Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Sham is a Malaysian citizen. He owns a bungalow which was transferred to him from his grandfather, Mr Soon, as a birthday gift

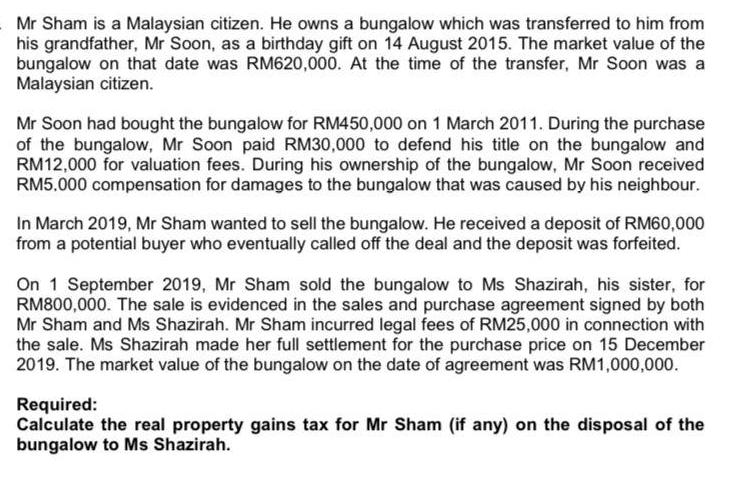

Mr Sham is a Malaysian citizen. He owns a bungalow which was transferred to him from his grandfather, Mr Soon, as a birthday gift on 14 August 2015. The market value of the bungalow on that date was RM620,000. At the time of the transfer, Mr Soon was a Malaysian citizen. Mr Soon had bought the bungalow for RM450,000 on 1 March 2011. During the purchase of the bungalow, Mr Soon paid RM30,000 to defend his title on the bungalow and RM12,000 for valuation fees. During his ownership of the bungalow, Mr Soon received RM5.000 compensation for damages to the bungalow that was caused by his neighbour. In March 2019, Mr Sham wanted to sell the bungalow. He received a deposit of RM60,000 from a potential buyer who eventually called off the deal and the deposit was forfeited. On 1 September 2019, Mr Sham sold the bungalow to Ms Shazirah, his sister, for RM800,000. The sale is evidenced in the sales and purchase agreement signed by both Mr Sham and Ms Shazirah. Mr Sham incurred legal fees of RM25,000 in connection with the sale. Ms Shazirah made her full settlement for the purchase price on 15 December 2019. The market value of the bungalow on the date of agreement was RM1,000,000. Required: Calculate the real property gains tax for Mr Sham (if any) on the disposal of the bungalow to Ms Shazirah.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Ans As it is a gifted property the cost incurred by previous owner is the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started