Question

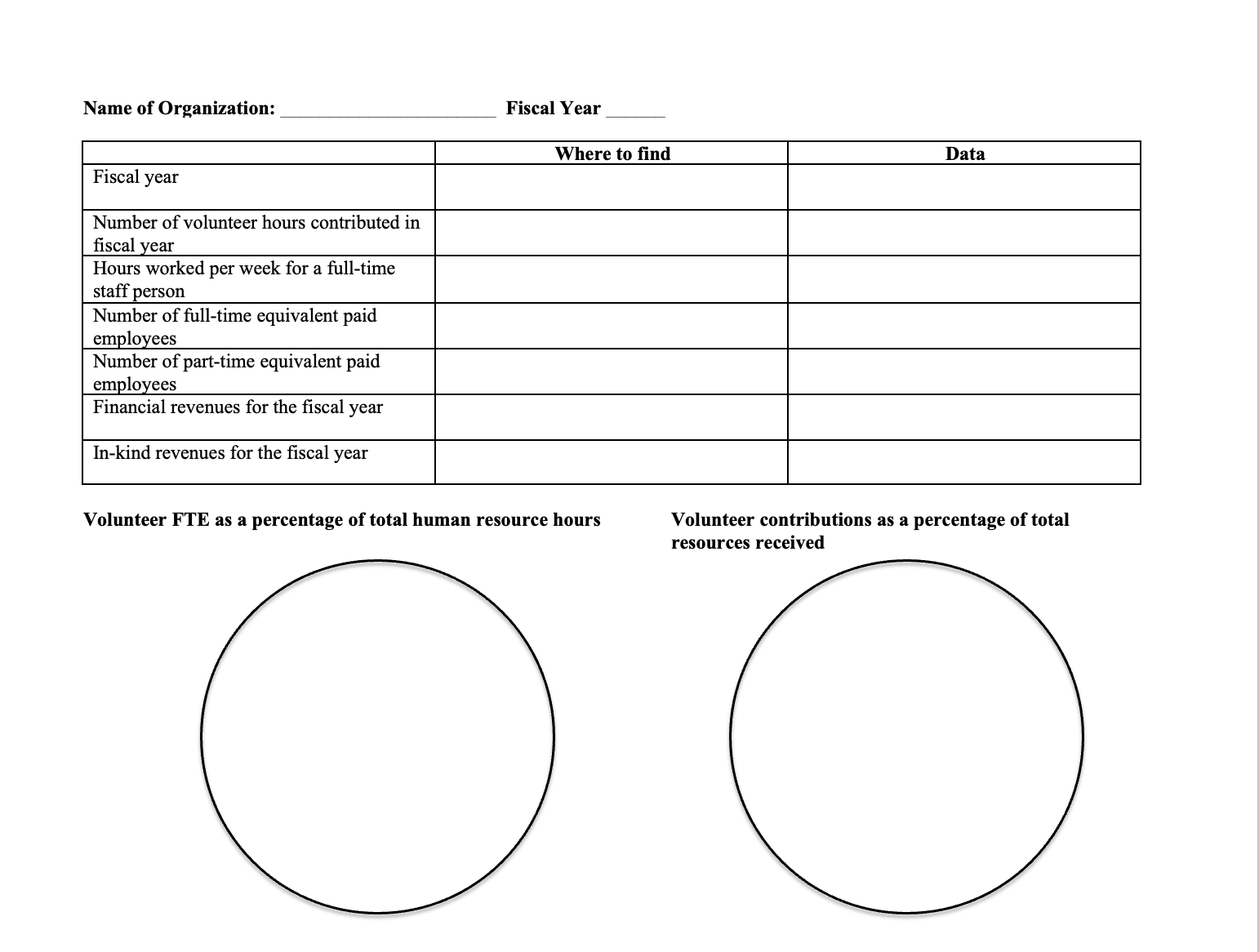

Name of Organization: Fiscal Year Where to find Data Fiscal year Number of volunteer hours contributed in fiscal year Hours worked per week for

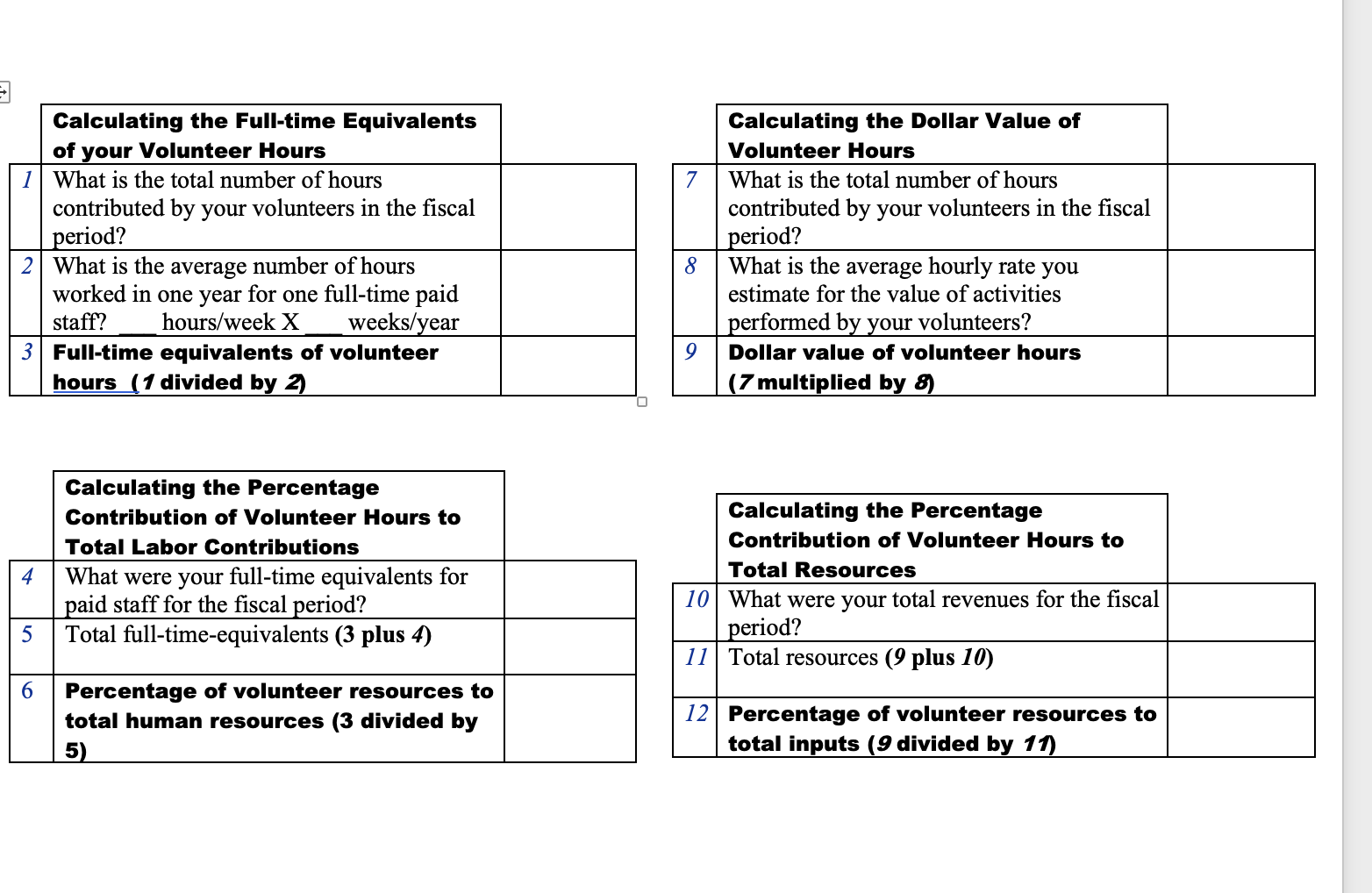

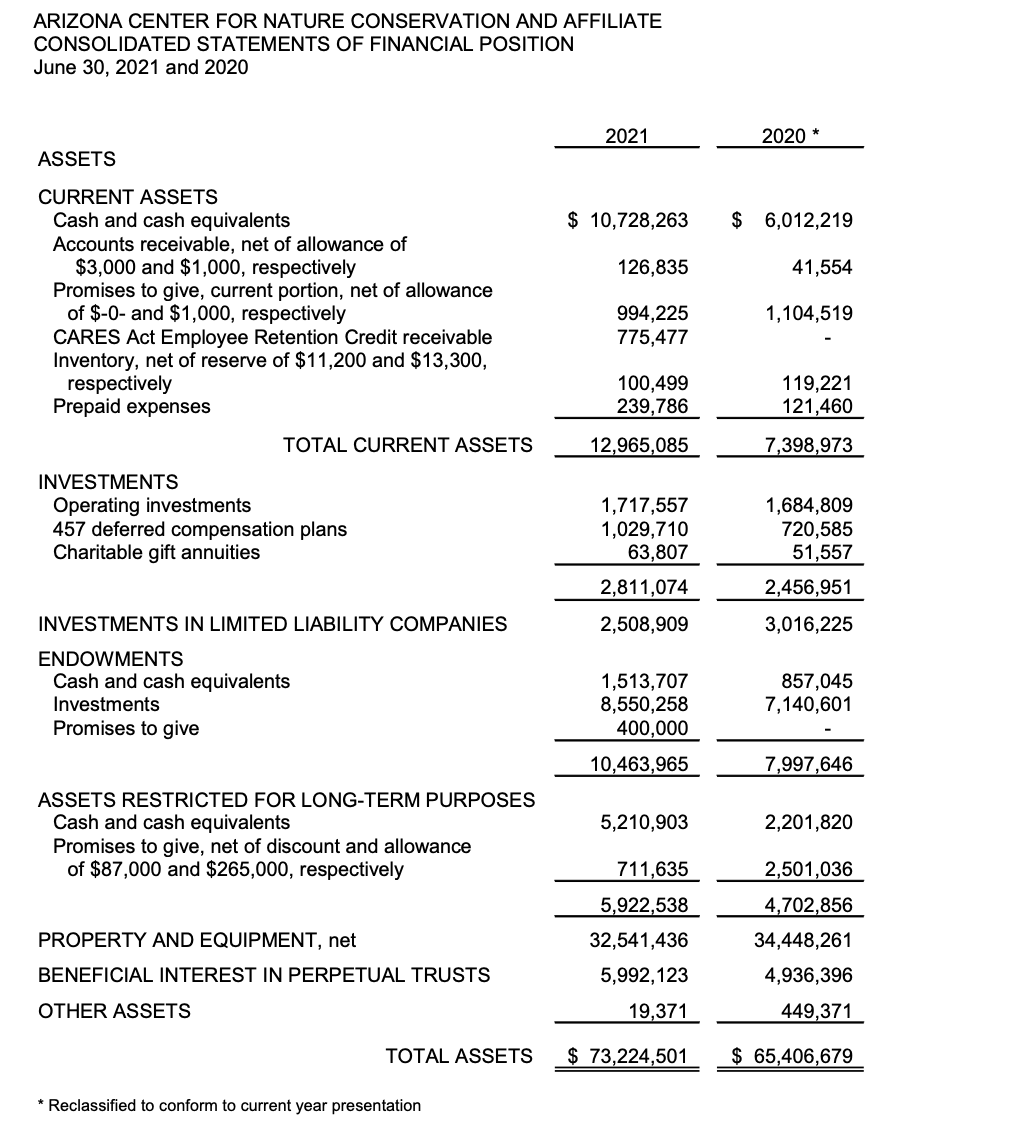

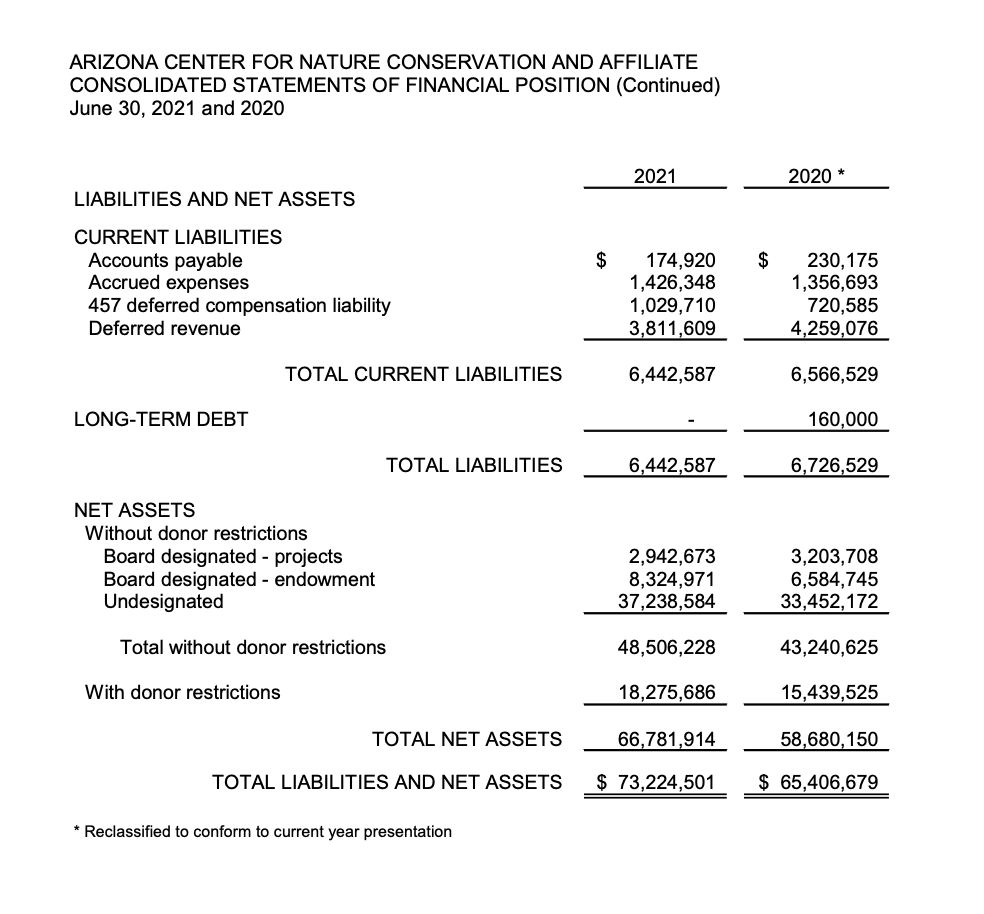

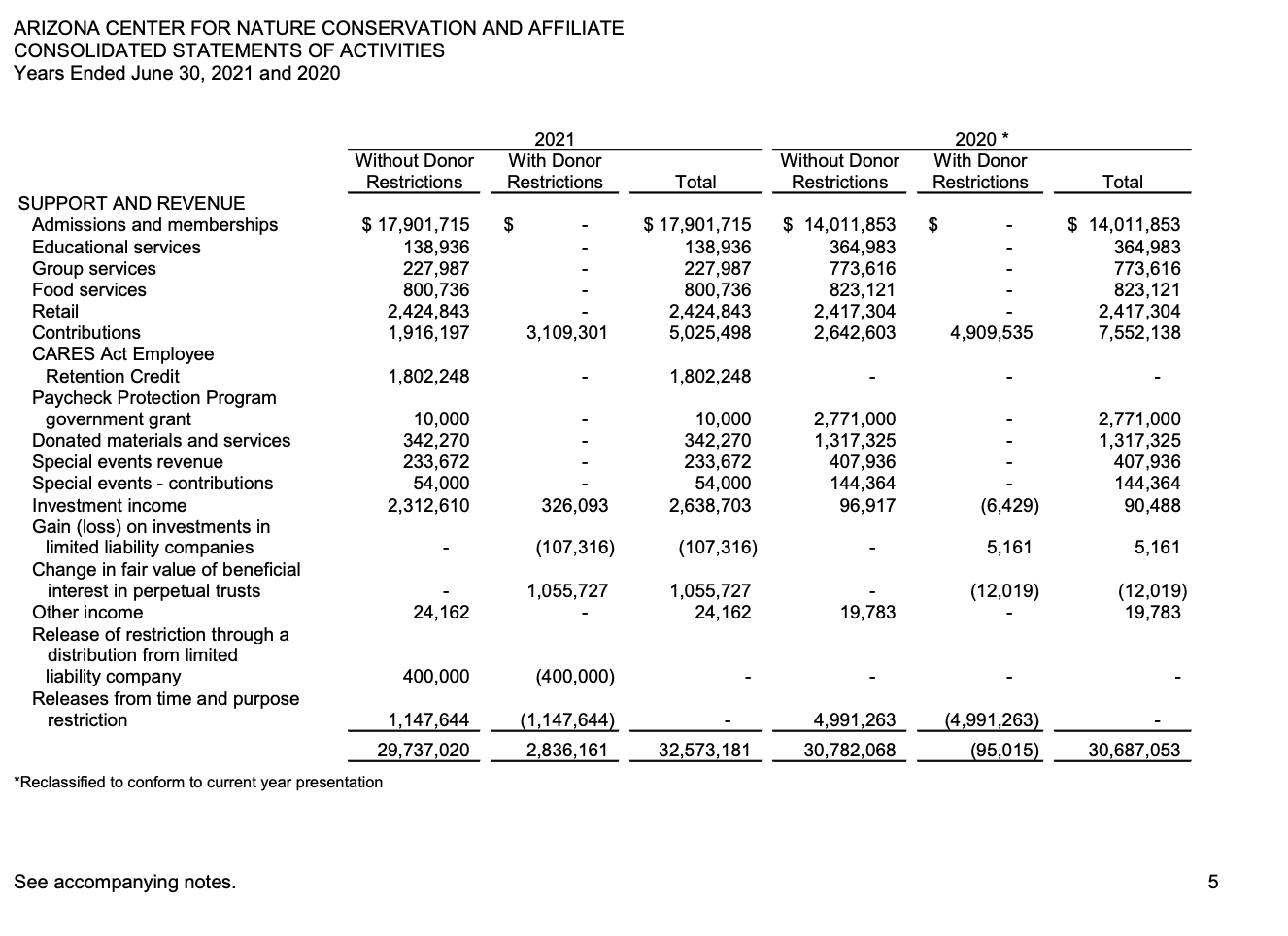

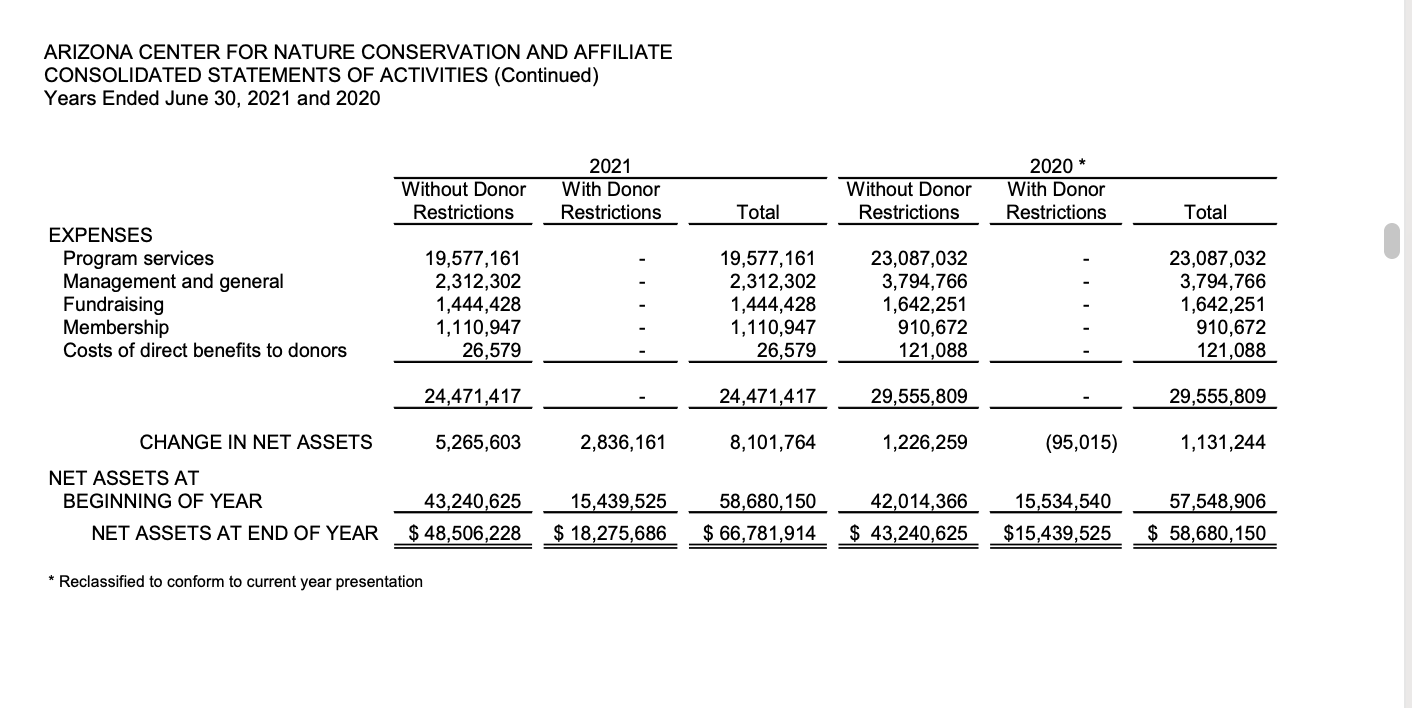

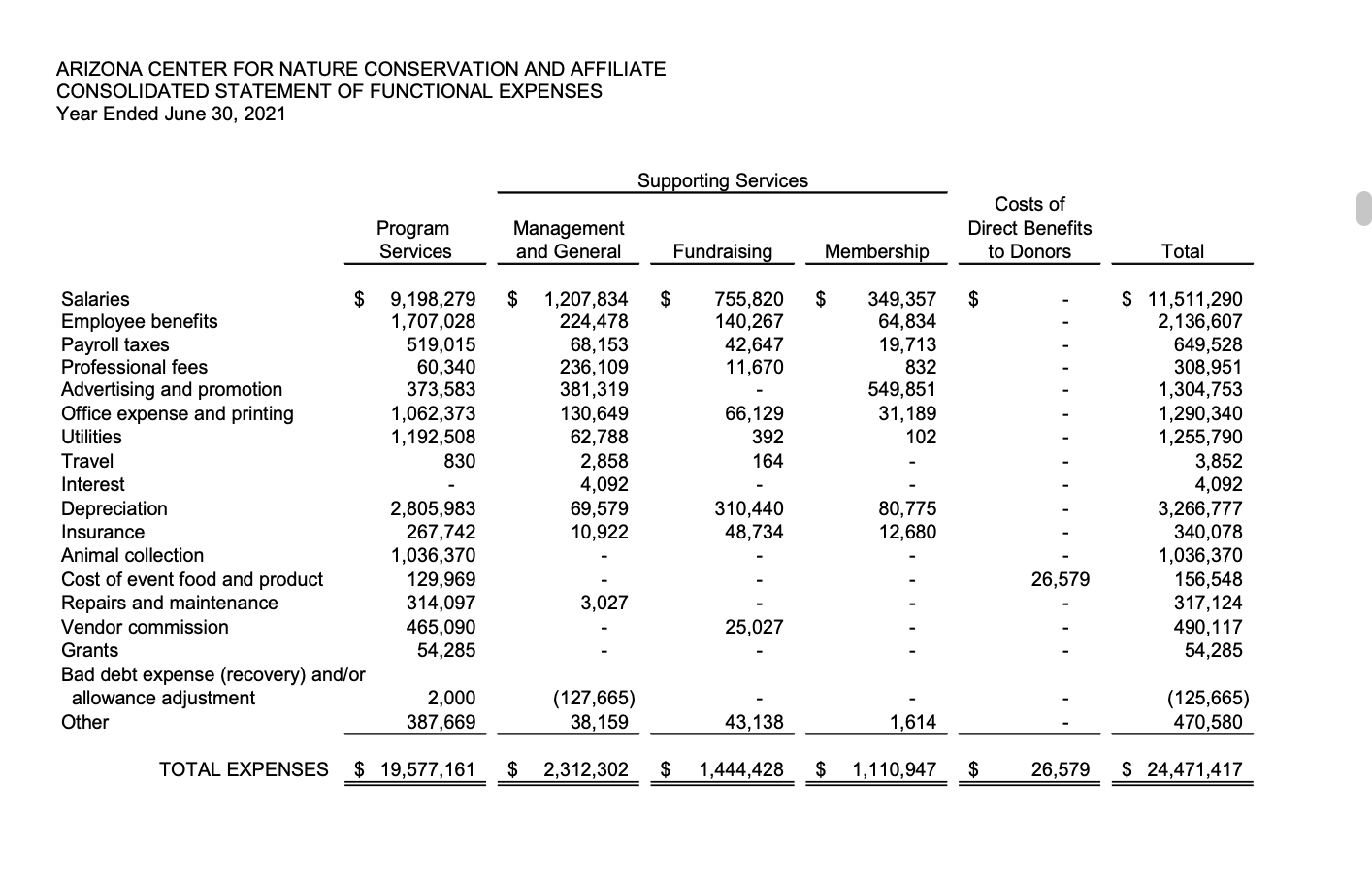

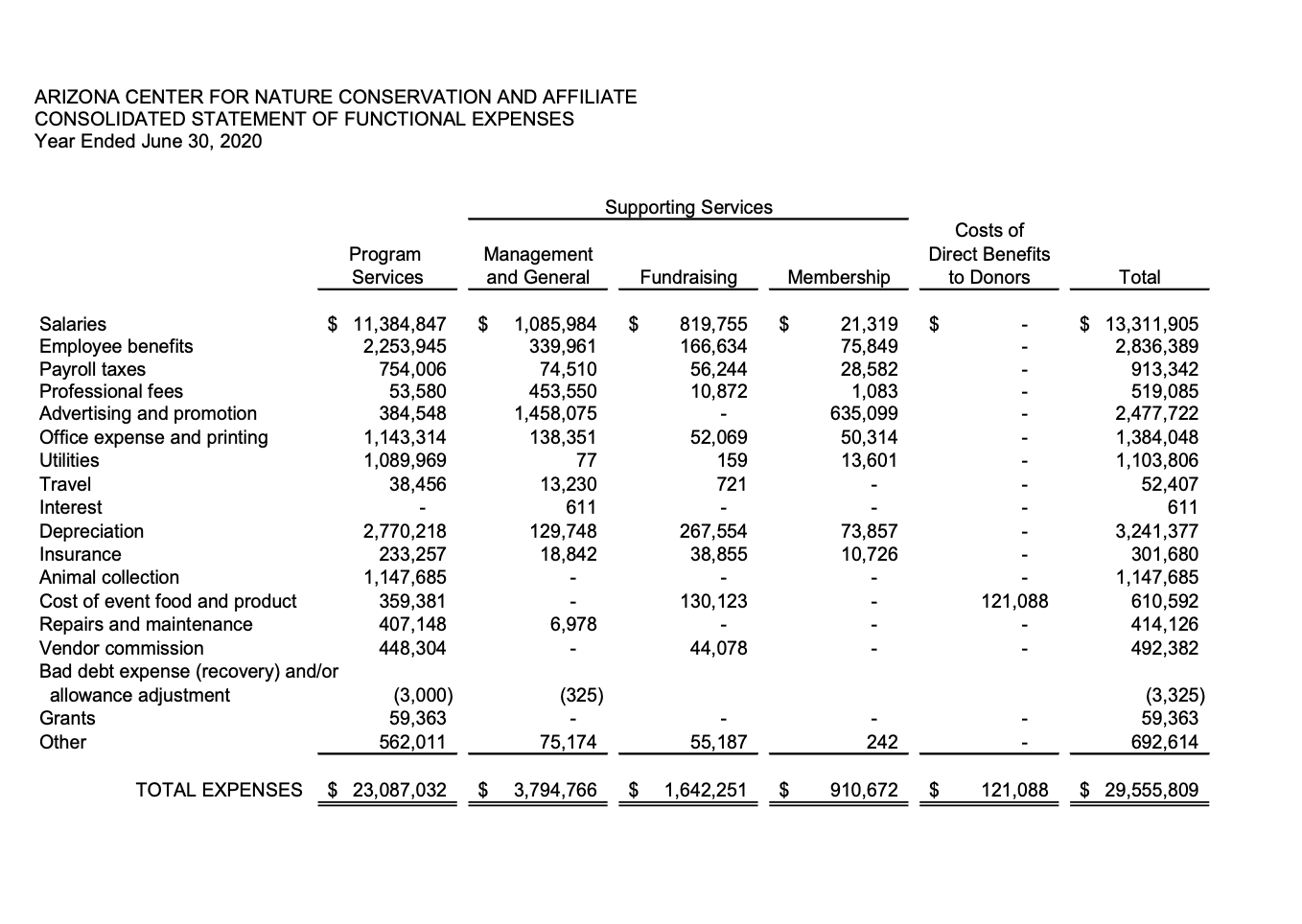

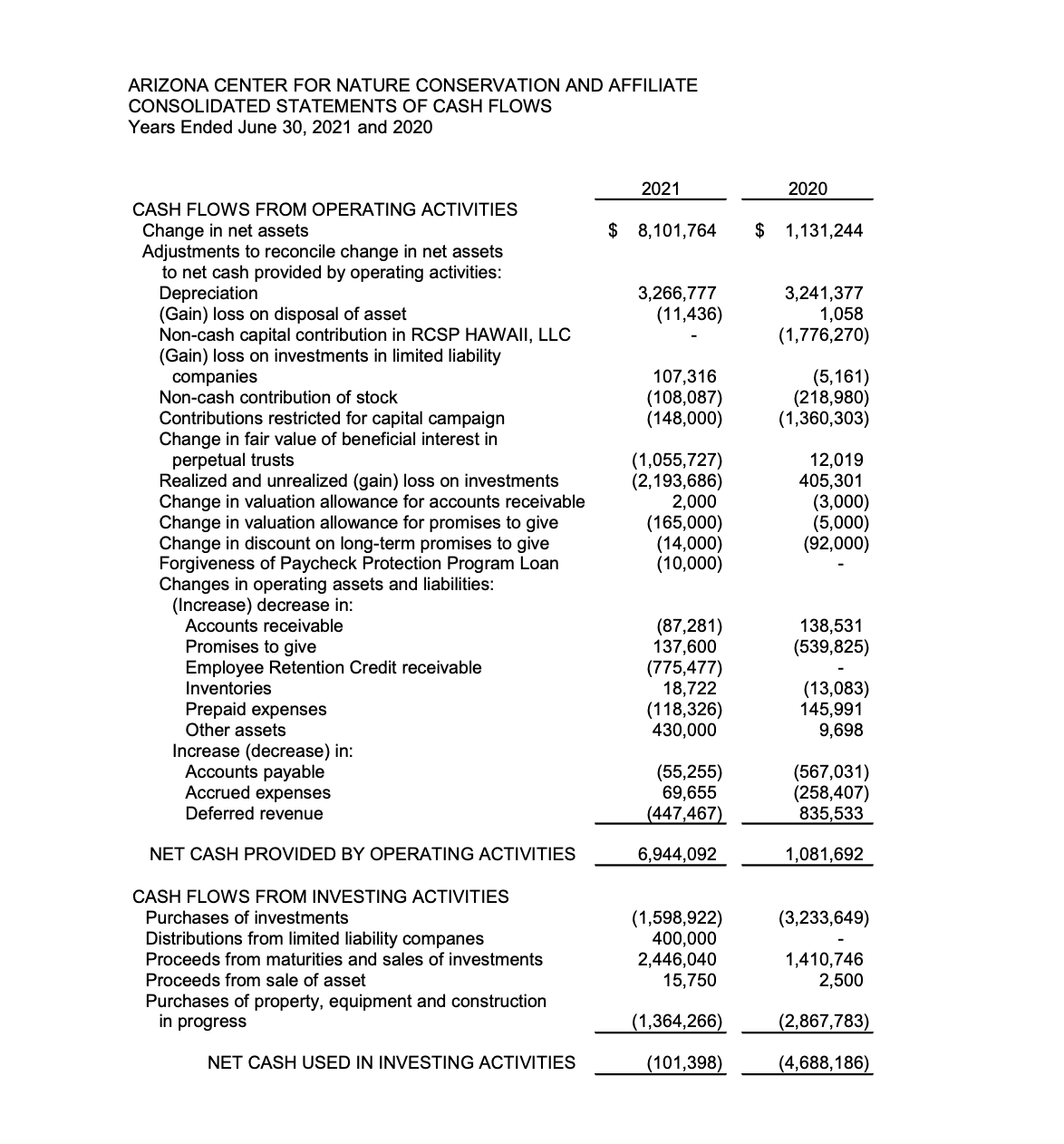

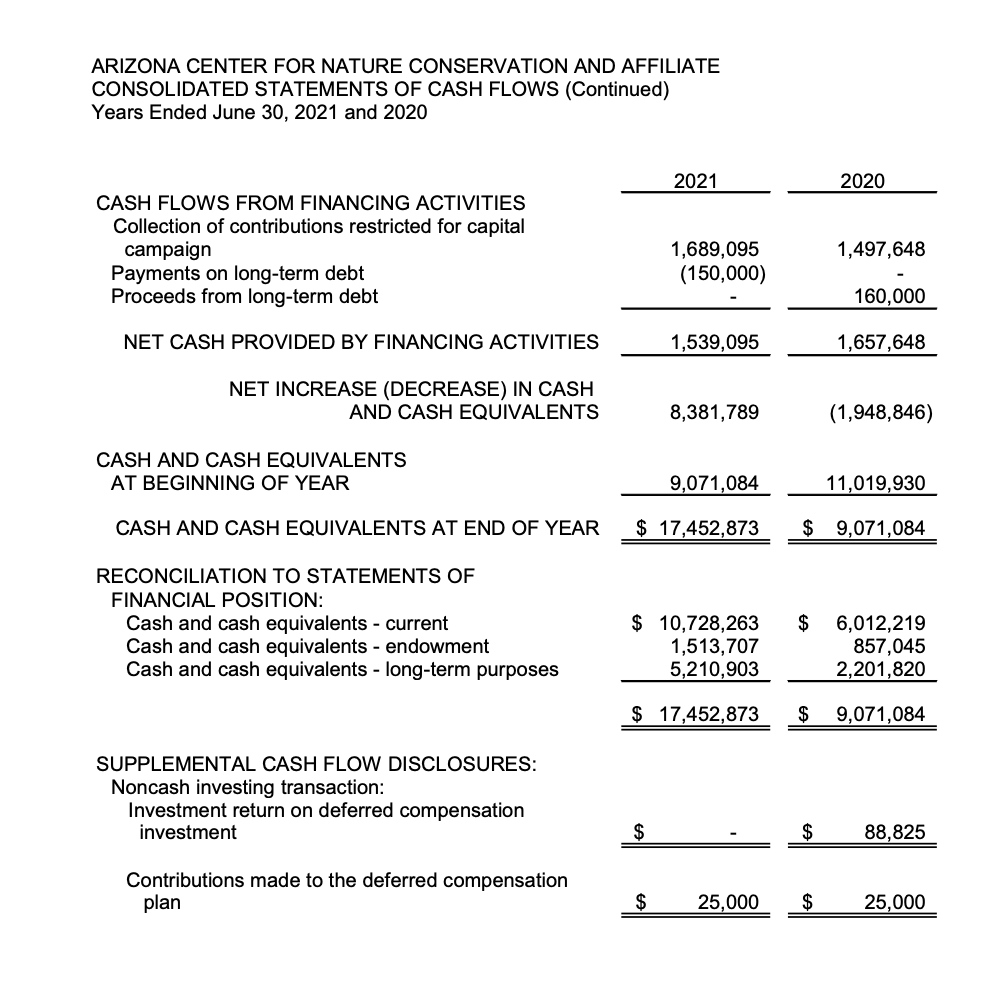

Name of Organization: Fiscal Year Where to find Data Fiscal year Number of volunteer hours contributed in fiscal year Hours worked per week for a full-time staff person Number of full-time equivalent paid employees Number of part-time equivalent paid employees Financial revenues for the fiscal year In-kind revenues for the fiscal year Volunteer FTE as a percentage of total human resource hours Volunteer contributions as a percentage of total resources received Calculating the Full-time Equivalents of your Volunteer Hours 1 What is the total number of hours contributed by your volunteers in the fiscal period? 2 What is the average number of hours worked in one year for one full-time paid staff? hours/week X weeks/year 3 Full-time equivalents of volunteer hours (1 divided by 2) 7 8 9 Calculating the Dollar Value of Volunteer Hours What is the total number of hours contributed by your volunteers in the fiscal period? What is the average hourly rate you estimate for the value of activities performed by your volunteers? Dollar value of volunteer hours (7 multiplied by 8) 4 5 6 Calculating the Percentage Contribution of Volunteer Hours to Total Labor Contributions What were your full-time equivalents for paid staff for the fiscal period? Total full-time-equivalents (3 plus 4) Percentage of volunteer resources to total human resources (3 divided by 5) Calculating the Percentage Contribution of Volunteer Hours to Total Resources 10 What were your total revenues for the fiscal period? 11 Total resources (9 plus 10) 12 Percentage of volunteer resources to total inputs (9 divided by 11) ARIZONA CENTER FOR NATURE CONSERVATION AND AFFILIATE CONSOLIDATED STATEMENTS OF FINANCIAL POSITION June 30, 2021 and 2020 2021 2020* ASSETS CURRENT ASSETS Cash and cash equivalents Accounts receivable, net of allowance of $3,000 and $1,000, respectively Promises to give, current portion, net of allowance of $-0- and $1,000, respectively $ 10,728,263 $ 6,012,219 126,835 41,554 994,225 1,104,519 CARES Act Employee Retention Credit receivable Inventory, net of reserve of $11,200 and $13,300, 775,477 respectively Prepaid expenses 100,499 119,221 239,786 121,460 TOTAL CURRENT ASSETS 12,965,085 7,398,973 INVESTMENTS Operating investments 457 deferred compensation plans Charitable gift annuities 1,717,557 1,684,809 1,029,710 720,585 63,807 51,557 2,811,074 2,456,951 INVESTMENTS IN LIMITED LIABILITY COMPANIES 2,508,909 3,016,225 ENDOWMENTS Cash and cash equivalents 1,513,707 857,045 Investments 8,550,258 7,140,601 Promises to give 400,000 