Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maryanne is a non-Scottish taxpayer and received the following incomes during the tax year 2021-22: Gross salary from employment (PAYE deducted at source 3,100)

Maryanne is a non-Scottish taxpayer and received the following incomes during the tax year 2021-22:

• Gross salary from employment (PAYE deducted at source £3,100) £32,000

• Bank interest of £2,160

• Dividends of £2,500

• Gross qualifying charitable donation £900

Required: Calculate Maryanne’s income tax payable for the tax year 2021-22.

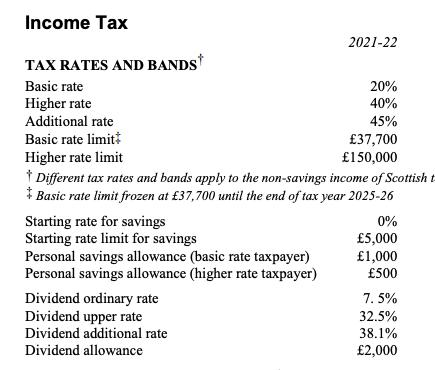

Income Tax 2021-22 TAX RATES AND BANDS 20% Basic rate Higher rate Additional rate 40% 45% Basic rate limit 37,700 Higher rate limit 150,000 * Different tax rates and bands apply to the non-savings income of Scottish t Basic rate limit frozen at 37,700 until the end of tax year 2025-26 0% Starting rate for savings Starting rate limit for savings 5,000 1,000 Personal savings allowance (basic rate taxpayer) Personal savings allowance (higher rate taxpayer) 500 7.5% Dividend ordinary rate Dividend upper rate Dividend additional rate 32.5% 38.1% Dividend allowance 2,000

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Description Gross Salary Bank Interest Dividends Cash receipt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started