Answered step by step

Verified Expert Solution

Question

1 Approved Answer

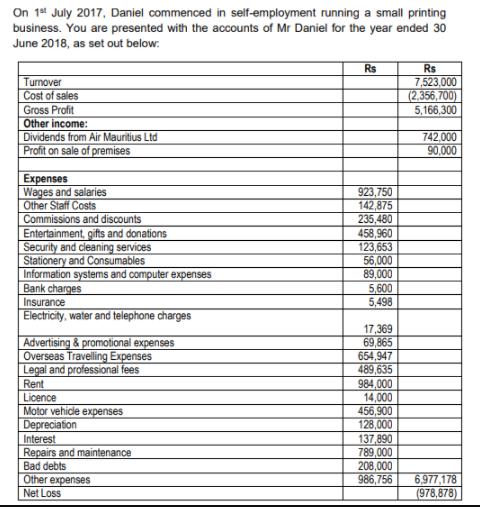

On 1st July 2017, Daniel commenced in self-employment running a small printing business. You are presented with the accounts of Mr Daniel for the

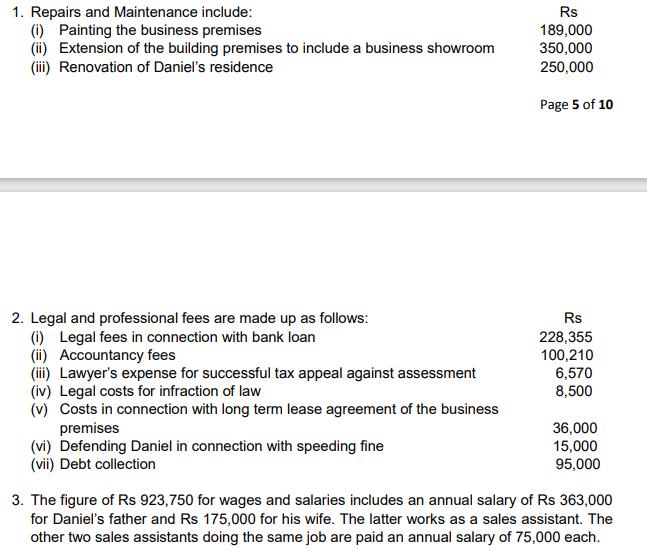

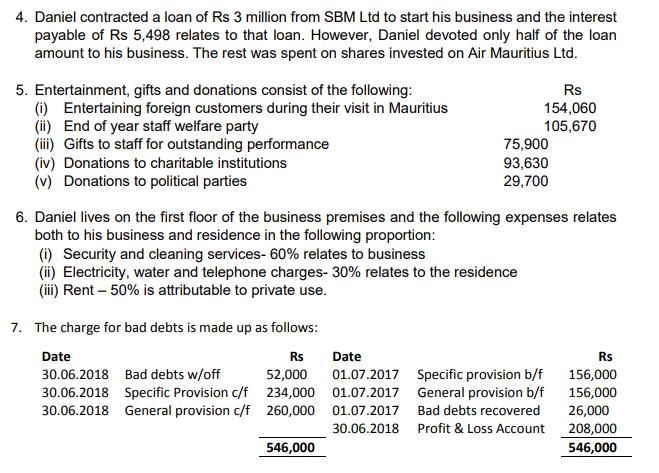

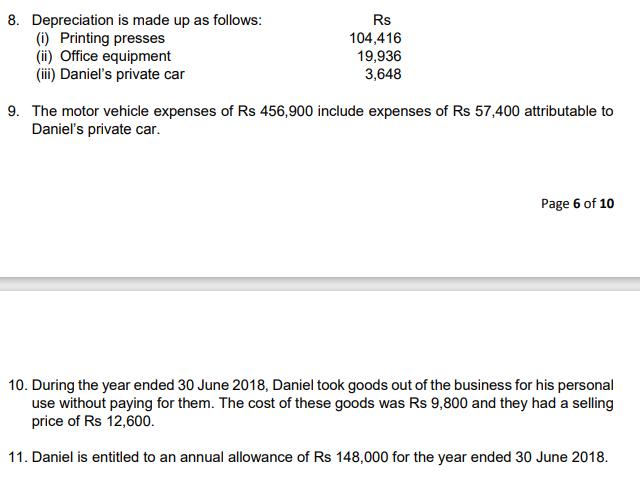

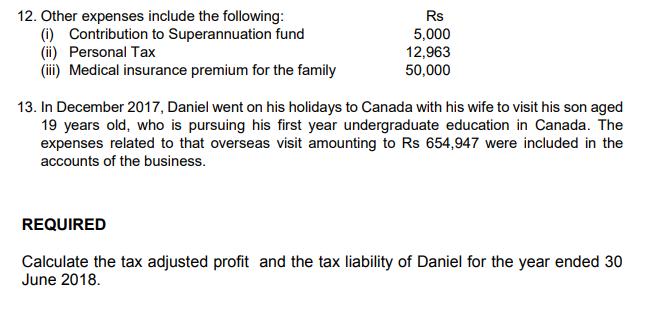

On 1st July 2017, Daniel commenced in self-employment running a small printing business. You are presented with the accounts of Mr Daniel for the year ended 30 June 2018, as set out below: Rs Turnover R$ 7,523,000 (2,356,700) Cost of sales Gross Profit 5,166,300 Other income: Dividends from Air Mauritius Ltd 742,000 Profit on sale of premises 90,000 Expenses Wages and salaries Other Staff Costs Commissions and discounts Entertainment, gifts and donations Security and cleaning services Stationery and Consumables Information systems and computer expenses Bank charges Insurance Electricity, water and telephone charges Advertising & promotional expenses Overseas Travelling Expenses Legal and professional fees Rent Licence Motor vehicle expenses Depreciation Interest Repairs and maintenance Bad debts Other expenses Net Loss 923,750 142,875 235,480 458,960 123,653 56,000 89,000 5,600 5,498 17,369 69,865 654,947 489,635 984,000 14,000 456,900 128,000 137,890 789,000 208,000 986,756 6,977,178 (978,878) 1. Repairs and Maintenance include: (i) Painting the business premises (ii) Extension of the building premises to include a business showroom (iii) Renovation of Daniel's residence 2. Legal and professional fees are made up as follows: (i) Legal fees in connection with bank loan (ii) Accountancy fees (iii) Lawyer's expense for successful tax appeal against assessment (iv) Legal costs for infraction of law (v) Costs in connection with long term lease agreement of the business premises 36,000 (vi) Defending Daniel in connection with speeding fine (vii) Debt collection 15,000 95,000 3. The figure of Rs 923,750 for wages and salaries includes an annual salary of Rs 363,000 for Daniel's father and Rs 175,000 for his wife. The latter works as a sales assistant. The other two sales assistants doing the same job are paid an annual salary of 75,000 each. Rs 189,000 350,000 250,000 Page 5 of 10 Rs 228,355 100,210 6,570 8,500 4. Daniel contracted a loan of Rs 3 million from SBM Ltd to start his business and the interest payable of Rs 5,498 relates to that loan. However, Daniel devoted only half of the loan amount to his business. The rest was spent on shares invested on Air Mauritius Ltd. 5. Entertainment, gifts and donations consist of the following: (i) Entertaining foreign customers during their visit in Mauritius (ii) End of year staff welfare party Rs 154,060 105,670 (iii) Gifts to staff for outstanding performance 75,900 93,630 (iv) Donations to charitable institutions (v) Donations to political parties 29,700 6. Daniel lives on the first floor of the business premises and the following expenses relates both to his business and residence in the following proportion: (i) Security and cleaning services- 60% relates to business (ii) Electricity, water and telephone charges- 30% relates to the residence (iii) Rent - 50% is attributable to private use. 7. The charge for bad debts is made up as follows: Date Rs Date Rs 156,000 52,000 30.06.2018 Bad debts w/off 30.06.2018 Specific Provision c/f 30.06.2018 General provision c/f 01.07.2017 Specific provision b/f General provision b/f 234,000 01.07.2017 156,000 260,000 01.07.2017 Bad debts recovered 26,000 30.06.2018 Profit & Loss Account 208,000 546,000 546,000 8. Depreciation is made up as follows: Rs 104,416 (i) Printing presses (ii) Office equipment 19,936 3,648 (iii) Daniel's private car 9. The motor vehicle expenses of Rs 456,900 include expenses of Rs 57,400 attributable to Daniel's private car. Page 6 of 10 10. During the year ended 30 June 2018, Daniel took goods out of the business for his personal use without paying for them. The cost of these goods was Rs 9,800 and they had a selling price of Rs 12,600. 11. Daniel is entitled to an annual allowance of Rs 148,000 for the year ended 30 June 2018. 12. Other expenses include the following: Rs 5,000 (i) Contribution to Superannuation fund (ii) Personal Tax 12,963 (iii) Medical insurance premium for the family 50,000 13. In December 2017, Daniel went on his holidays to Canada with his wife to visit his son aged 19 years old, who is pursuing his first year undergraduate education in Canada. The expenses related to that overseas visit amounting to Rs 654,947 were included in the accounts of the business. REQUIRED Calculate the tax adjusted profit and the tax liability of Daniel for the year ended 30 June 2018.

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

calculation of tax adjusted profit and tax liability of Daniel for the year ended 30 June 2018 parti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started