Question: Only 20 min to answer will rate!!!! Modigliani and Miller followed up their initial work assuming no taxes with a new model that incorporated a

Only 20 min to answer will rate!!!!

Only 20 min to answer will rate!!!!

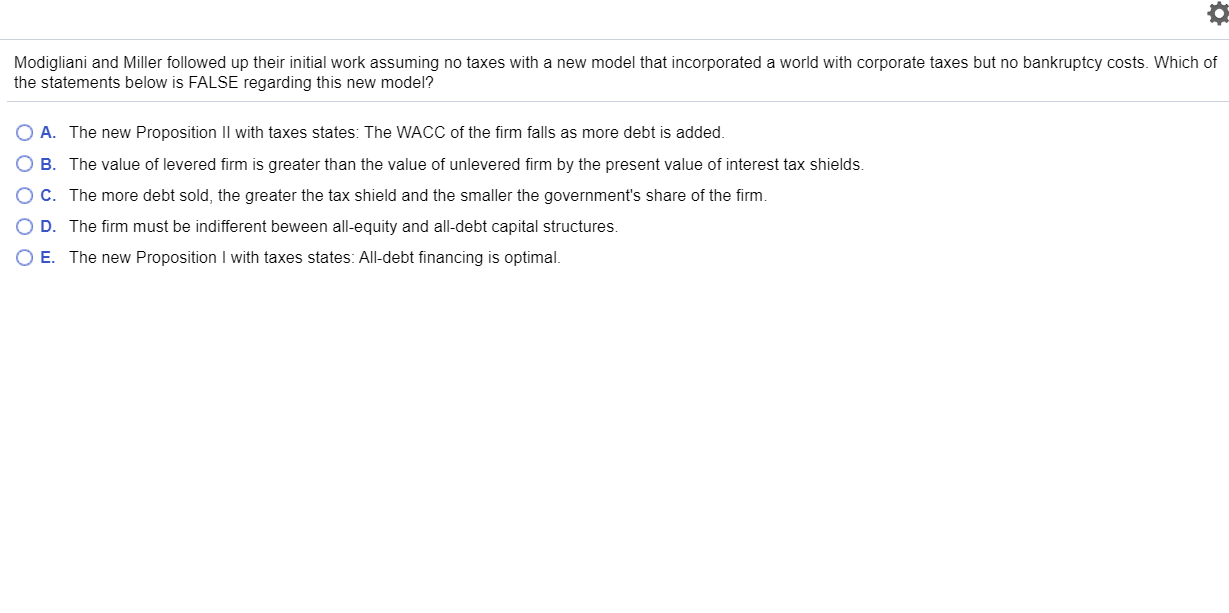

Modigliani and Miller followed up their initial work assuming no taxes with a new model that incorporated a world with corporate taxes but no bankruptcy costs. Which of the statements below is FALSE regarding this new model? O A. The new Proposition Il with taxes states: The WACC of the firm falls as more debt is added. O B. The value of levered firm is greater than the value of unlevered firm by the present value of interest tax shields. O C. The more debt sold, the greater the tax shield and the smaller the government's share of the firm. OD. The firm must be indifferent beween all-equity and all-debt capital structures. O E. The new Proposition I with taxes states: All-debt financing is optimal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts