Question

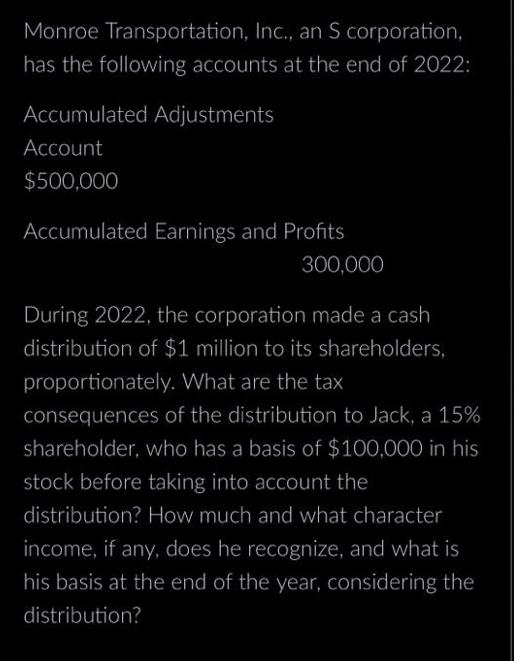

Monroe Transportation, Inc., an S corporation, has the following accounts at the end of 2022: Accumulated Adjustments Account $500,000 Accumulated Earnings and Profits 300,000

Monroe Transportation, Inc., an S corporation, has the following accounts at the end of 2022: Accumulated Adjustments Account $500,000 Accumulated Earnings and Profits 300,000 During 2022, the corporation made a cash distribution of $1 million to its shareholders, proportionately. What are the tax consequences of the distribution to Jack, a 15% shareholder, who has a basis of $100,000 in his stock before taking into account the distribution? How much and what character income, if any, does he recognize, and what is his basis at the end of the year, considering the distribution?

Step by Step Solution

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

In order to determine the tax consequences of the cash distribution to Jack we need to calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App