Answered step by step

Verified Expert Solution

Question

1 Approved Answer

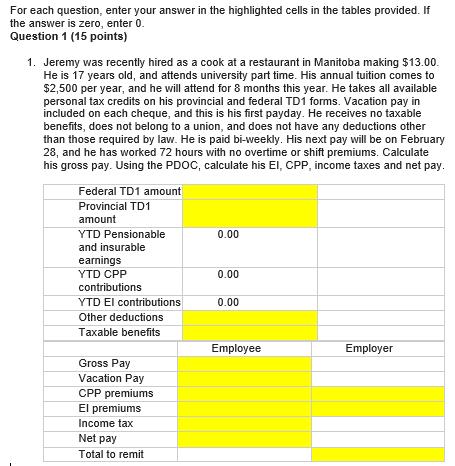

For each question, enter your answer in the highlighted cells in the tables provided. If the answer is zero, enter 0. Question 1 (15

For each question, enter your answer in the highlighted cells in the tables provided. If the answer is zero, enter 0. Question 1 (15 points) 1. Jeremy was recently hired as a cook at a restaurant in Manitoba making $13.00. He is 17 years old, and attends university part time. His annual tuition comes to $2,500 per year, and he will attend for 8 months this year. He takes all available personal tax credits on his provincial and federal TD1 forms. Vacation pay in included on each cheque, and this is his first payday. He receives no taxable benefits, does not belong to a union, and does not have any deductions other than those required by law. He is paid bi-weekly. His next pay will be on February 28, and he has worked 72 hours with no overtime or shift premiums. Calculate his gross pay. Using the PDOC, calculate his EI, CPP, income taxes and net pay. Federal TD1 amount Provincial TD1 amount YTD Pensionable and insurable earnings YTD CPP contributions YTD El contributions Other deductions Taxable benefits Gross Pay Vacation Pay CPP premiums El premiums Income tax Net pay Total to remit 0.00 0.00 0.00 Employee Employer

Step by Step Solution

★★★★★

3.60 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Federal TD1 amount 11809 Provincial TD1 amount 9354 YTD Pensionable and insurable earnings 1080 YTD ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started