Question: Ms. Neha submits following details for her income for the assessment year 2020-21. Compute the gross total income after considering the relevant provisions of set

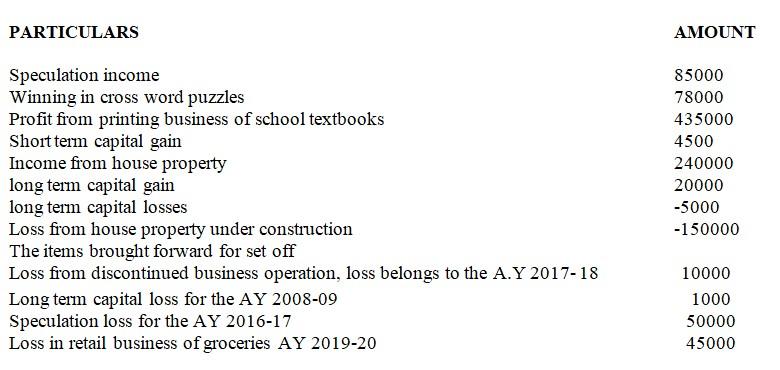

Ms. Neha submits following details for her income for the assessment year 2020-21. Compute the gross total income after considering the relevant provisions of set off and carry forward of losses

a. Calculate income from Business and Profession (5 Marks)

b. Calculate income under the head of House Property, income from other sources and capital gai

PARTICULARS AMOUNT Speculation income Winning in cross word puzzles Profit from printing business of school textbooks Short term capital gain Income from house property long term capital gain long term capital losses Loss from house property under construction The items brought forward for set off Loss from discontinued business operation, loss belongs to the A.Y 2017-18 85000 78000 435000 4500 240000 20000 -5000 -150000 10000 Long term capital loss for the AY 2008-09 Speculation loss for the AY 2016-17 Loss in retail business of groceries AY 2019-20 1000 50000 45000

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts