Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Now a little more complex situation. Assume you work for the South Carolina Department of Natural Resources and have been asked to determine if

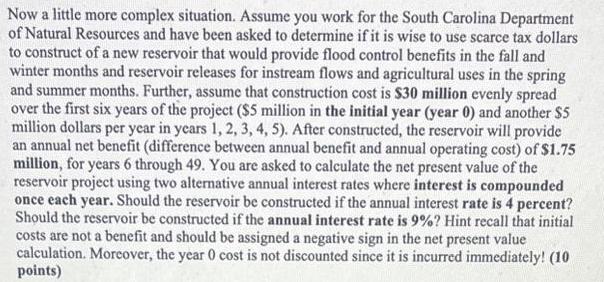

Now a little more complex situation. Assume you work for the South Carolina Department of Natural Resources and have been asked to determine if it is wise to use scarce tax dollars to construct of a new reservoir that would provide flood control benefits in the fall and winter months and reservoir releases for instream flows and agricultural uses in the spring and summer months. Further, assume that construction cost is $30 million evenly spread over the first six years of the project ($5 million in the initial year (year 0) and another $5 million dollars per year in years 1, 2, 3, 4, 5). After constructed, the reservoir will provide an annual net benefit (difference between annual benefit and annual operating cost) of $1.75 million, for years 6 through 49. You are asked to calculate the net present value of the reservoir project using two alternative annual interest rates where interest is compounded once each year. Should the reservoir be constructed if the annual interest rate is 4 percent? Should the reservoir be constructed if the annual interest rate is 9%? Hint recall that initial costs are not a benefit and should be assigned a negative sign in the net present value calculation. Moreover, the year 0 cost is not discounted since it is incurred immediately! (10 points)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine whether it is financially viable to construct the reservoir we need to calculate the net present value NPV of the project using ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started