10,463,965 7,997,646 ASSETS RESTRICTED FOR LONG-TERM PURPOSES Cash and cash equivalents 5,210,903 2,201,820 Promises to give, net of discount and allowance of $87,000 and $265,000, respectively 711,635 2,501,036 5,922,538 4,702,856 PROPERTY AND EQUIPMENT, net 32,541,436 34,448,261 BENEFICIAL INTEREST IN PERPETUAL TRUSTS 5,992,123 4,936,396 OTHER ASSETS 19,371 449,371 TOTAL ASSETS $ 73,224,501 $ 65,406,679 Reclassified to conform to current year presentation ARIZONA CENTER FOR NATURE CONSERVATION AND AFFILIATE CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (Continued) June 30, 2021 and 2020 LIABILITIES AND NET ASSETS 2021 2020* CURRENT LIABILITIES Accounts payable $ 174,920 $ Accrued expenses 1,426,348 230,175 1,356,693 457 deferred compensation liability Deferred revenue 1,029,710 720,585 3,811,609 4,259,076 TOTAL CURRENT LIABILITIES 6,442,587 6,566,529 LONG-TERM DEBT 160,000 TOTAL LIABILITIES 6,442,587 6,726,529 NET ASSETS Without donor restrictions Board designated - projects 2,942,673 3,203,708 Board designated - endowment Undesignated 8,324,971 6,584,745 37,238,584 33,452,172 Total without donor restrictions 48,506,228 43,240,625 With donor restrictions 18,275,686 15,439,525 TOTAL NET ASSETS 66,781,914 58,680,150 TOTAL LIABILITIES AND NET ASSETS $ 73,224,501 $ 65,406,679 * Reclassified to conform to current year presentation ARIZONA CENTER FOR NATURE CONSERVATION AND AFFILIATE CONSOLIDATED STATEMENTS OF ACTIVITIES Years Ended June 30, 2021 and 2020 Without Donor Restrictions 2021 With Donor Restrictions Total SUPPORT AND REVENUE Educational services Group services Admissions and memberships $ 17,901,715 $ $ 17,901,715 138,936 138,936 Without Donor Restrictions $ 14,011,853 364,983 2020* With Donor Restrictions $ Total $ 14,011,853 364,983 227,987 227,987 773,616 773,616 Food services 800,736 800,736 823.121 823,121 Retail Contributions CARES Act Employee Retention Credit 2,424,843 2,424,843 2,417,304 2,417,304 1,916,197 3,109,301 5,025,498 2,642,603 4,909,535 7,552.138 1,802,248 1,802,248 Paycheck Protection Program government grant 10,000 10,000 2,771,000 2,771,000 Donated materials and services 342,270 342,270 1,317,325 1,317,325 Special events revenue 233,672 233,672 407,936 407,936 Special events - contributions 54,000 54,000 144,364 144,364 Investment income 2,312,610 326,093 2,638,703 96,917 (6,429) 90,488 Gain (loss) on investments in limited liability companies (107,316) (107,316) 5,161 5,161 Change in fair value of beneficial interest in perpetual trusts 1,055,727 Other income 24,162 1,055,727 24,162 (12,019) 19,783 (12,019) 19,783 Release of restriction through a distribution from limited liability company 400,000 (400,000) Releases from time and purpose restriction 1,147,644 29,737,020 (1,147,644) 2,836,161 32,573,181 4,991,263 30,782,068 (4,991,263) (95,015) 30,687,053 *Reclassified to conform to current year presentation See accompanying notes. 5 ARIZONA CENTER FOR NATURE CONSERVATION AND AFFILIATE CONSOLIDATED STATEMENTS OF ACTIVITIES (Continued) Years Ended June 30, 2021 and 2020 Without Donor 2021 With Donor Without Donor Restrictions Restrictions Total Restrictions 2020* With Donor Restrictions Total EXPENSES Program services 19,577,161 19,577,161 23,087,032 Management and general 2,312,302 2,312,302 3,794,766 Fundraising 1,444,428 1,444,428 1,642,251 Membership 1,110,947 1,110,947 910,672 Costs of direct benefits to donors 26.579 26,579 121,088 23,087,032 3,794,766 1,642,251 910,672 121,088 24,471,417 24,471,417 29,555,809 29,555,809 CHANGE IN NET ASSETS 5,265,603 2,836,161 8,101,764 1,226,259 (95,015) 1,131,244 NET ASSETS AT BEGINNING OF YEAR 43,240,625 15,439,525 NET ASSETS AT END OF YEAR $ 48,506,228 $ 18,275,686 58,680,150 $ 66,781,914 42,014,366 $43.240.625 15,534,540 $15,439,525 57,548,906 $ 58,680,150 * Reclassified to conform to current year presentation ARIZONA CENTER FOR NATURE CONSERVATION AND AFFILIATE CONSOLIDATED STATEMENT OF FUNCTIONAL EXPENSES Year Ended June 30, 2021 Supporting Services Program Services Management and General Fundraising Membership Payroll taxes Salaries Employee benefits Professional fees $ 9,198,279 1,707,028 519,015 $ 1,207,834 $ 755,820 $ 349,357 $ 224,478 140,267 64,834 68,153 42,647 19,713 Costs of Direct Benefits to Donors Total $ 11,511,290 2,136,607 649,528 60,340 236,109 11,670 832 308,951 Advertising and promotion 373,583 381,319 549,851 1,304,753 Office expense and printing 1,062,373 130,649 66,129 31,189 1,290,340 Utilities 1,192,508 62,788 392 102 1,255,790 Travel 830 2,858 164 Interest 4,092 Depreciation 2,805,983 69,579 310.440 80.775 Insurance 267,742 10,922 48,734 12.680 3,852 4,092 3,266,777 340,078 Animal collection 1,036,370 1,036,370 Cost of event food and product 129,969 26,579 156,548 Repairs and maintenance 314,097 3,027 317,124 Vendor commission 465,090 25,027 490,117 Grants 54,285 54,285 Bad debt expense (recovery) and/or allowance adjustment 2,000 Other 387,669 (127,665) 38,159 43,138 1,614 (125,665) 470,580 TOTAL EXPENSES $ 19,577,161 $ 2,312,302 $ 1,444,428 $ 1,110,947 $ 26,579 $ 24,471,417 ARIZONA CENTER FOR NATURE CONSERVATION AND AFFILIATE CONSOLIDATED STATEMENT OF FUNCTIONAL EXPENSES Year Ended June 30, 2020 Supporting Services Program Services Management and General Costs of Direct Benefits Fundraising Membership to Donors Salaries Employee benefits $ 11,384,847 Payroll taxes 2,253,945 754,006 $ 1,085,984 339,961 $ 819,755 $ 21,319 $ 166,634 75,849 74,510 56,244 28,582 Total $ 13,311,905 2,836,389 913,342 Professional fees 53,580 453,550 10,872 1,083 519,085 Advertising and promotion 384,548 1,458,075 635,099 2,477,722 Office expense and printing 1,143,314 138,351 52,069 50,314 Utilities 1,089,969 77 159 13,601 Travel 38,456 13,230 721 1,384,048 1,103,806 52,407 Interest 611 Depreciation 2,770,218 129,748 267,554 73,857 611 3,241,377 Insurance 233,257 18,842 38,855 10,726 301,680 Animal collection 1,147,685 1,147,685 Cost of event food and product 359,381 130,123 121,088 610,592 Repairs and maintenance 407,148 6,978 414,126 Vendor commission 448,304 44,078 492,382 Bad debt expense (recovery) and/or allowance adjustment (3,000) (325) (3,325) Grants 59,363 59,363 Other 562,011 75.174 55,187 242 692.614 TOTAL EXPENSES $ 23,087,032 $ 3,794,766 $ 1,642,251 $ 910,672 $ 121,088 $ 29,555,809 ARIZONA CENTER FOR NATURE CONSERVATION AND AFFILIATE CONSOLIDATED STATEMENTS OF CASH FLOWS Years Ended June 30, 2021 and 2020 2021 2020 CASH FLOWS FROM OPERATING ACTIVITIES Change in net assets Adjustments to reconcile change in net assets to net cash provided by operating activities: Depreciation (Gain) loss on disposal of asset Non-cash capital contribution in RCSP HAWAII, LLC (Gain) loss on investments in limited liability companies Non-cash contribution of stock Contributions restricted for capital campaign Change in fair value of beneficial interest in perpetual trusts $ 8,101,764 $ 1,131,244 3,266,777 (11,436) 3,241,377 1,058 (1,776,270) 107,316 (5,161) (108,087) (148,000) (218,980) (1,360,303) (1,055,727) 12,019 Realized and unrealized (gain) loss on investments Change in valuation allowance for accounts receivable Change in valuation allowance for promises to give Change in discount on long-term promises to give Forgiveness of Paycheck Protection Program Loan Changes in operating assets and liabilities: (Increase) decrease in: (2,193,686) 405,301 2,000 (3,000) (165,000) (5,000) (14,000) (92,000) (10,000) Accounts receivable Promises to give Employee Retention Credit receivable Inventories Prepaid expenses (87,281) 138,531 137,600 (539,825) (775,477) 18,722 (13,083) (118,326) 145,991 Other assets 430,000 9,698 Increase (decrease) in: Accounts payable (55,255) (567,031) Accrued expenses 69,655 (258,407) Deferred revenue (447,467) 835,533 NET CASH PROVIDED BY OPERATING ACTIVITIES 