Question

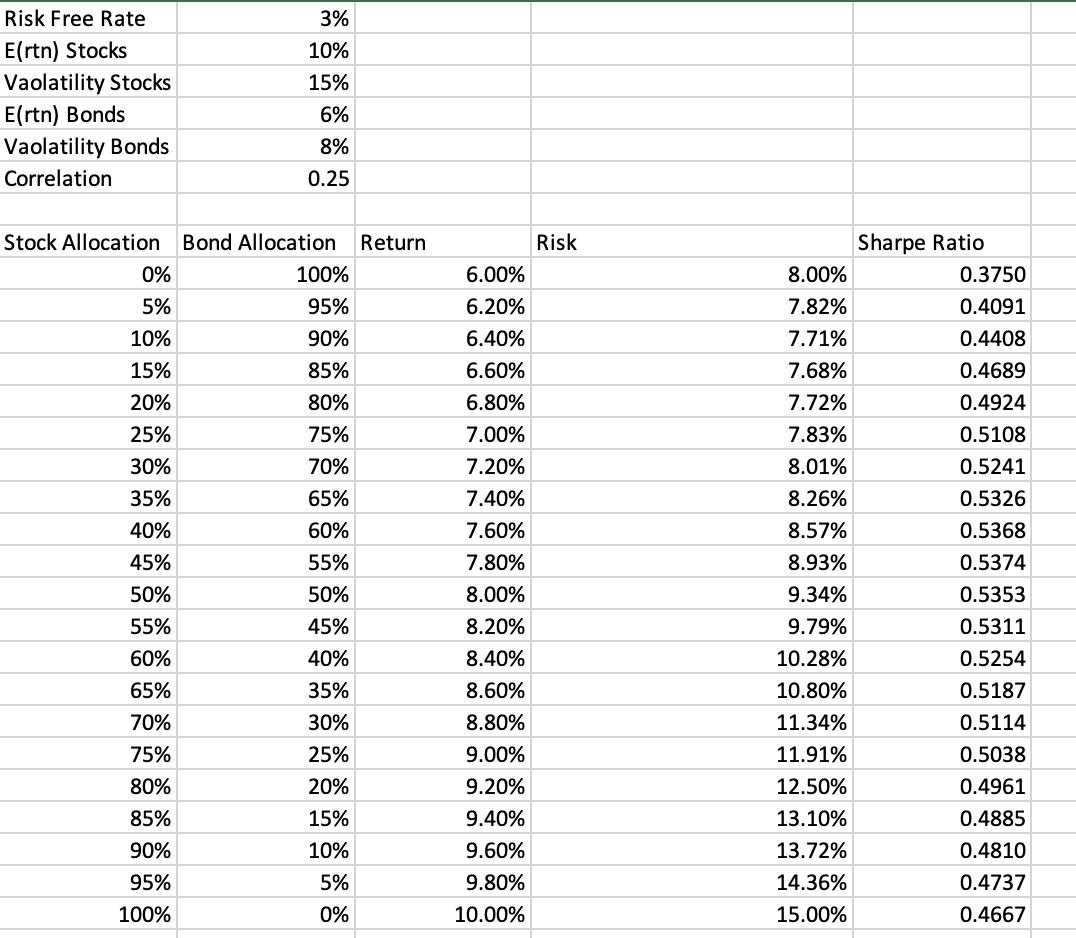

Optimal risky portfolio (i.e. the optimal combination of stocks and bonds)? What is the return, risk and Sharpe Ratio of the optimal risky portfolio? Risk

Optimal risky portfolio (i.e. the optimal combination of stocks and bonds)?

What is the return, risk and Sharpe Ratio of the optimal risky portfolio?

Risk Free Rate E(rtn) Stocks Vaolatility Stocks E(rtn) Bonds Vaolatility Bonds Correlation Stock Allocation Bond 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% 80% 85% 90% 95% 100% 3% 10% 15% 6% 8% 0.25 Allocation Return 100% 95% 90% 6.00% 8.00% 6.20% 7.82% 6.40% 7.71% 6.60% 7.68% 6.80% 7.72% 75% 7.00% 7.83% 70% 7.20% 8.01% 65% 7.40% 8.26% 0.5326 60% 7.60% 8.57% 0.5368 55% 7.80% 8.93% 0.5374 |||| 50% 8.00% 9.34% 0.5353 45% 8.20% 9.79% 0.5311 40% 8.40% 10.28% 0.5254 35% 8.60% 10.80% 0.5187 30% 8.80% 11.34% 25% 9.00% 11.91% 9.20% 12.50% 9.40% 13.10% 9.60% 13.72% 9.80% 14.36% 10.00% 15.00% 85% 80% 20% 15% 10% 5% Risk 0% Sharpe Ratio 0.3750 0.4091 0.4408 0.4689 0.4924 0.5108 0.5241 0.5114 0.5038 0.4961 0.4885 0.4810 0.4737 0.4667

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The table you provided contains various combinations of stock and bond allocations for the optimal r...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started