Answered step by step

Verified Expert Solution

Question

1 Approved Answer

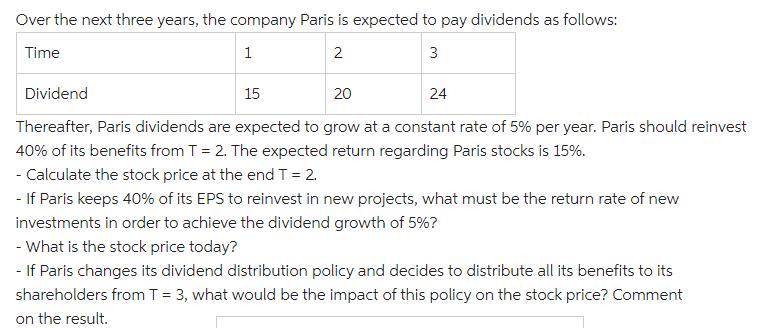

Over the next three years, the company Paris is expected to pay dividends as follows: Time 1 2 3 Dividend 15 20 24 Thereafter,

Over the next three years, the company Paris is expected to pay dividends as follows: Time 1 2 3 Dividend 15 20 24 Thereafter, Paris dividends are expected to grow at a constant rate of 5% per year. Paris should reinvest 40% of its benefits from T = 2. The expected return regarding Paris stocks is 15%. - Calculate the stock price at the end T = 2. - If Paris keeps 40% of its EPS to reinvest in new projects, what must be the return rate of new investments in order to achieve the dividend growth of 5%? - What is the stock price today? - If Paris changes its dividend distribution policy and decides to distribute all its benefits to its shareholders from T = 3, what would be the impact of this policy on the stock price? Comment on the result.

Step by Step Solution

★★★★★

3.43 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Calcul ate the stock price at the end T 2 WORK ING P D 1 D 2 D 3 15 20 24 59 P 1 g ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started