Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jershey, a chocolate candy manufacturer based in New Jersey, has decided to expand its production line. In order to launch their newest product in

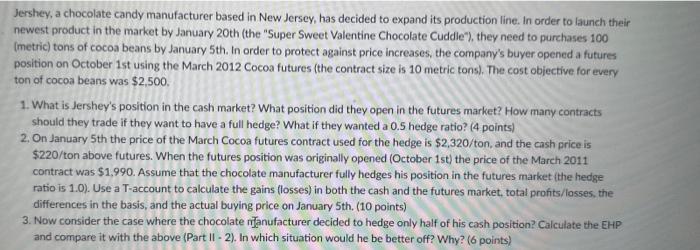

Jershey, a chocolate candy manufacturer based in New Jersey, has decided to expand its production line. In order to launch their newest product in the market by January 20th (the "Super Sweet Valentine Chocolate Cuddle"), they need to purchases 100 (metric) tons of cocoa beans by January 5th. In order to protect against price increases, the company's buyer opened a futures position on October 1st using the March 2012 Cocoa futures (the contract size is 10 metric tons). The cost objective for every ton of cocoa beans was $2,500. 1. What is Jershey's position in the cash market? What position did they open in the futures market? How many contracts should they trade if they want to have a full hedge? What if they wanted a 0.5 hedge ratio? (4 points) 2. On January 5th the price of the March Cocoa futures contract used for the hedge is $2,320/ton, and the cash price is $220/ton above futures. When the futures position was originally opened (October 1st) the price of the March 2011 contract was $1,990. Assume that the chocolate manufacturer fully hedges his position in the futures market (the hedge ratio is 1.0). Use a T-account to calculate the gains (losses) in both the cash and the futures market, total profits/losses, the differences in the basis, and the actual buying price on January 5th. (10 points) 3. Now consider the case where the chocolate manufacturer decided to hedge only half of his cash position? Calculate the EHP and compare it with the above (Part II - 2). In which situation would he be better off? Why? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Jersheys Position Cash Market Long position in cocoa beans Futures Market Short position in March ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started