Answered step by step

Verified Expert Solution

Question

1 Approved Answer

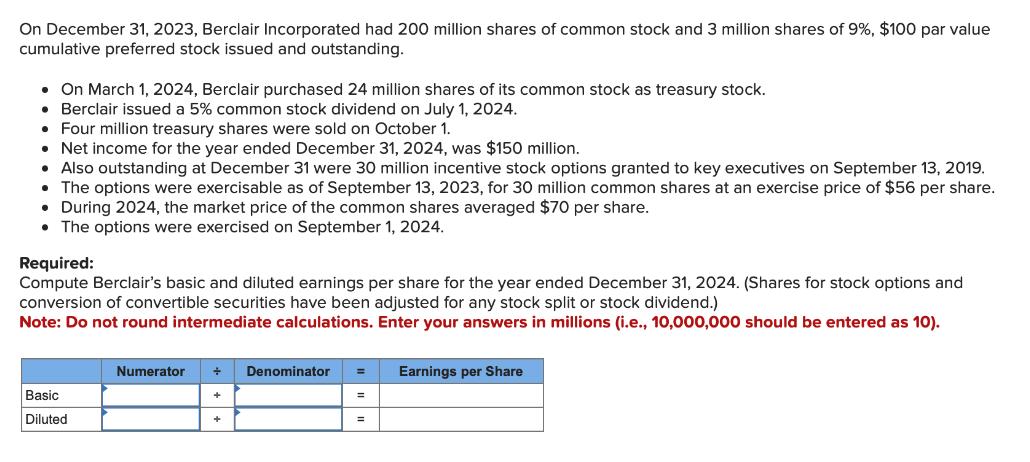

On December 31, 2023, Berclair Incorporated had 200 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred

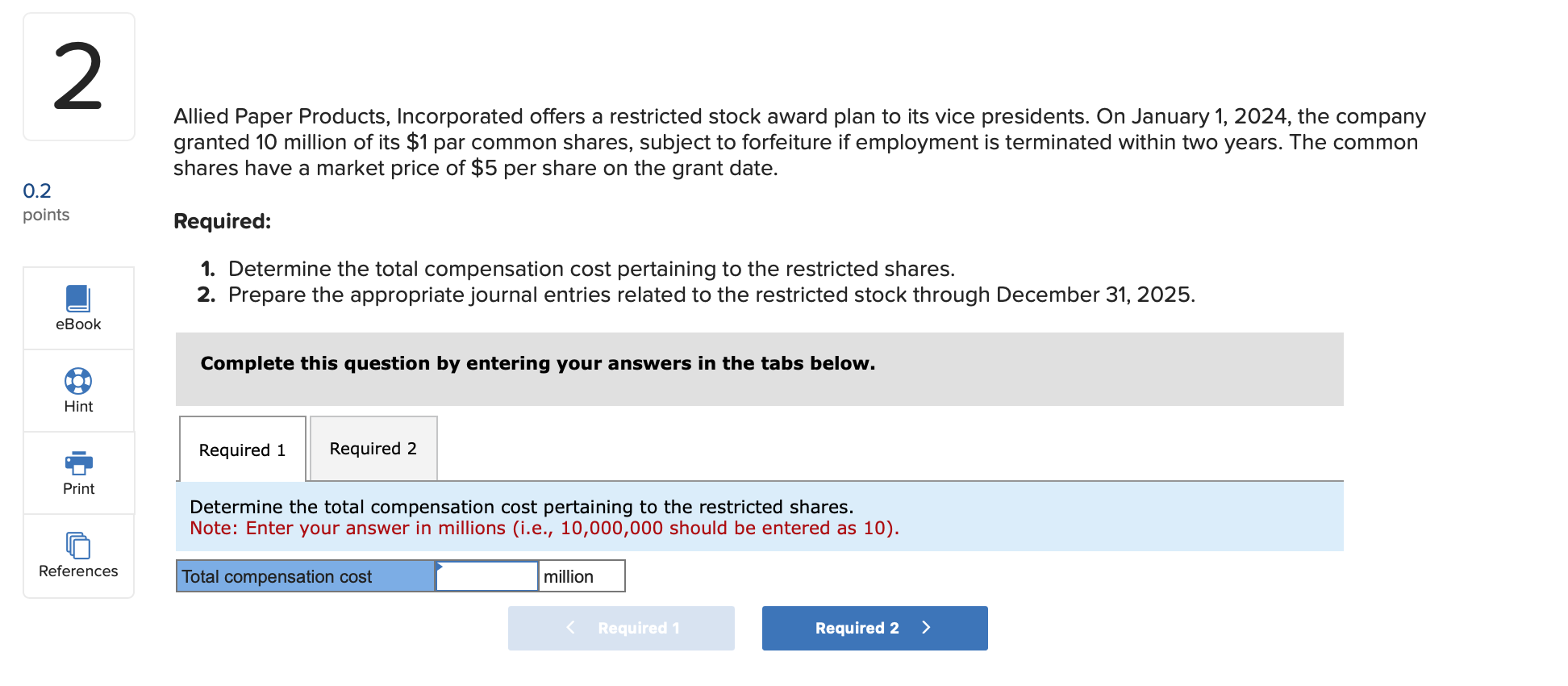

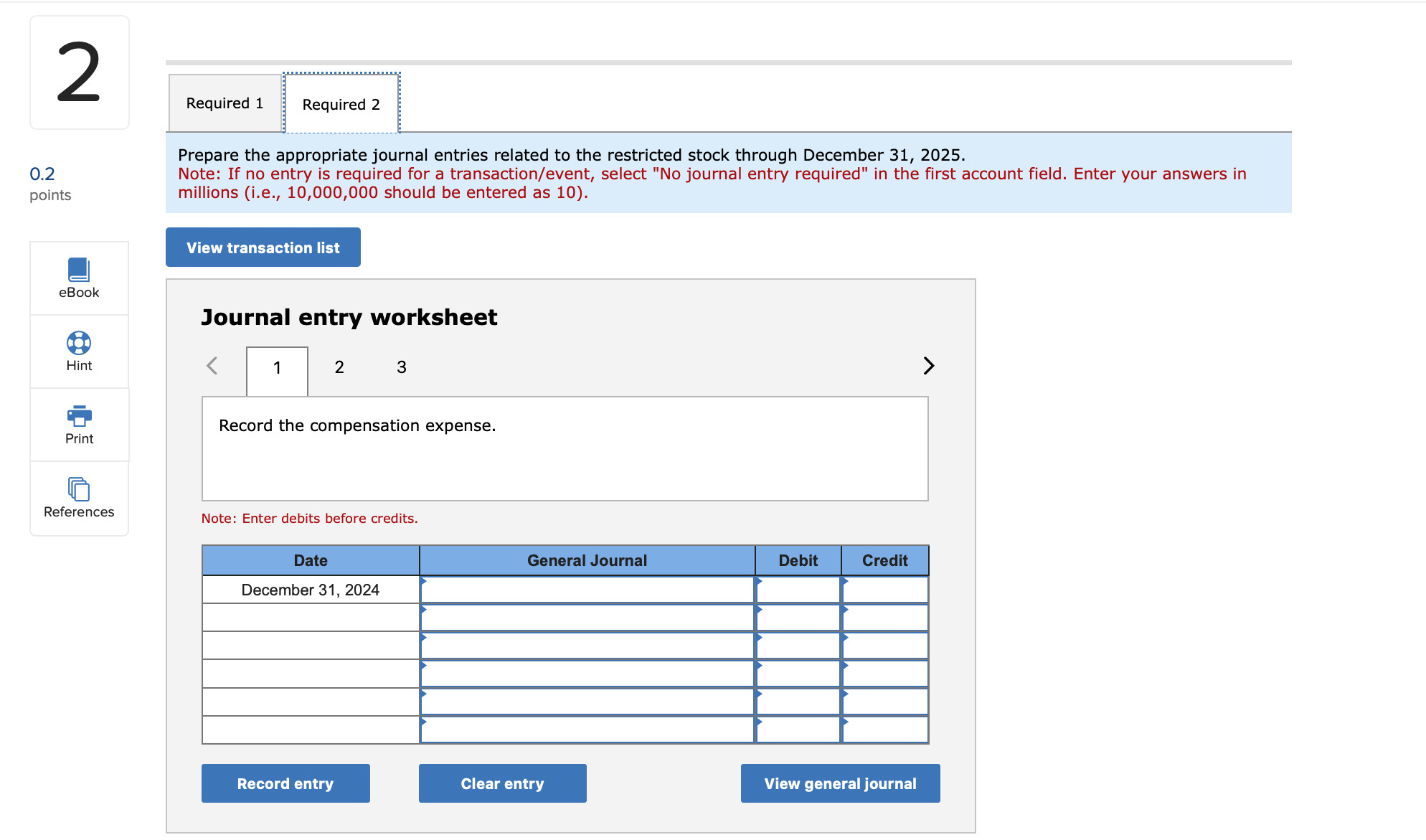

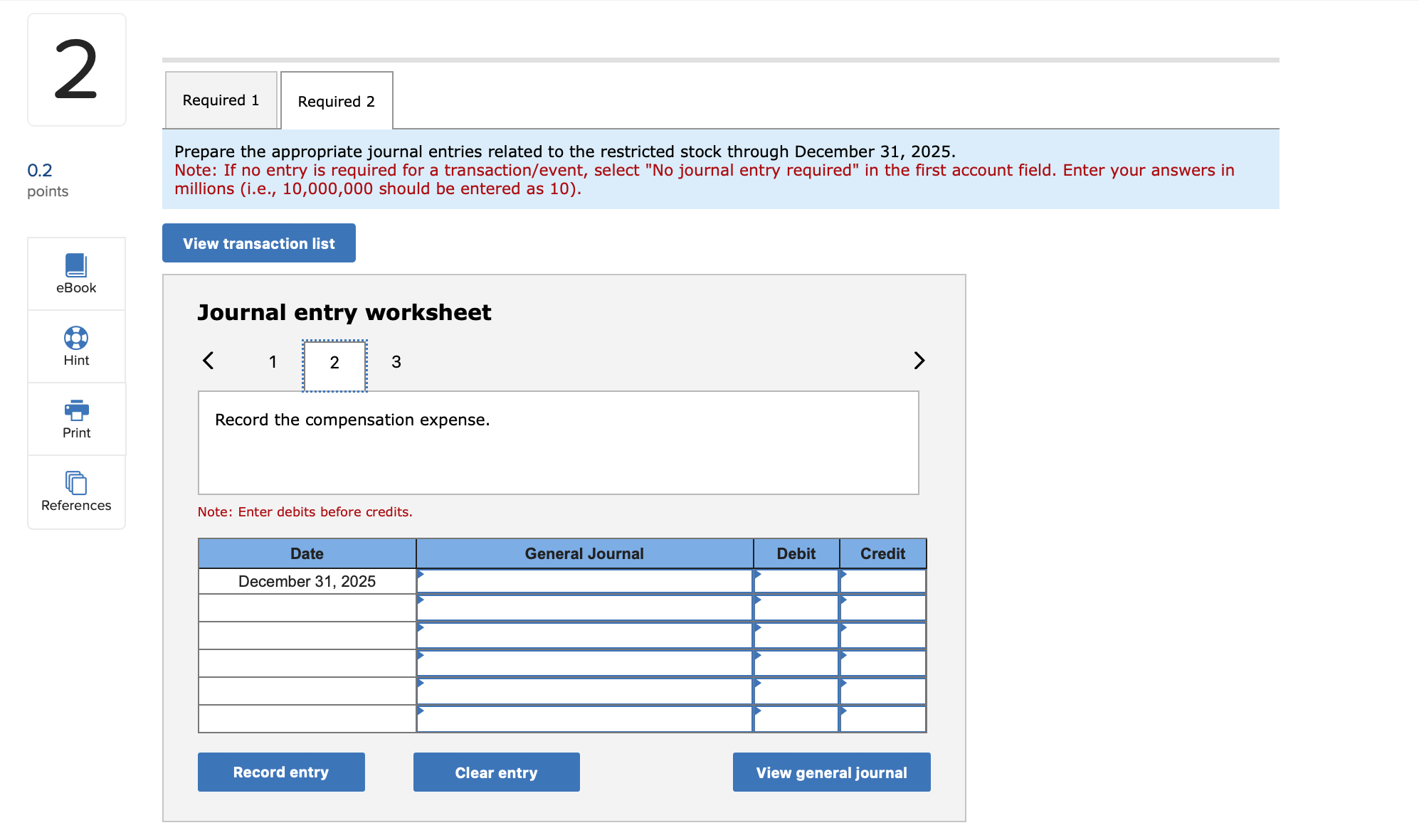

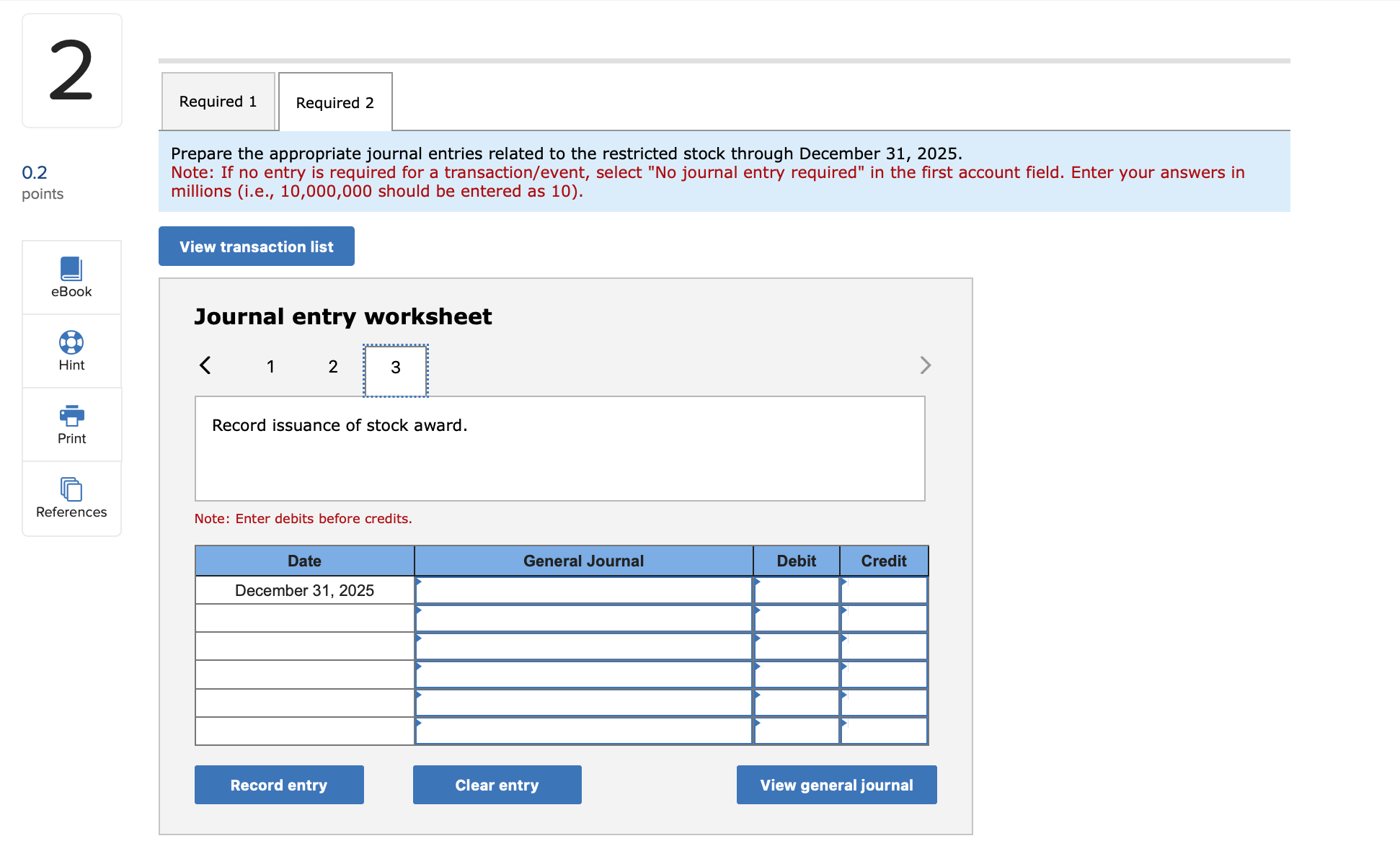

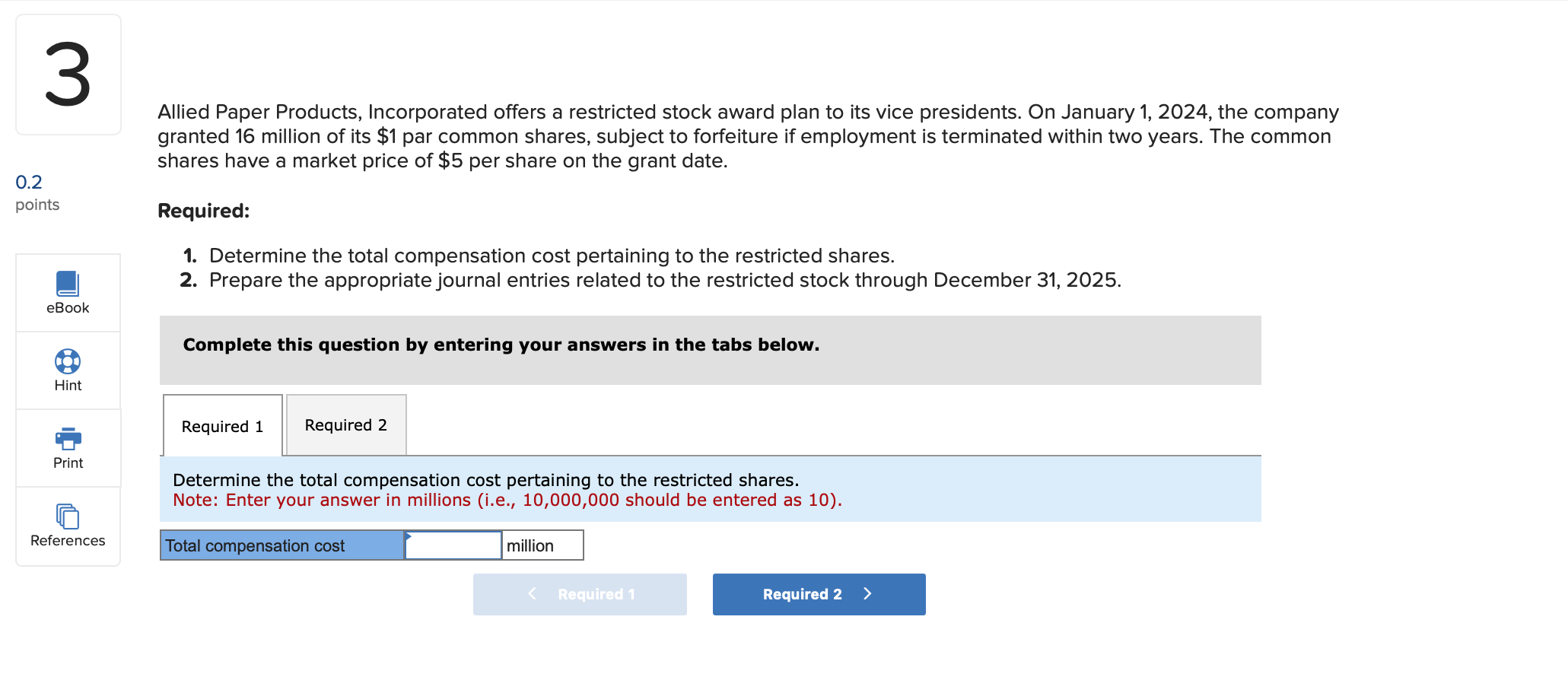

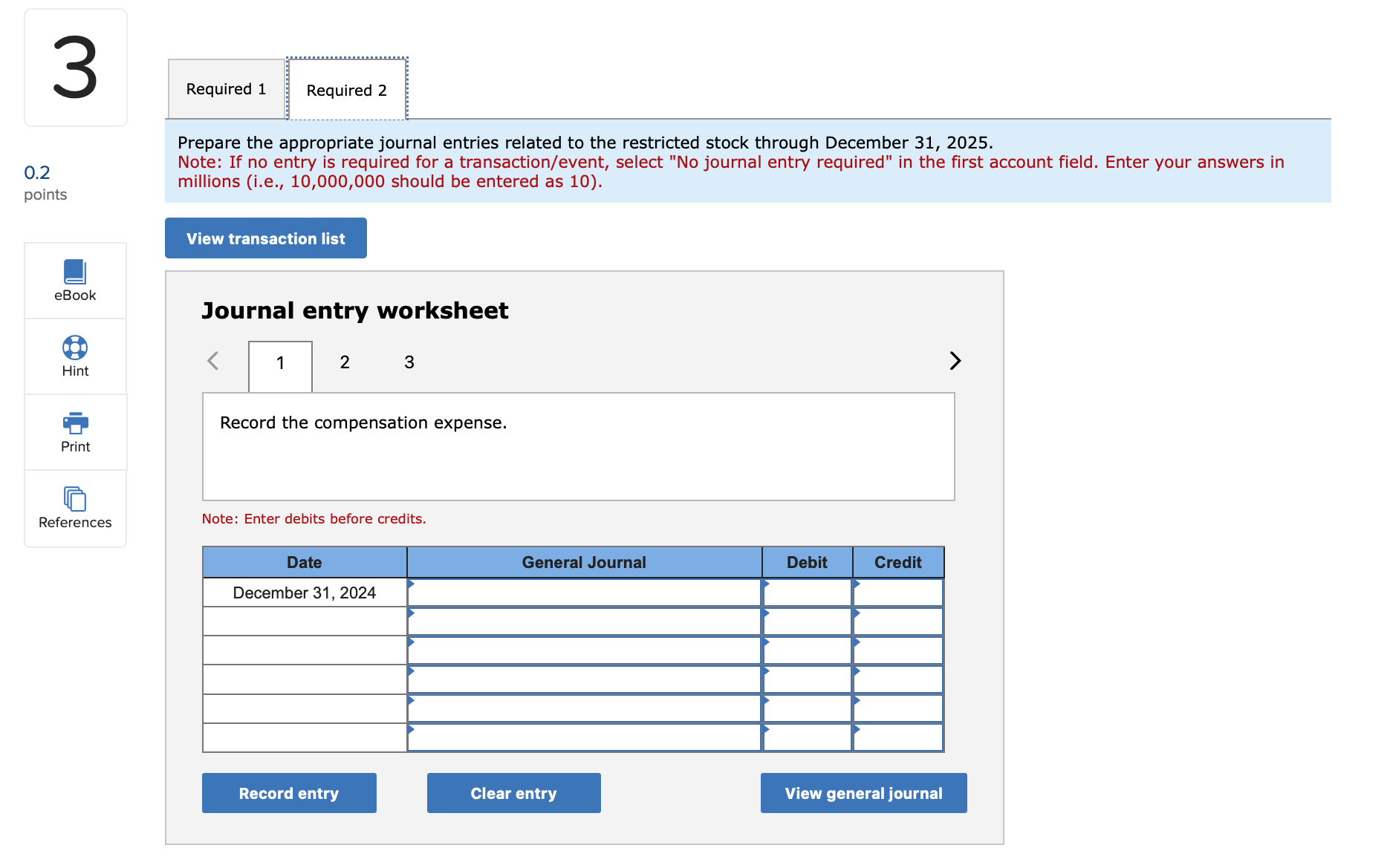

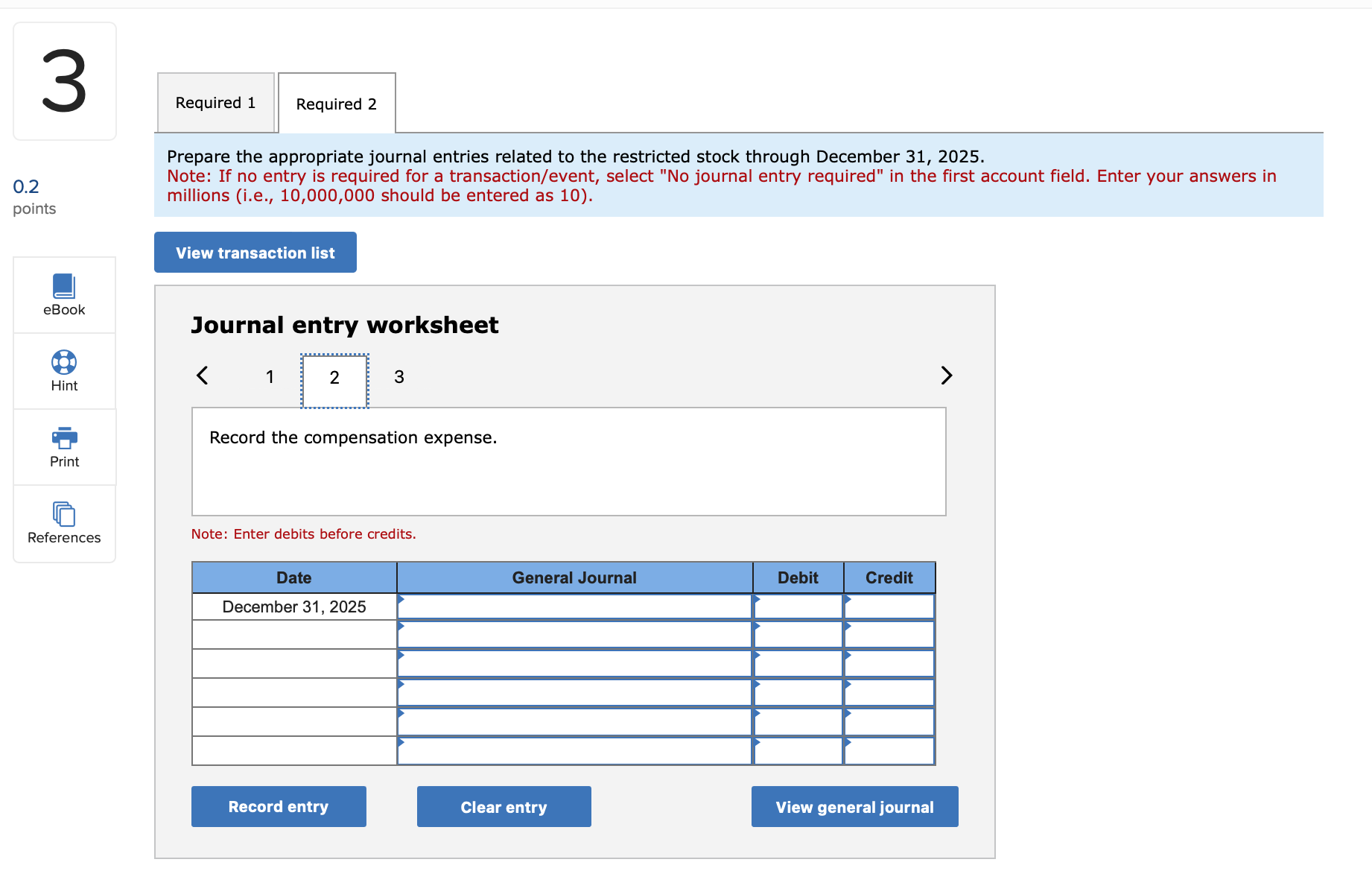

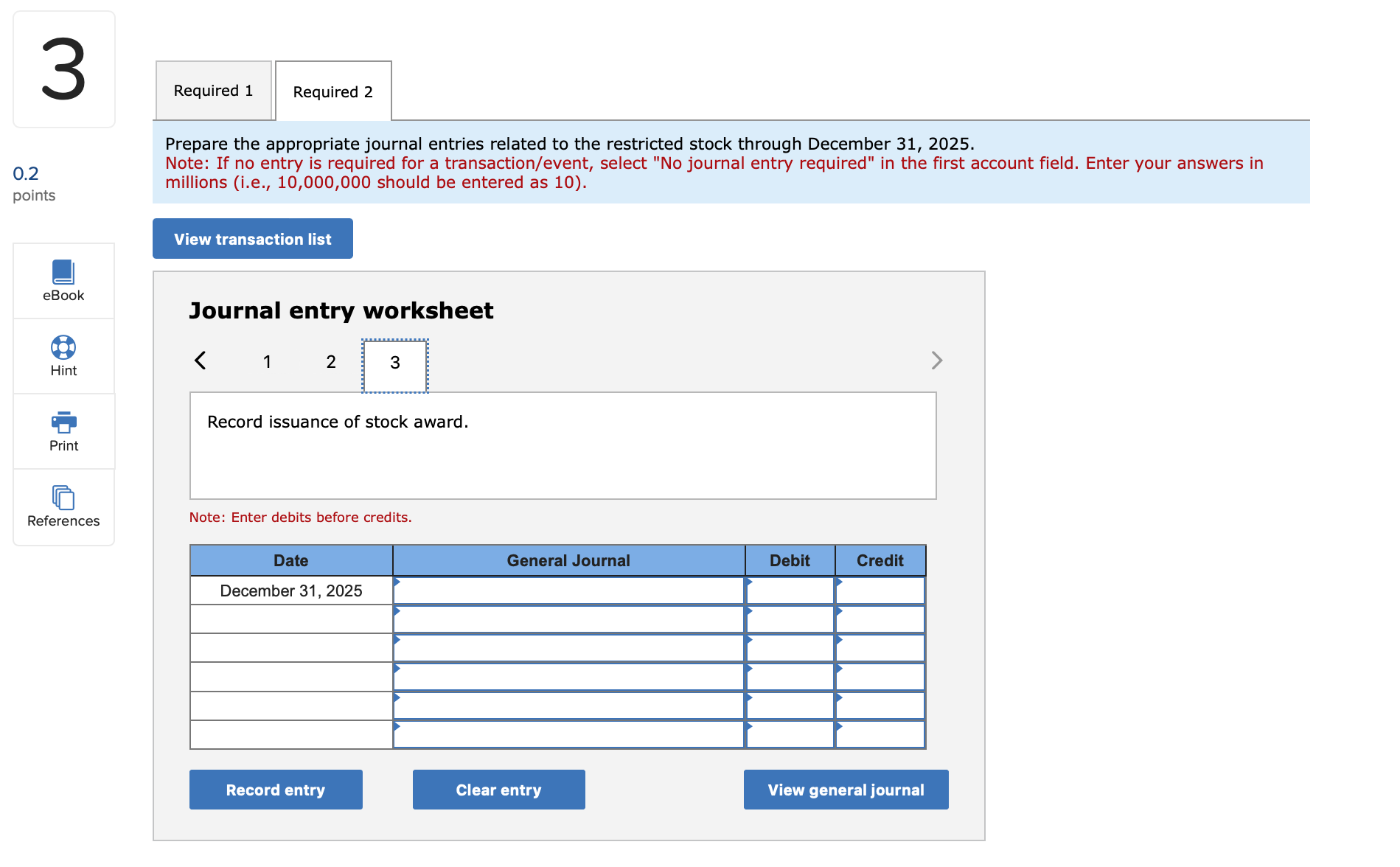

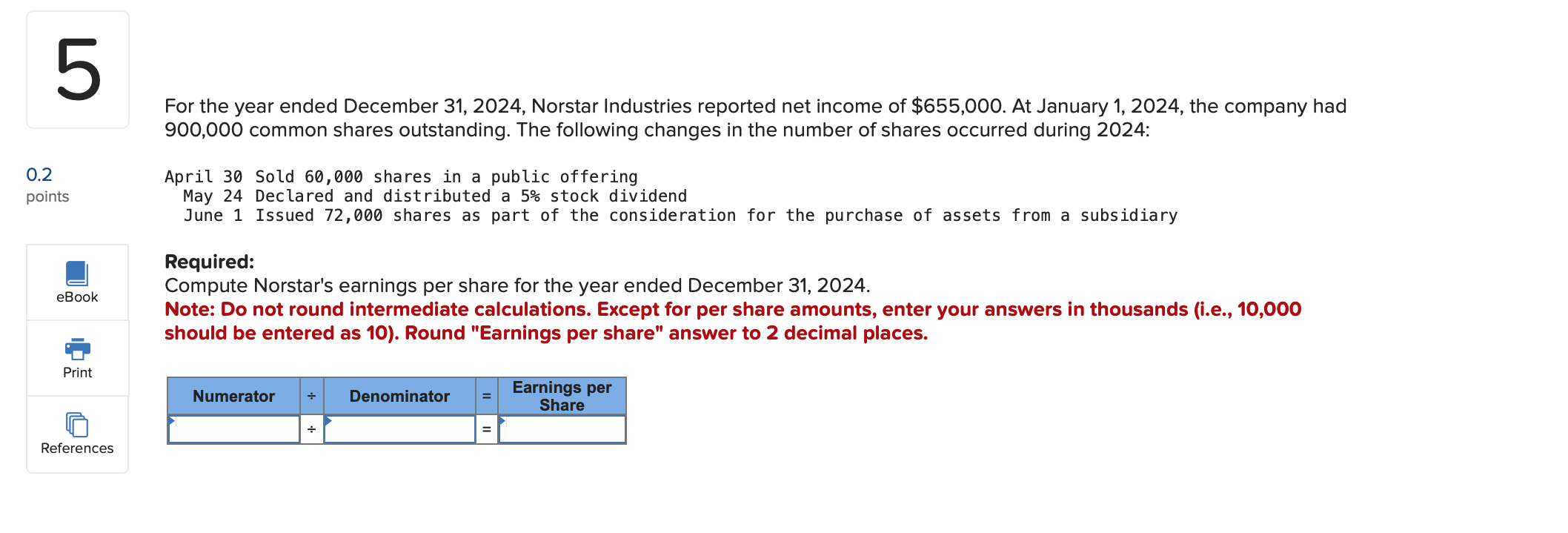

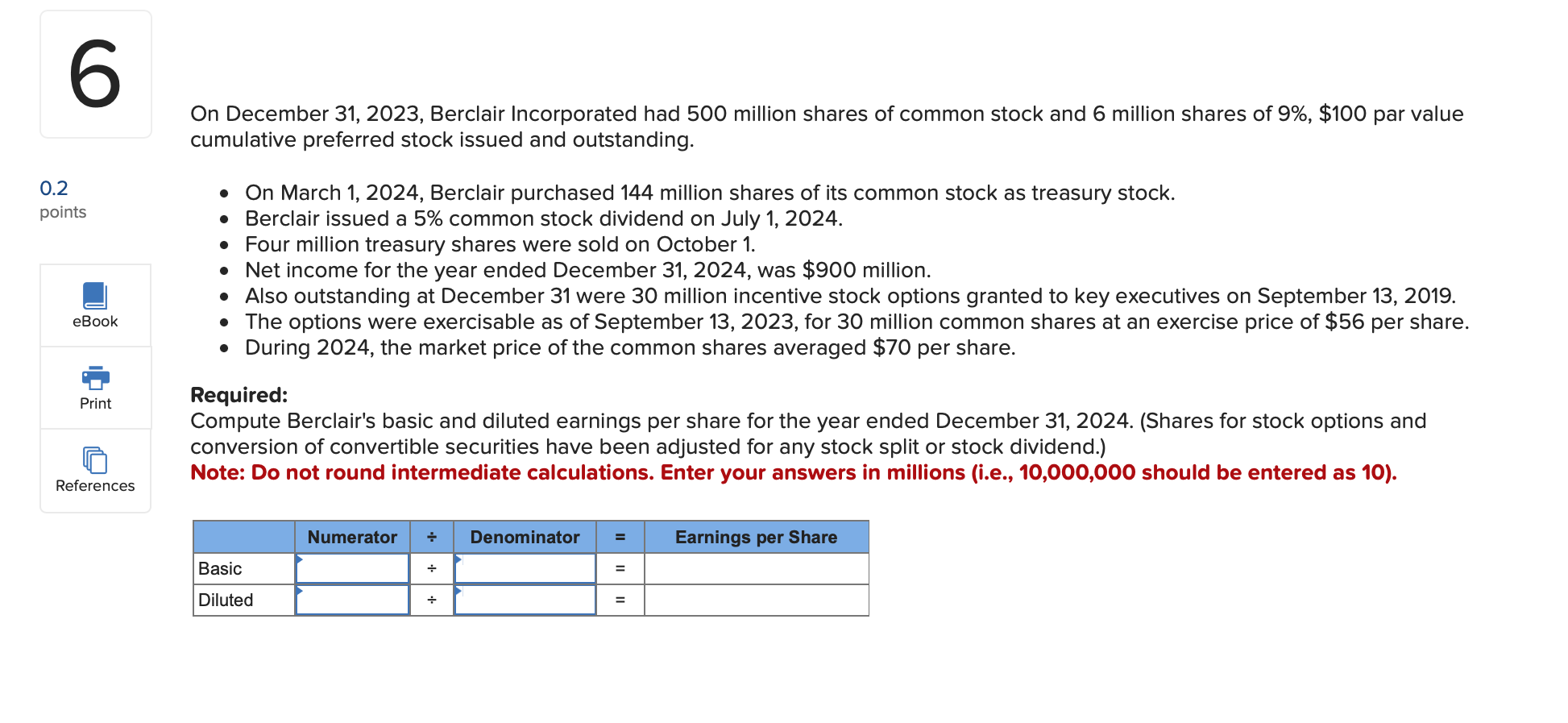

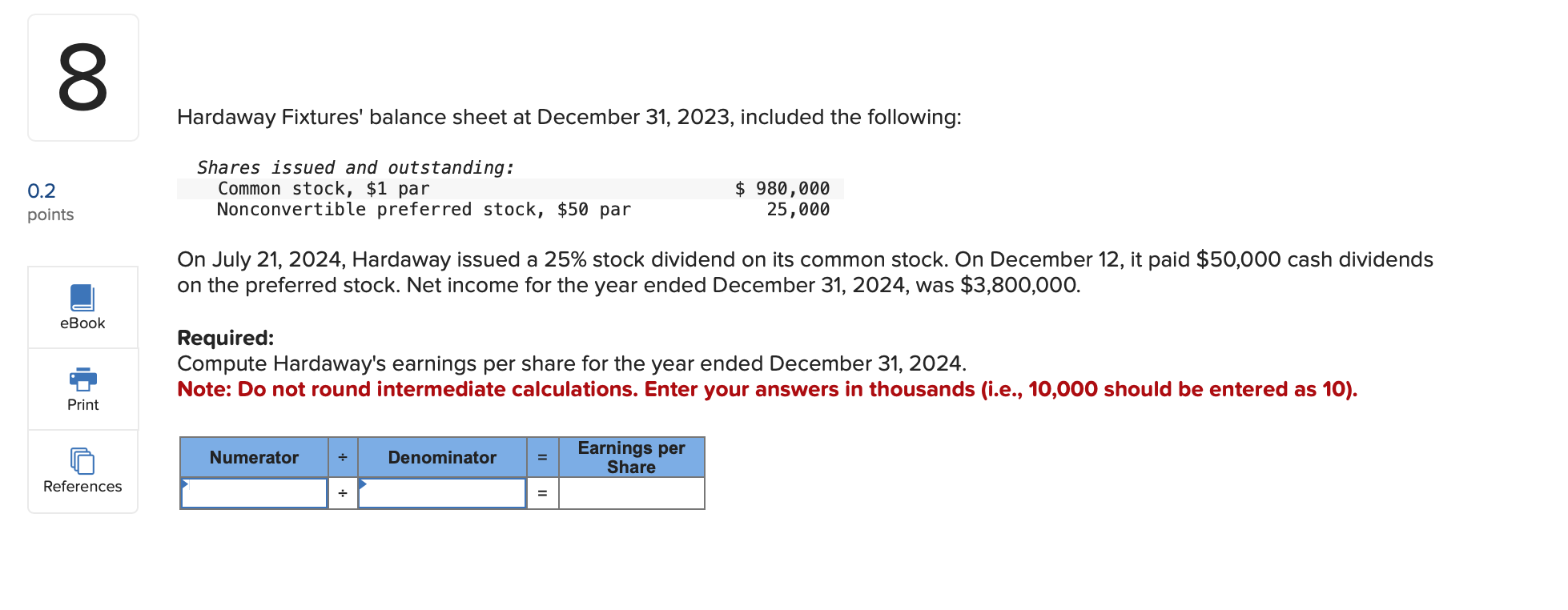

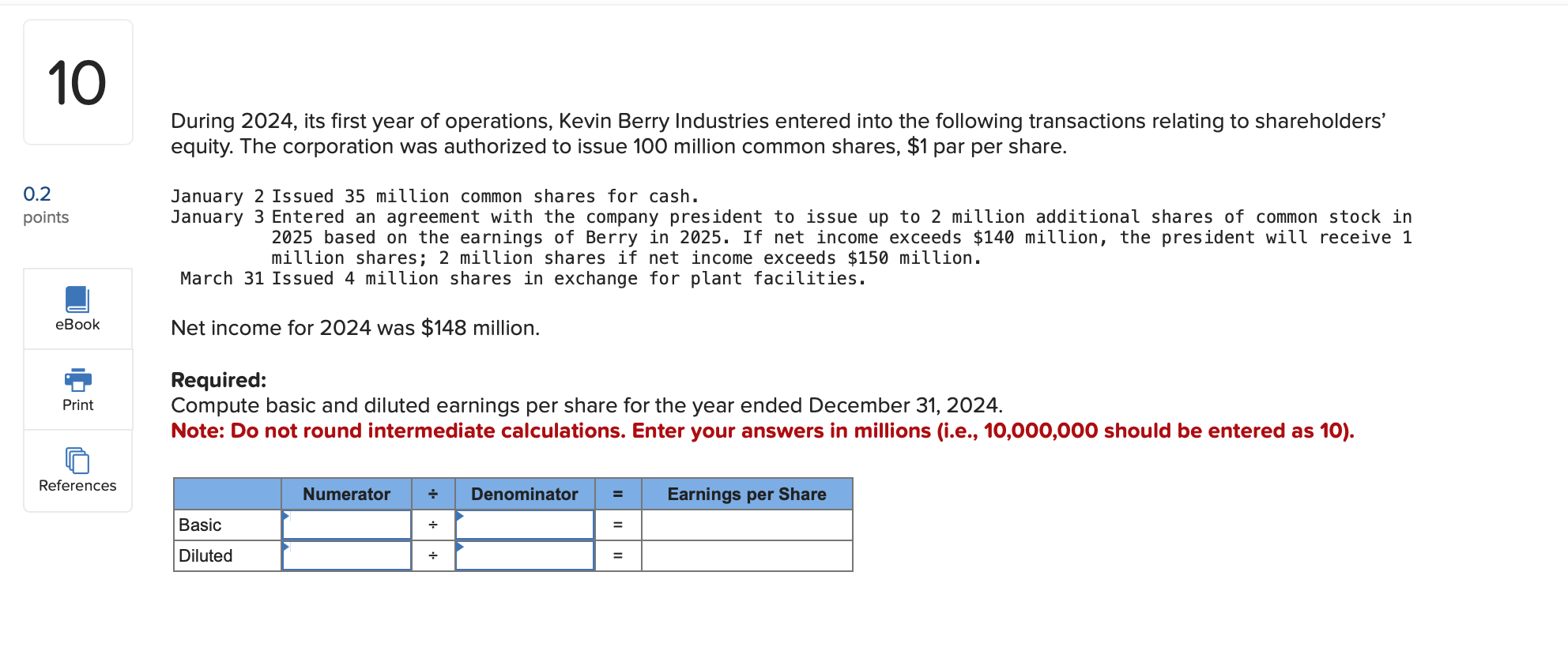

On December 31, 2023, Berclair Incorporated had 200 million shares of common stock and 3 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2024, Berclair purchased 24 million shares of its common stock as treasury stock. Berclair issued a 5% common stock dividend on July 1, 2024. Four million treasury shares were sold on October 1. Net income for the year ended December 31, 2024, was $150 million. Also outstanding at December 31 were 30 million incentive stock options granted to key executives on September 13, 2019. The options were exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share. During 2024, the market price of the common shares averaged $70 per share. The options were exercised on September 1, 2024. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities have been adjusted for any stock split or stock dividend.) Note: Do not round intermediate calculations. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Basic Diluted Numerator + Denominator = Earnings per Share + 2 0.2 points eBook Allied Paper Products, Incorporated offers a restricted stock award plan to its vice presidents. On January 1, 2024, the company granted 10 million of its $1 par common shares, subject to forfeiture if employment is terminated within two years. The common shares have a market price of $5 per share on the grant date. Required: 1. Determine the total compensation cost pertaining to the restricted shares. 2. Prepare the appropriate journal entries related to the restricted stock through December 31, 2025. Complete this question by entering your answers in the tabs below. Hint Required 1 Required 2 Print References Determine the total compensation cost pertaining to the restricted shares. Note: Enter your answer in millions (i.e., 10,000,000 should be entered as 10). Total compensation cost million Required 1 Required 2 > 2 Required 1 Required 2 0.2 points eBook Hint Print Prepare the appropriate journal entries related to the restricted stock through December 31, 2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). View transaction list Journal entry worksheet 1 2 3 Record the compensation expense. References Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2024 View general journal Record entry Clear entry > 0.2 2 Required 1 Required 2 points eBook Prepare the appropriate journal entries related to the restricted stock through December 31, 2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). View transaction list Journal entry worksheet Hint < 1 2 3 Print Record the compensation expense. References Note: Enter debits before credits. Date December 31, 2025 General Journal Debit Credit Record entry Clear entry View general journal > 2 Required 1 Required 2 0.2 points eBook Prepare the appropriate journal entries related to the restricted stock through December 31, 2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). View transaction list Journal entry worksheet Hint < 1 2 3 Print Record issuance of stock award. References Note: Enter debits before credits. Date December 31, 2025 General Journal Debit Credit View general journal Record entry Clear entry 3 0.2 points eBook O 201 Hint Allied Paper Products, Incorporated offers a restricted stock award plan to its vice presidents. On January 1, 2024, the company granted 16 million of its $1 par common shares, subject to forfeiture if employment is terminated within two years. The common shares have a market price of $5 per share on the grant date. Required: 1. Determine the total compensation cost pertaining to the restricted shares. 