Question

Lauter Tun Corporation acquired equipment on January 1, 2017, for $300,000. The equipment had an estimated useful life of 10 years and an estimated

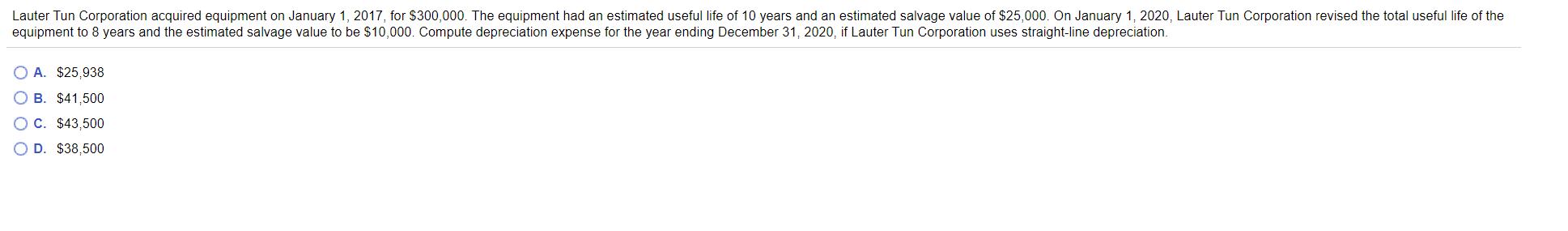

Lauter Tun Corporation acquired equipment on January 1, 2017, for $300,000. The equipment had an estimated useful life of 10 years and an estimated salvage value of $25,000. On January 1, 2020, Lauter Tun Corporation revised the total useful life of the equipment to 8 years and the estimated salvage value to be $10,000. Compute depreciation expense for the year ending December 31, 2020, if Lauter Tun Corporation uses straight-line depreciation. O A. $25,938 B. $41,500 C. $43,500 O D. $38,500

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation per yearCostResidual v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

7th edition

978-0077614041, 9780077446475, 77614046, 007744647X, 77647092, 978-0077647094

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App