Answered step by step

Verified Expert Solution

Question

1 Approved Answer

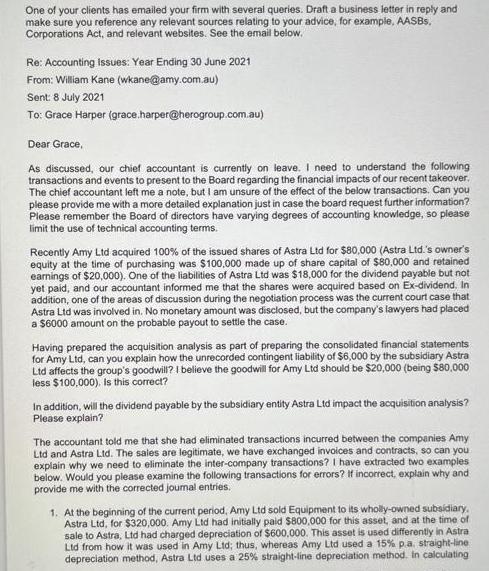

One of your clients has emailed your firm with several queries. Draft a business letter in reply and make sure you reference any relevant

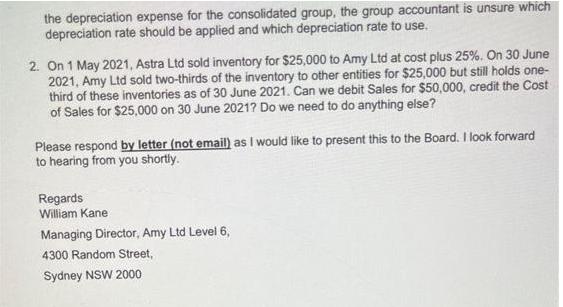

One of your clients has emailed your firm with several queries. Draft a business letter in reply and make sure you reference any relevant sources relating to your advice, for example, AASBs. Corporations Act, and relevant websites. See the email below. Re: Accounting Issues: Year Ending 30 June 2021 From: William Kane (wkane@amy.com.au) Sent: 8 July 2021 To: Grace Harper (grace.harper@herogroup.com.au) Dear Grace, As discussed, our chief accountant is currently on leave. I need to understand the following. transactions and events to present to the Board regarding the financial impacts of our recent takeover. The chief accountant left me a note, but I am unsure of the effect of the below transactions. Can you please provide me with a more detailed explanation just in case the board request further information? Please remember the Board of directors have varying degrees of accounting knowledge, so please limit the use of technical accounting terms. Recently Amy Ltd acquired 100% of the issued shares of Astra Ltd for $80,000 (Astra Ltd.'s owner's equity at the time of purchasing was $100,000 made up of share capital of $80,000 and retained earnings of $20,000). One of the liabilities of Astra Ltd was $18,000 for the dividend payable but not yet paid, and our accountant informed me that the shares were acquired based on Ex-dividend. In addition, one of the areas of discussion during the negotiation process was the current court case that Astra Ltd was involved in. No monetary amount was disclosed, but the company's lawyers had placed a $6000 amount on the probable payout to settle the case. Having prepared the acquisition analysis as part of preparing the consolidated financial statements for Amy Ltd, can you explain how the unrecorded contingent liability of $6,000 by the subsidiary Astra Ltd affects the group's goodwill? I believe the goodwill for Amy Ltd should be $20,000 (being $80,000 less $100,000). Is this correct? In addition, will the dividend payable by the subsidiary entity Astra Ltd impact the acquisition analysis? Please explain? The accountant told me that she had eliminated transactions incurred between the companies Amy Ltd and Astra Ltd. The sales are legitimate, we have exchanged invoices and contracts, so can you explain why we need to eliminate the inter-company transactions? I have extracted two examples below. Would you please examine the following transactions for errors? If incorrect, explain why and provide me with the corrected journal entries. 1. At the beginning of the current period, Amy Ltd sold Equipment to its wholly-owned subsidiary. Astra Ltd, for $320,000. Amy Ltd had initially paid $800,000 for this asset, and at the time of sale to Astra, Ltd had charged depreciation of $600,000. This asset is used differently in Astra Ltd from how it was used in Amy Ltd; thus, whereas Amy Ltd used a 15% p.a. straight-line depreciation method, Astra Ltd uses a 25% straight-line depreciation method. In calculating the depreciation expense for the consolidated group, the group accountant is unsure which depreciation rate should be applied and which depreciation rate to use. 2. On 1 May 2021, Astra Ltd sold inventory for $25,000 to Amy Ltd at cost plus 25%. On 30 June 2021, Amy Ltd sold two-thirds of the inventory to other entities for $25,000 but still holds one- third of these inventories as of 30 June 2021. Can we debit Sales for $50,000, credit the Cost of Sales for $25,000 on 30 June 2021? Do we need to do anything else? Please respond by letter (not email) as I would like to present this to the Board. I look forward to hearing from you shortly. Regards William Kane Managing Director, Amy Ltd Level 6, 4300 Random Street, Sydney NSW 2000

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Dear William Thank you for your email I have prepared a more detailed explanation of the accounting ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started