6,944,092 1,081,692 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of investments (1,598,922) (3,233,649) Distributions from limited liability companes Proceeds from maturities and sales of investments Proceeds from sale of asset 400,000 2,446,040 15,750 1,410,746 2,500 Purchases of property, equipment and construction in progress NET CASH USED IN INVESTING ACTIVITIES (1,364,266) (2,867,783) (101,398) (4,688,186) ARIZONA CENTER FOR NATURE CONSERVATION AND AFFILIATE CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued) Years Ended June 30, 2021 and 2020 2021 2020 CASH FLOWS FROM FINANCING ACTIVITIES Collection of contributions restricted for capital campaign Payments on long-term debt Proceeds from long-term debt 1,689,095 1,497,648 (150,000) 160,000 NET CASH PROVIDED BY FINANCING ACTIVITIES 1,539,095 1,657,648 NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS 8,381,789 (1,948,846) CASH AND CASH EQUIVALENTS 9,071,084 11,019,930 AT BEGINNING OF YEAR CASH AND CASH EQUIVALENTS AT END OF YEAR RECONCILIATION TO STATEMENTS OF FINANCIAL POSITION: Cash and cash equivalents - current Cash and cash equivalents - endowment Cash and cash equivalents - long-term purposes $ 17,452,873 $ 9,071,084 $ 10,728,263 $ 6,012,219 1,513,707 5,210,903 857,045 2,201,820 $ 17,452,873 $ 9,071,084 SUPPLEMENTAL CASH FLOW DISCLOSURES: Noncash investing transaction: Investment return on deferred compensation investment $ $ 88,825 Contributions made to the deferred compensation plan $ 25,000 $ 25,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started