Answered step by step

Verified Expert Solution

Question

1 Approved Answer

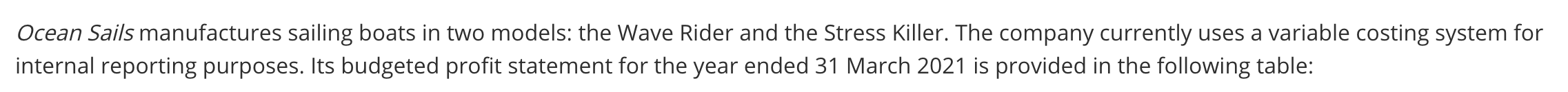

Ocean Sails manufactures sailing boats in two models: the Wave Rider and the Stress Killer. The company currently uses a variable costing system for

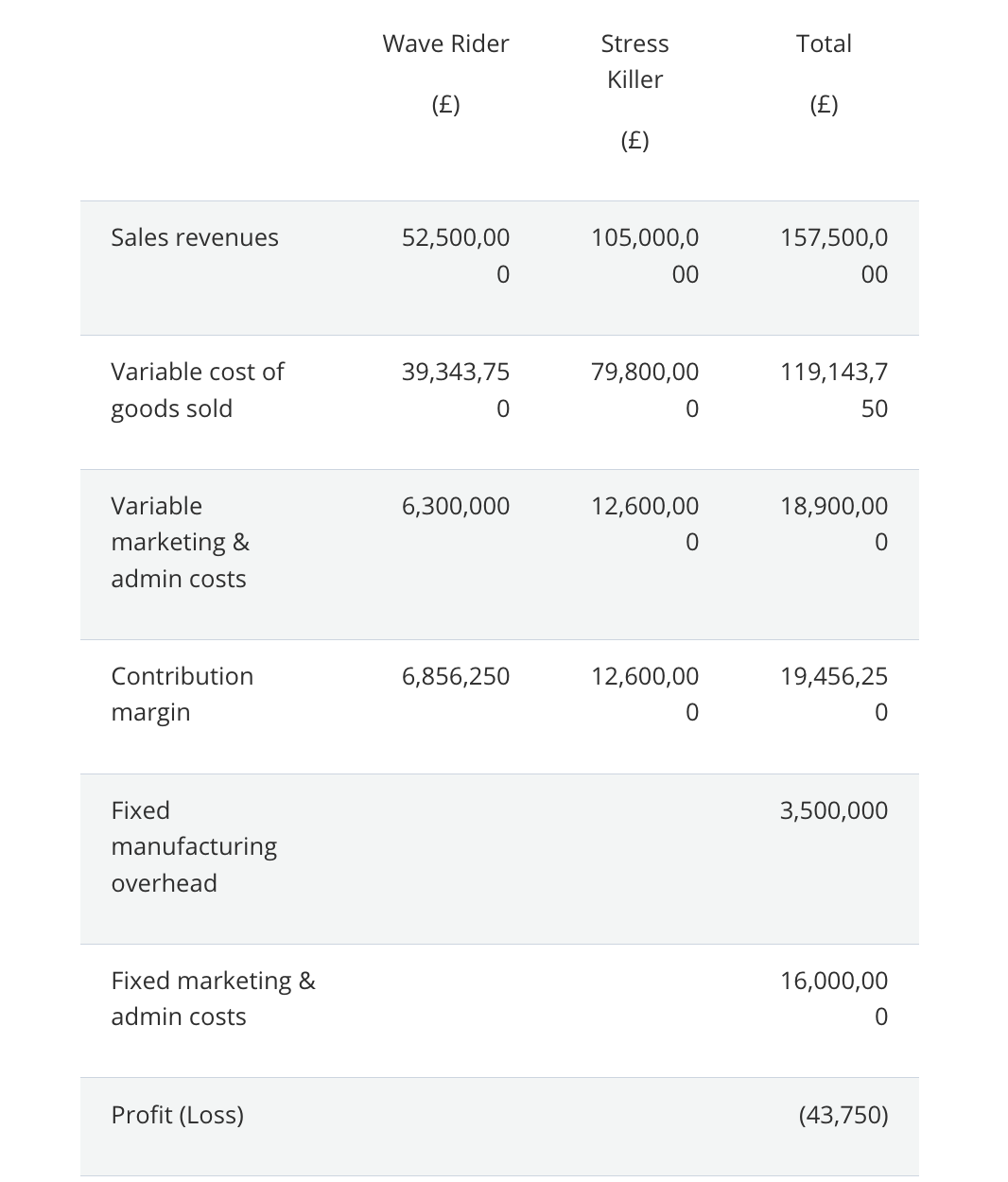

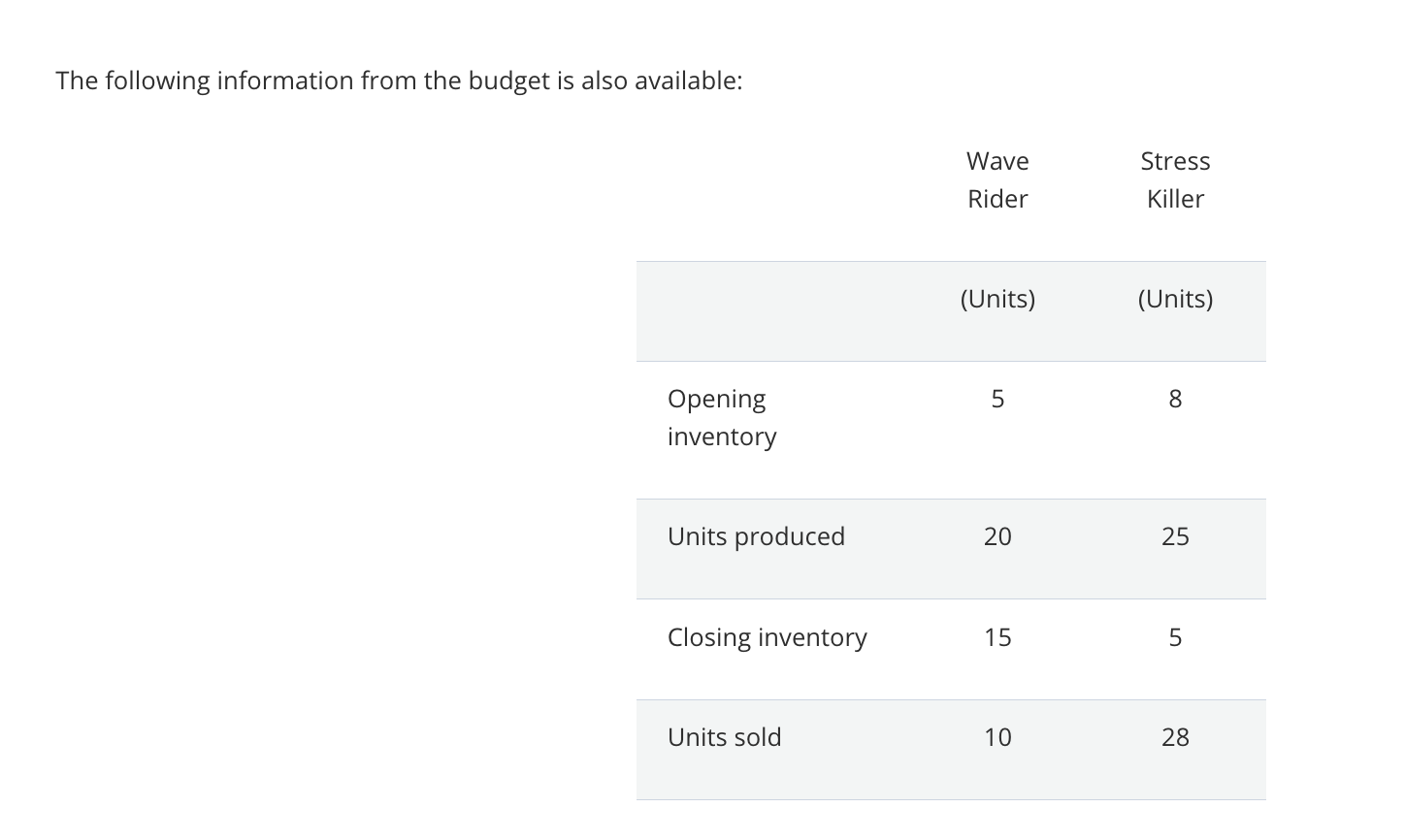

Ocean Sails manufactures sailing boats in two models: the Wave Rider and the Stress Killer. The company currently uses a variable costing system for internal reporting purposes. Its budgeted profit statement for the year ended 31 March 2021 is provided in the following table: Sales revenues Variable cost of goods sold Variable marketing & admin costs Contribution margin Fixed manufacturing overhead Fixed marketing & admin costs Profit (Loss) Wave Rider () 52,500,00 0 39,343,75 0 6,300,000 6,856,250 Stress Killer () 105,000,0 00 79,800,00 0 12,600,00 0 12,600,00 0 Total () 157,500,0 00 119,143,7 50 18,900,00 0 19,456,25 0 3,500,000 16,000,00 0 (43,750) The following information from the budget is also available: Opening inventory Units produced Closing inventory Units sold Wave Rider (Units) 5 20 15 10 Stress Killer (Units) 8 25 5 28 The variable cost of goods sold comprises of direct materials and direct labour (there are no variable manufacturing overheads). The production of each unit of Wave Rider takes 750 labour hours, while each unit of Stress Killer requires 1,000 labour hours. Required: (a) Using labour hours as overhead allocation base, rewrite the budgeted profit statement in an absorption costing format. Show all workings clearly. (b) Compare the budgeted profit calculated under absorption costing with the budgeted profit under variable costing and explain what causes the difference in profit figures. Show all workings clearly. (c) Which income reporting method is the manager responsible for the performance of the Wave Rider product likely to prefer? Which method is the manager responsible for the performance of the Stress Killer likely to prefer? Explain your answers. (d) Discuss merits and limits of absorption costing and variable costing. Illustrate with examples.

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Absorption costing Under the absorption costing approach all the costs incurred for manufacturing a product will be allocated to the costs The cost incurred for manufacturing will consist of direct ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started