Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Matt and Skye Moriarty are a married couple who file a joint tax return. Matt is 66. Skye is 40. They got married five

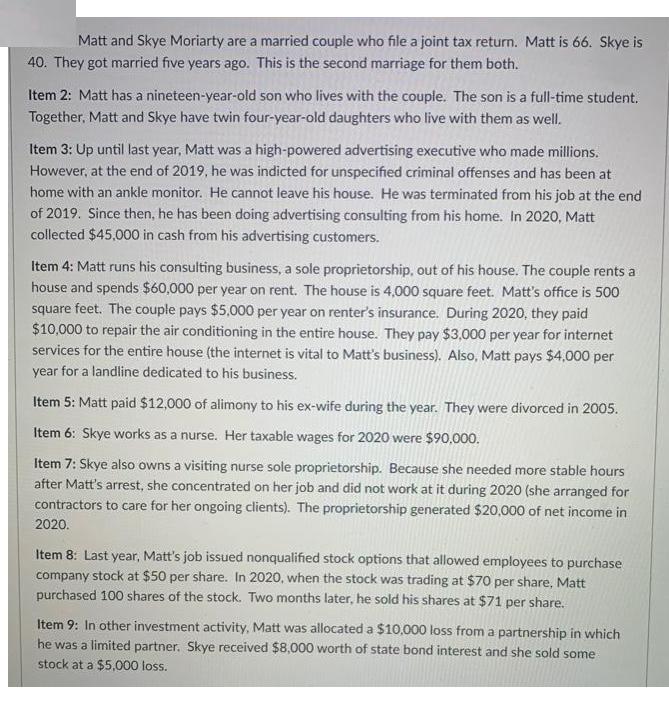

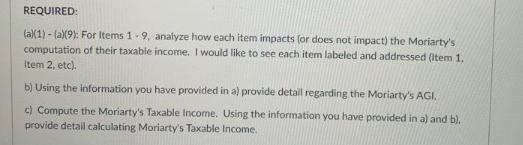

Matt and Skye Moriarty are a married couple who file a joint tax return. Matt is 66. Skye is 40. They got married five years ago. This is the second marriage for them both. Item 2: Matt has a nineteen-year-old son who lives with the couple. The son is a full-time student. Together, Matt and Skye have twin four-year-old daughters who live with them as well. Item 3: Up until last year, Matt was a high-powered advertising executive who made millions. However, at the end of 2019, he was indicted for unspecified criminal offenses and has been at home with an ankle monitor. He cannot leave his house. He was terminated from his job at the end of 2019. Since then, he has been doing advertising consulting from his home. In 2020, Matt collected $45,000 in cash from his advertising customers. Item 4: Matt runs his consulting business, a sole proprietorship, out of his house. The couple rents a house and spends $60,000 per year on rent. The house is 4,000 square feet. Matt's office is 500 square feet. The couple pays $5,000 per year on renter's insurance. During 2020, they paid $10,000 to repair the air conditioning in the entire house. They pay $3,000 per year for internet services for the entire house (the internet is vital to Matt's business). Also, Matt pays $4,000 per year for a landline dedicated to his business. Item 5: Matt paid $12,000 of alimony to his ex-wife during the year. They were divorced in 2005. Item 6: Skye works as a nurse. Her taxable wages for 2020 were $90,000. Item 7: Skye also owns a visiting nurse sole proprietorship. Because she needed more stable hours after Matt's arrest, she concentrated on her job and did not work at it during 2020 (she arranged for contractors to care for her ongoing clients). The proprietorship generated $20,000 of net income in 2020. Item 8: Last year, Matt's job issued nonqualified stock options that allowed employees to purchase company stock at $50 per share. In 2020, when the stock was trading at $70 per share, Matt purchased 100 shares of the stock. Two months later, he sold his shares at $71 per share. Item 9: In other investment activity, Matt was allocated a $10,000 loss from a partnership in which he was a limited partner. Skye received $8,000 worth of state bond interest and she sold some stock at a $5,000 loss. REQUIRED: (a)(1)-(a)(9): For Items 19, analyze how each item impacts (or does not impact) the Moriarty's computation of their taxable income. I would like to see each item labeled and addressed (item 1. Item 2, etc). b) Using the information you have provided in a) provide detail regarding the Moriarty's AGI. c) Compute the Moriarty's Taxable Income. Using the information you have provided in a) and b). provide detail calculating Moriarty's Taxable Income.

Step by Step Solution

★★★★★

3.41 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

a Item 1 This item does not have an impact on the Moriartys computation of taxable income Item 2 Thi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started