Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Income Statements under Absorption Costing and Variable Costing Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1

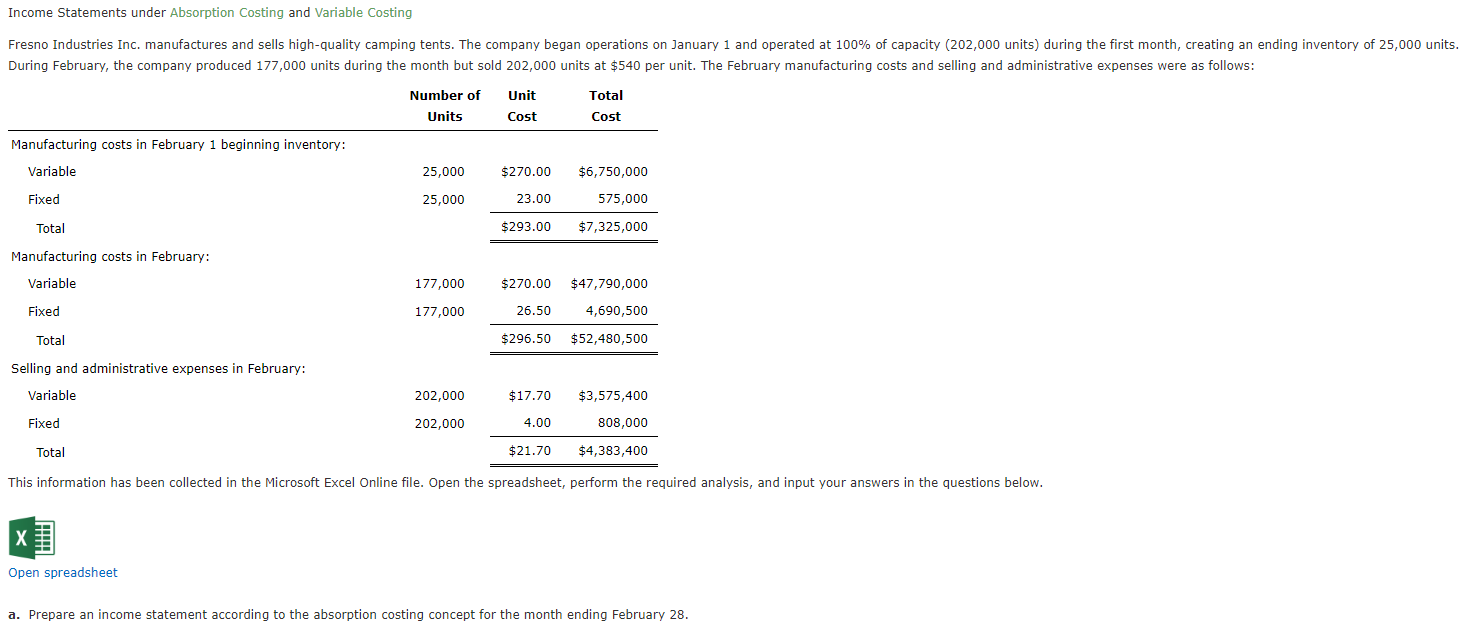

Income Statements under Absorption Costing and Variable Costing Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (202,000 units) during the first month, creating an ending inventory of 25,000 units. During February, the company produced 177,000 units during the month but sold 202,000 units at $540 per unit. The February manufacturing costs and selling and administrative expenses were as follows: Number of Units Unit Cost Total Cost Manufacturing costs in February 1 beginning inventory: Variable 25,000 $270.00 $6,750,000 Fixed 25,000 23.00 575,000 Total $293.00 $7,325,000 Manufacturing costs in February: Variable Fixed Total 177,000 177,000 26.50 $270.00 $47,790,000 4,690,500 $296.50 $52,480,500 Selling and administrative expenses in February: Variable Fixed 202,000 202,000 4.00 Total $21.70 $17.70 $3,575,400 808,000 $4,383,400 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Prepare an income statement according to the absorption costing concept for the month ending February 28.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started