Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kincaid Company owns equipment with a cost of $365,700 and accumulated depreciation of $53,700 that can be sold for $274,900, less a 5% sales

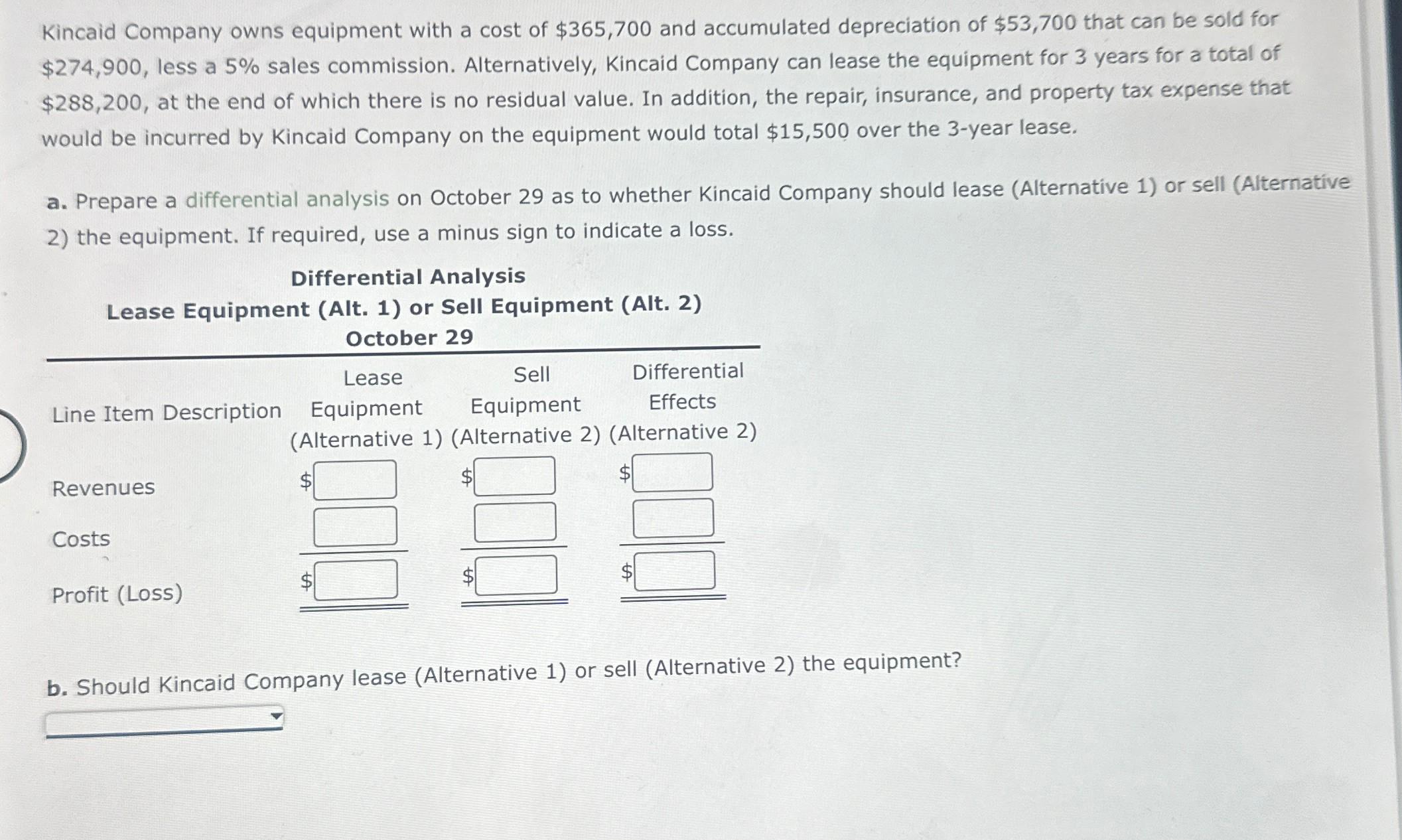

Kincaid Company owns equipment with a cost of $365,700 and accumulated depreciation of $53,700 that can be sold for $274,900, less a 5% sales commission. Alternatively, Kincaid Company can lease the equipment for 3 years for a total of $288,200, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Kincaid Company on the equipment would total $15,500 over the 3-year lease. a. Prepare a differential analysis on October 29 as to whether Kincaid Company should lease (Alternative 1) or sell (Alternative 2) the equipment. If required, use a minus sign to indicate a loss. Differential Analysis Lease Equipment (Alt. 1) or Sell Equipment (Alt. 2) October 29 Lease Line Item Description Equipment Sell Equipment Differential Effects (Alternative 1) (Alternative 2) (Alternative 2) $ Revenues Costs Profit (Loss) b. Should Kincaid Company lease (Alternative 1) or sell (Alternative 2) the equipment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started