Question

Moira's Fruit Wine is planning to expand the amount of wine bottle inventory they are holding, and are evaluating two plans to finance the

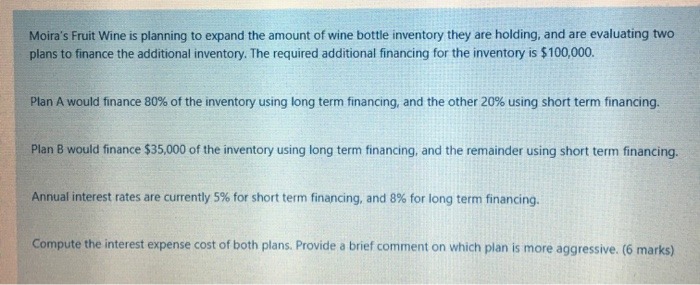

Moira's Fruit Wine is planning to expand the amount of wine bottle inventory they are holding, and are evaluating two plans to finance the additional inventory. The required additional financing for the inventory is $100,000. Plan A would finance 80% of the inventory using long term financing, and the other 20% using short term financing. Plan B would finance $35,000 of the inventory using long term financing, and the remainder using short term financing. Annual interest rates are currently 5% for short term financing, and 8% for long term financing. Compute the interest expense cost of both plans. Provide a brief comment on which plan is more aggressive. (6 marks)

Step by Step Solution

3.29 Rating (117 Votes )

There are 3 Steps involved in it

Step: 1

Interest Expense Cost of Each Plan Plan A Longterm financing 100000 80 80000 Sho...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started