Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Brooks, a local builder specialized in multi-story buildings, made this arrangement to convert his construction company into a trust after his death. Mr

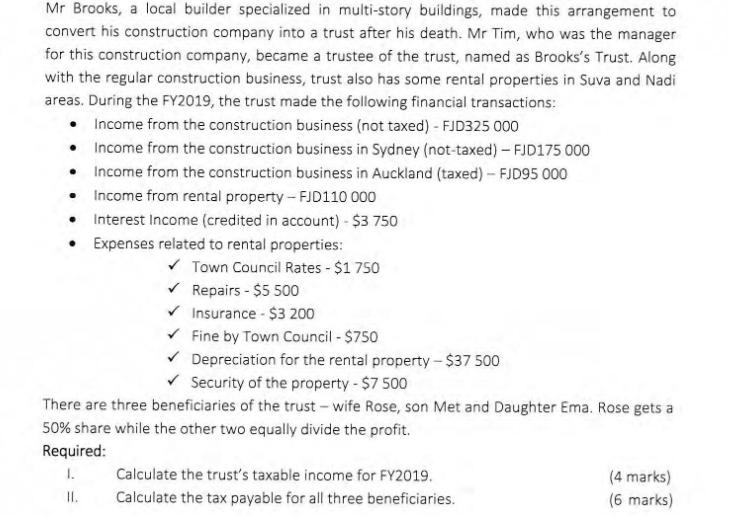

Mr Brooks, a local builder specialized in multi-story buildings, made this arrangement to convert his construction company into a trust after his death. Mr Tim, who was the manager for this construction company, became a trustee of the trust, named as Brooks's Trust. Along with the regular construction business, trust also has some rental properties in Suva and Nadi areas. During the FY2019, the trust made the following financial transactions: Income from the construction business (not taxed) - FJD325 000 Income from the construction business in Sydney (not-taxed) - FJD175 000 Income from the construction business in Auckland (taxed) - FJD95 000 Income from rental property - FJD110 000 Interest Income (credited in account) - $3 750 Expenses related to rental properties: Town Council Rates - $1 750 Repairs - $5 500 Insurance - $3 200 Fine by Town Council - $750 Depreciation for the rental property-$37 500 Security of the property - $7 500 There are three beneficiaries of the trust - wife Rose, son Met and Daughter Ema. Rose gets a 50% share while the other two equally divide the profit. Required: 1. II. Calculate the trust's taxable income for FY2019. Calculate the tax payable for all three beneficiaries. (4 marks) (6 marks) RATES OF NORMAL TAX RESIDENT INDIVIDUALS AND RESIDENT INDIVIDUAL TRUSTEES Year of Assessment 2018 and 2019 Chargeable Income ($) 0-30,000 30,001 - 50,000 50,001 - 270,000 270,001- 300,000 300,001- 350,000 350,001- 400,000 400,001- 450,000 450,001- 500,000 500,001- 1,000,000 1,000,001 + Tax Payable ($) Nil 18% of excess over $30,000 $3,600 + 20% of excess over $50,000 $47,600 + 20 of excess over $270,000 $53,600 + 20% of excess over $300,000 563,600 + 20% of excess over $350,000 $73,600 + 20% of excess over $400,000 $83,600 + 20% of excess over $450,000 $93,600 + 20% of excess over $500,000 $193,600 + 20% of excess over $1,000,000 SoCfal Responsibility Tax Nil Nil Nil 13% of excess over $270,000 $3,900 + 14% of excess over $300,000 $10,900 + 15% of excess over 350,000 $18,400 + 16% of excess over $400,000 526,400 + 17% of excess over $450,000 $34,900 + 18% of excess over $500,000 $124,900 + 19% of excess over $1,000,000 Environment and Climate Adaptation Levy (ECAL) Nil Nil Nil 10% of excess over $270,000 10% of excess over $270,000 10% of excess over $270,000 10% of excess over $270,000 10% of excess over $270,000 10% of excess over $270,000 100 of excess over $270,000

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started