Question

Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm

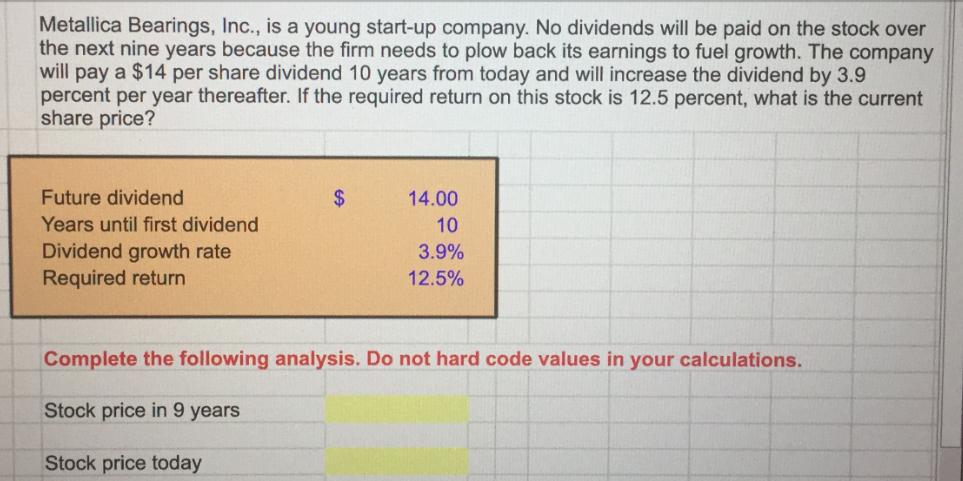

Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a $14 per share dividend 10 years from today and will increase the dividend by 3.9 percent per year thereafter. If the required return on this stock is 12.5 percent, what is the current share price? Future dividend Years until first dividend Dividend growth rate Required return $ 14.00 10 3.9% 12.5% Complete the following analysis. Do not hard code values in your calculations. Stock price in 9 years Stock price today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the current share price stock price today we need to find the present value of all futu...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started