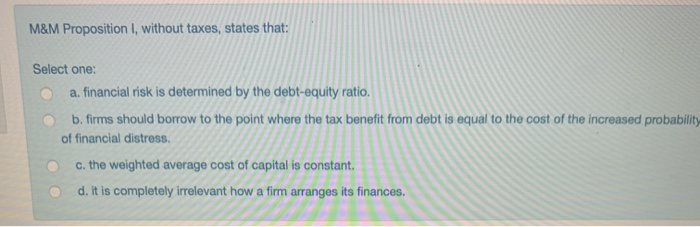

Question: M&M Proposition I, without taxes, states that: Select one: a. financial risk is determined by the debt-equity ratio. b. firms should borrow to the point

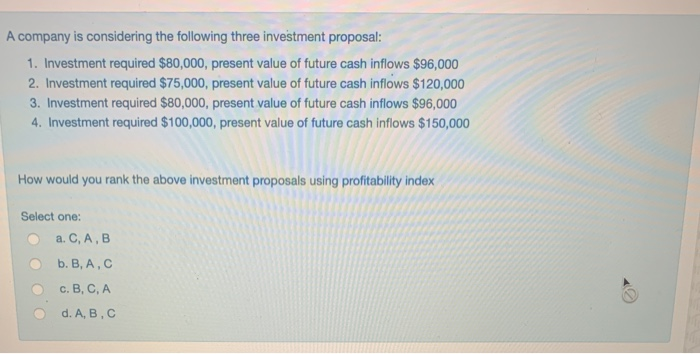

M&M Proposition I, without taxes, states that: Select one: a. financial risk is determined by the debt-equity ratio. b. firms should borrow to the point where the tax benefit from debt is equal to the cost of the increased probability of financial distress c. the weighted average cost of capital is constant. d. It is completely irrelevant how a firm arranges its finances. A company is considering the following three investment proposal: 1. Investment required $80,000, present value of future cash inflows $96,000 2. Investment required $75,000, present value of future cash inflows $120,000 3. Investment required $80,000, present value of future cash inflows $96,000 4. Investment required $100,000, present value of future cash inflows $150,000 How would you rank the above investment proposals using profitability index Select one: a. C, A, B b.B.A.C c. B, C, A d. A, B, C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts