well as pharmacy, services. CVS purchased MinuteClinic in mid-2006 for $170 million. 31 CVS ended the year just shy of $44 billion in total revenue. As 2006 drew to a close, CVS launched its most aggressive move yet, bidding $21 billion (all stock) for outstanding shares of Caremark. Caremark provided PBM services to a network of 60,000 retail pharmacies and managed drug benefits for a number of large employers such as the 4.5 million federal government employees, retirees, and their families. By contrast, PharmaCare, the in-house CVS PBM, counted the Chrysler Corporation as a large client with 183,000 enrollees. 32 With the acquisition, CVS would extend its reach and power in the "back of the house" part of the pharmacy business. Coupled with CVS's 6,300 retail pharmacies, the CVS/Caremark combination could combine customer-based services in ways that pure PBM companies could not. CVS made its bid in November 2006, shortly after Walmart announced plans to sell generic prescriptions for $4 through its in-store pharmacies. The Walmart announcement had driven shares of Caremark down by 17 percent. 33 The country's other PBMs took notice of the potential disruption, and one, Express Scripts, launched its own $26 billion (cash and stock) bid for Caremark, a premium of 15 percent over the CVS bid. Express Scripts wooed shareholders with the promise that an Express Scripts/ Caremark combination would provide at least $100 million in additional costs savings (and profit) for Caremark over what it would get through the CVS offer. Express Scripts would also combine its strengths in prescription management with Caremark's mail order and specialty pharmacy strengths. With a market cap roughly one-third of Caremark's (\$9 billion to $23.45 billion for Caremark), Express Scripts would fund the deal by increasing the debt load on its balance sheet. Express Scripts leaders hoped to negotiate a cooperative agreement but indicated a willingness to engage in a shareholder vote if needed. Negating the merger agreement with CVS would cost Caremark a $675 million termination fee. After four months of contesting the merger, which eventually went to a shareholder vote, Caremark chose to accept the now $26.5 billion bid from CVS. 34A deal with Express Scripts faced uncertain prospects in an anti-trust review, but the merger with CVS would create a complementary vertical merger rather than a horizontal one. Express Scripts would eventually buy Medco for $29 billion in 2011, becoming the largest PBM company with revenues of $116 billion. 35 CVS and Caremark would both benefit through larger size and greater negotiating leverage. CVS gained access to Caremark's excellent mail order and specialty operations, while Caremark could now offer its customers promotions and discounts at CVS retail outlets. During the next three years, CVS would invest $110 million in new information systems to help integrate the two companies. 36CVS changed its name to CVS/Caremark and was a market leading competitor in both the retail and PBM segments of the industry. Exhibit 4 provides selected financial data on CVS from 2009 to 2014. Charting New Territory: The 2010s and Beyond CVS/Caremark continued to grow through acquisition. In 2008 the company extended its reach into the western United States and Hawaii with a $2.9 billion (cash tender offer) acquisition of 541 Long's Drugs. 37 With a new focus as a healthcare provider, CVS took the name CVS Health as it continued to move into new markets. Its 2014 purchase of Coram for $2.1 billion represented an extension of its specialty pharmacy business into the specialty infusion niche. CVS hoped to win in this new segment by reducing patient therapy costs (its own data indicated that homebased infusion treatments cost less than hospital or clinic-based ones), bringing order and scale to this fragmented, emerging segment, and capitalizing on the expected growth in infusion therapy. Several infusion-based drugs looked to become top-10 selling drugs by 2020.38 CVS Selected Financial Data 2015 brought further activity with the $12.7 billion dollar purchase of Omnicare, the largest provider of pharmacy services to nursing homes. Omnicare took CVS into the institutional pharmacy segment, the only area of the business where CVS had no presence. Larry Merlo commented on the Omnicare deal: "With this acquisition, we will significantly expand our ability to dispense prescriptions in assisted living and long-term care facilities serving the senior patient population. And again, with the population aging, more people are projected to use assisted living facilities and independent living communities in the coming decades, creating a substantial growth opportunity for us. n9 The June purchase of 1,600 Target pharmacies for $1.9 billion extended the company geographically in all 50 states, and it gave the chain a brand presence inside locations that might be viewed as competition. Target gained immediate scale on its pharmacy operations and access to the CVS Health PBM network; likewise, CVS would now boast the largest retail pharmacy chain with 9,500 locations. 40 One out of every five retail pharmacies would now be owned and operated by CVS. With the Target acquisition, CVS would gain another venue to place MinuteClinics and other diagnostic services. On the flip side, however, CVS would need to figure out how to create a complementary relationship with the Target brand, merchandise, and retailing philosophy. Larry Merlo glanced briefly at what he had said just a few months previously about Omnicare. He felt confident that CVS had made good moves and was well positioned for the future. Nevertheless, two questions haunted him. First, how would CVS respond to a world of declining reimbursement rates for prescription drugs? Would CVS see margin erosion in a lower priced world, or would massive scale continue to provide CVS with adequate profits? How would entering the institutional pharmacy affect scale and CVS' ability to contain costs? Second, what were the short- and long-term implications of CVS becoming more of a healthcare provider? Could the company continue to provide value as an alternative to institutional (hospital and clinic) based medical care? How would third-party insurers respond? What were the risks in this new business model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts