Answered step by step

Verified Expert Solution

Question

1 Approved Answer

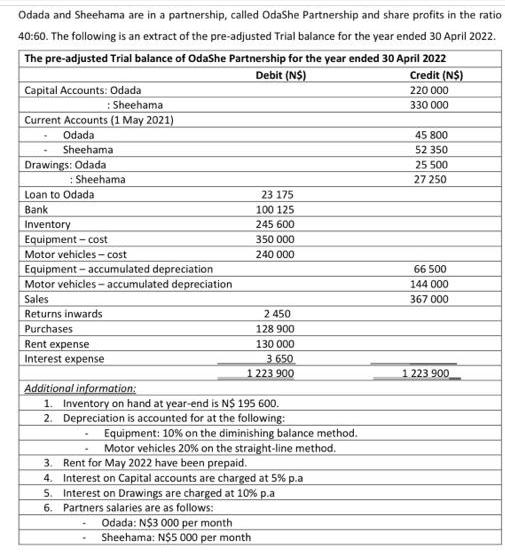

Odada and Sheehama are in a partnership, called OdaShe Partnership and share profits in the ratio 40:60. The following is an extract of the

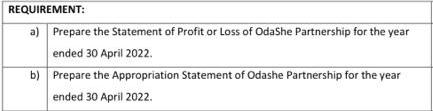

Odada and Sheehama are in a partnership, called OdaShe Partnership and share profits in the ratio 40:60. The following is an extract of the pre-adjusted Trial balance for the year ended 30 April 2022. The pre-adjusted Trial balance of OdaShe Partnership for the year ended 30 April 2022 Debit (NS) Credit (NS) 220 000 330 000 Capital Accounts: Odada : Sheehama Current Accounts (1 May 2021) Odada Sheehama Drawings: Odada :Sheehama Loan to Odada Bank Inventory Equipment-cost Motor vehicles - cost Equipment-accumulated depreciation Motor vehicles-accumulated depreciation Sales Returns inwards Purchases Rent expense Interest expense . 23 175 100 125 245 600 350 000 240 000 2 450 128 900 130 000 3.650 1223 900 Additional information: 1. Inventory on hand at year-end is N$ 195 600. 2. Depreciation is accounted for at the following: Equipment: 10% on the diminishing balance method. Motor vehicles 20% on the straight-line method. Odada: N$3 000 per month Sheehama: N$5 000 per month 3. Rent for May 2022 have been prepaid. 4. Interest on Capital accounts are charged at 5% p.a 5. Interest on Drawings are charged at 10% p.a 6. Partners salaries are as follows: 45 800 52 350 25 500 27 250 66 500 144 000 367 000 1 223 900 REQUIREMENT: a) Prepare the Statement of Profit or Loss of OdaShe Partnership for the year ended 30 April 2022. b) Prepare the Appropriation Statement of Odashe Partnership for the year ended 30 April 2022.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the Statement of Profit or Loss and the Appropriation Statement for OdaShe Partnership we need to consider the given information and make certain adjustments Lets go step by step a Statemen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started