Question

Mr. Akhil, is 45-year-old man. He is the CEO of a big company. He has one son and one daughter. His son Aditya is

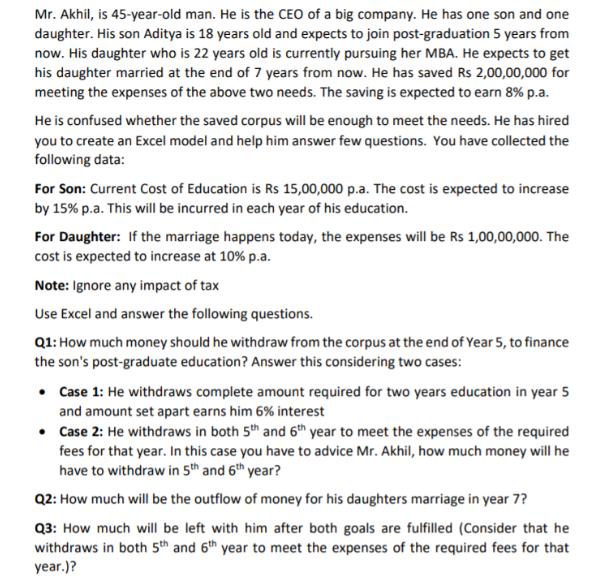

Mr. Akhil, is 45-year-old man. He is the CEO of a big company. He has one son and one daughter. His son Aditya is 18 years old and expects to join post-graduation 5 years from now. His daughter who is 22 years old is currently pursuing her MBA. He expects to get his daughter married at the end of 7 years from now. He has saved Rs 2,00,00,000 for meeting the expenses of the above two needs. The saving is expected to earn 8% p.a. He is confused whether the saved corpus will be enough to meet the needs. He has hired you to create an Excel model and help him answer few questions. You have collected the following data: For Son: Current Cost of Education is Rs 15,00,000 p.a. The cost is expected to increase by 15% p.a. This will be incurred in each year of his education. For Daughter: If the marriage happens today, the expenses will be Rs 1,00,00,000. The cost is expected to increase at 10% p.a. Note: Ignore any impact of tax Use Excel and answer the following questions. Q1: How much money should he withdraw from the corpus at the end of Year 5, to finance the son's post-graduate education? Answer this considering two cases: Case 1: He withdraws complete amount required for two years education in year 5 and amount set apart earns him 6% interest Case 2: He withdraws in both 5th and 6th year to meet the expenses of the required fees for that year. In this case you have to advice Mr. Akhil, how much money will he have to withdraw in 5th and 6th year? Q2: How much will be the outflow of money for his daughters marriage in year 7? Q3: How much will be left with him after both goals are fulfilled (Consider that he withdraws in both 5th and 6th year to meet the expenses of the required fees for that year.)? Mr. Akhil, is 45-year-old man. He is the CEO of a big company. He has one son and one daughter. His son Aditya is 18 years old and expects to join post-graduation 5 years from now. His daughter who is 22 years old is currently pursuing her MBA. He expects to get his daughter married at the end of 7 years from now. He has saved Rs 2,00,00,000 for meeting the expenses of the above two needs. The saving is expected to earn 8% p.a. He is confused whether the saved corpus will be enough to meet the needs. He has hired you to create an Excel model and help him answer few questions. You have collected the following data: For Son: Current Cost of Education is Rs 15,00,000 p.a. The cost is expected to increase by 15% p.a. This will be incurred in each year of his education. For Daughter: If the marriage happens today, the expenses will be Rs 1,00,00,000. The cost is expected to increase at 10% p.a. Note: Ignore any impact of tax Use Excel and answer the following questions. Q1: How much money should he withdraw from the corpus at the end of Year 5, to finance the son's post-graduate education? Answer this considering two cases: Case 1: He withdraws complete amount required for two years education in year 5 and amount set apart earns him 6% interest Case 2: He withdraws in both 5th and 6th year to meet the expenses of the required fees for that year. In this case you have to advice Mr. Akhil, how much money will he have to withdraw in 5th and 6th year? Q2: How much will be the outflow of money for his daughters marriage in year 7? Q3: How much will be left with him after both goals are fulfilled (Consider that he withdraws in both 5th and 6th year to meet the expenses of the required fees for that year.)?

Step by Step Solution

3.10 Rating (124 Votes )

There are 3 Steps involved in it

Step: 1

For Q1 Case 1 Calculate the future value of the required amount for two y...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started