2. Prepare the appropriate journal entries related to the restricted stock through December 31, 2025. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Print References Determine the total compensation cost pertaining to the restricted shares. Note: Enter your answer in millions (i.e., 10,000,000 should be entered as 10). Total compensation cost million < Required 1 Required 2 > 3 Required 1 Required 2 0.2 points eBook Hint Print Prepare the appropriate journal entries related to the restricted stock through December 31, 2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). View transaction list Journal entry worksheet 1 2 3 Record the compensation expense. References Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2024 Record entry Clear entry View general journal > 0.2 3 Required 1 Required 2 points eBook Hint Print Prepare the appropriate journal entries related to the restricted stock through December 31, 2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). View transaction list Journal entry worksheet 1 2 3 Record the compensation expense. References Note: Enter debits before credits. Date December 31, 2025 General Journal Debit Credit Record entry Clear entry View general journal 3 Required 1 Required 2 0.2 points eBook Prepare the appropriate journal entries related to the restricted stock through December 31, 2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). View transaction list Journal entry worksheet 201 Hint < 1 2 3 Print Record issuance of stock award. References Note: Enter debits before credits. Date December 31, 2025 General Journal Debit Credit Record entry Clear entry View general journal 5 0.2 points eBook Print For the year ended December 31, 2024, Norstar Industries reported net income of $655,000. At January 1, 2024, the company had 900,000 common shares outstanding. The following changes in the number of shares occurred during 2024: April 30 Sold 60,000 shares in a public offering May 24 Declared and distributed a 5% stock dividend June 1 Issued 72,000 shares as part of the consideration for the purchase of assets from a subsidiary Required: Compute Norstar's earnings per share for the year ended December 31, 2024. Note: Do not round intermediate calculations. Except for per share amounts, enter your answers in thousands (i.e., 10,000 should be entered as 10). Round "Earnings per share" answer to 2 decimal places. References Numerator Denominator = Earnings per Share 0.2 6 On December 31, 2023, Berclair Incorporated had 500 million shares of common stock and 6 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2024, Berclair