Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine that you are a new employee in the financial analysis division of a [fictitious] company called FLIP finance enterprises [Ticker = FLIP]. The

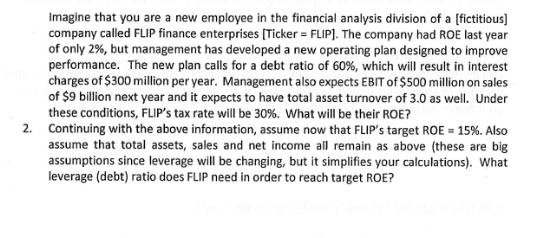

Imagine that you are a new employee in the financial analysis division of a [fictitious] company called FLIP finance enterprises [Ticker = FLIP]. The company had ROE last year of only 2%, but management has developed a new operating plan designed to improve performance. The new plan calls for a debt ratio of 60%, which will result in interest charges of $300 million per year. Management also expects EBIT of $500 million on sales of $9 billion next year and it expects to have total asset turnover of 3.0 as well. Under these conditions, FLIP's tax rate will be 30%. What will be their ROE? 2. Continuing with the above information, assume now that FLIP's target ROE = 15%. Also assume that total assets, sales and net income all remain as above (these are big assumptions since leverage will be changing, but it simplifies your calculations). What leverage (debt) ratio does FLIP need in order to reach target ROE?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate FLIPs return on equity ROE well use the DuPont formula which breaks down ROE into thr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started