Answered step by step

Verified Expert Solution

Question

1 Approved Answer

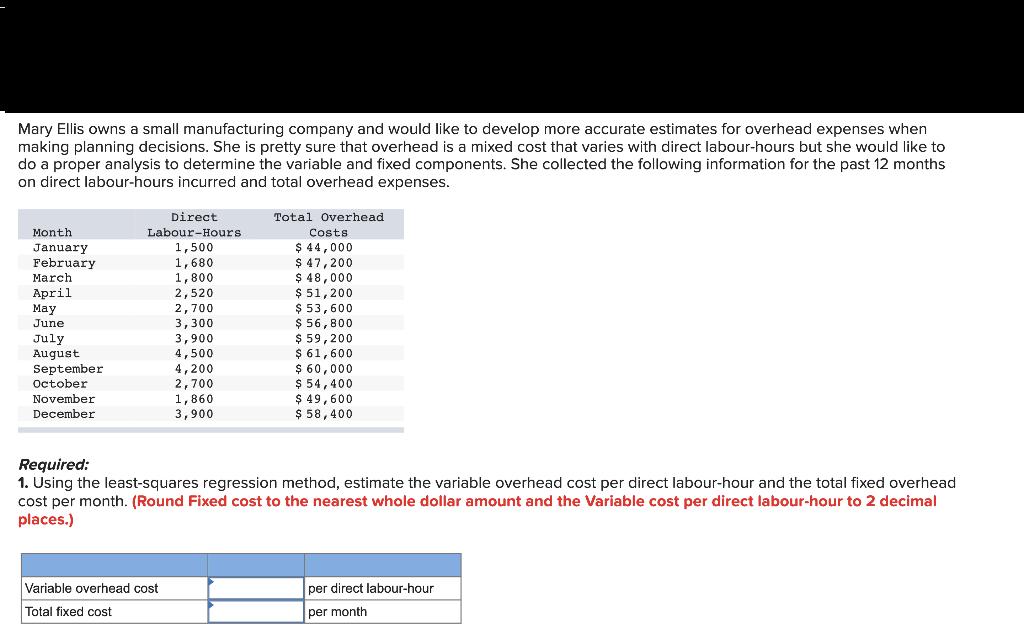

Mary Ellis owns a small manufacturing company and would like to develop more accurate estimates for overhead expenses when making planning decisions. She is

Mary Ellis owns a small manufacturing company and would like to develop more accurate estimates for overhead expenses when making planning decisions. She is pretty sure that overhead is a mixed cost that varies with direct labour-hours but she would like to do a proper analysis to determine the variable and fixed components. She collected the following information for the past 12 months on direct labour-hours incurred and total overhead expenses. Direct Labour-Hours 1,500 1,680 $ 47,200 1,800 $ 48,000 2,520 $ 51,200 2,700 $ 53,600 ETT 3,300 $ 56,800 3,900 $ 59,200 4,500 $ 61,600 4,200 $ 60,000 2,700 $ 54,400 1,860 3,900 Month January February March April May June July August September October November December Total Overhead Variable overhead cost Total fixed cost Costs $ 44,000 $ 49,600 $ 58,400 Required: 1. Using the least-squares regression method, estimate the variable overhead cost per direct labour-hour and the total fixed overhead cost per month. (Round Fixed cost to the nearest whole dollar amount and the Variable cost per direct labour-hour to 2 decimal places.) per direct labour-hour per month 2. Express the cost data derived in part 1 above in the form Y= a + bx. (Round Fixed cost to the nearest whole dollar amount and the Variable cost to 2 decimal places.) Y = X 3. Using the cost formula stated in part 2, estimate total overhead costs for a month where direct labour-hours are expected to be 3,900. (Round your Variable cost per direct labor hour to 2 decimal places and round your final answer to the nearest whole dollar amount.) Total overhead costs

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Variable Overhead cost Total fixed cost 2 Y 3 Total overhead costs Working notes Calculation of to...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started