purchased 144 million shares of its common stock as treasury stock. points Berclair issued a 5% common stock dividend on July 1, 2024. Four million treasury shares were sold on October 1. eBook Print References Net income for the year ended December 31, 2024, was $900 million. Also outstanding at December 31 were 30 million incentive stock options granted to key executives on September 13, 2019. The options were exercisable as of September 13, 2023, for 30 million common shares at an exercise price of $56 per share. . During 2024, the market price of the common shares averaged $70 per share. Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31, 2024. (Shares for stock options and conversion of convertible securities have been adjusted for any stock split or stock dividend.) Note: Do not round intermediate calculations. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). Basic Diluted Numerator Denominator = Earnings per Share = = 0.2 8 Hardaway Fixtures' balance sheet at December 31, 2023, included the following: Shares issued and outstanding: Common stock, $1 par Nonconvertible preferred stock, $50 par $ 980,000 25,000 points eBook On July 21, 2024, Hardaway issued a 25% stock dividend on its common stock. On December 12, it paid $50,000 cash dividends on the preferred stock. Net income for the year ended December 31, 2024, was $3,800,000. Required: Compute Hardaway's earnings per share for the year ended December 31, 2024. Note: Do not round intermediate calculations. Enter your answers in thousands (i.e., 10,000 should be entered as 10). Print Numerator Denominator = Earnings per Share References = 10 0.2 points eBook Print During 2024, its first year of operations, Kevin Berry Industries entered into the following transactions relating to shareholders' equity. The corporation was authorized to issue 100 million common shares, $1 par per share. January 2 Issued 35 million common shares for cash. January 3 Entered an agreement with the company president to issue up to 2 million additional shares of common stock in 2025 based on the earnings of Berry in 2025. If net income exceeds $140 million, the president will receive 1 million shares; 2 million shares if net income exceeds $150 million. March 31 Issued 4 million shares in exchange for plant facilities. Net income for 2024 was $148 million. Required: Compute basic and diluted earnings per share for the year ended December 31, 2024. Note: Do not round intermediate calculations. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). 2 References Numerator Basic Diluted Denominator = Earnings per Share = =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started