Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Philip Chan owns a residential property in Kowloon Bay which has been let to Lily on the following terms: 1. Lease term: Two years

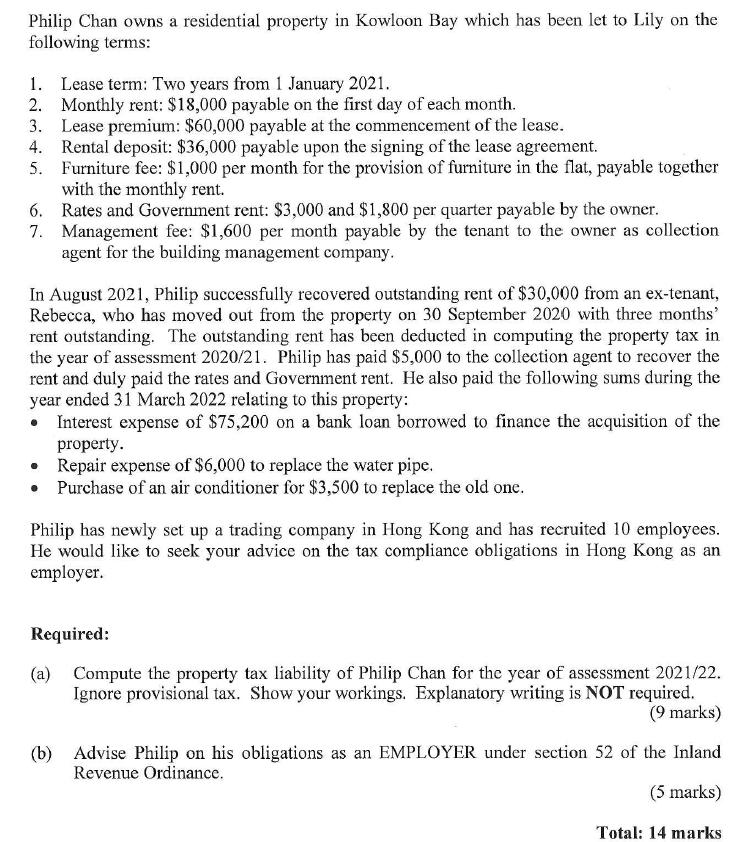

Philip Chan owns a residential property in Kowloon Bay which has been let to Lily on the following terms: 1. Lease term: Two years from 1 January 2021. 2. Monthly rent: $18,000 payable on the first day of each month. 3. Lease premium: $60,000 payable at the commencement of the lease. 4. Rental deposit: $36,000 payable upon the signing of the lease agreement. 5. Furniture fee: $1,000 per month for the provision of furniture in the flat, payable together with the monthly rent. 6. Rates and Government rent: $3,000 and $1,800 per quarter payable by the owner. 7. Management fee: $1,600 per month payable by the tenant to the owner as collection agent for the building management company. In August 2021, Philip successfully recovered outstanding rent of $30,000 from an ex-tenant, Rebecca, who has moved out from the property on 30 September 2020 with three months' rent outstanding. The outstanding rent has been deducted in computing the property tax in the year of assessment 2020/21. Philip has paid $5,000 to the collection agent to recover the rent and duly paid the rates and Government rent. He also paid the following sums during the year ended 31 March 2022 relating to this property: Interest expense of $75,200 on a bank loan borrowed to finance the acquisition of the property. Repair expense of $6,000 to replace the water pipe. Purchase of an air conditioner for $3,500 to replace the old one. Philip has newly set up a trading company in Hong Kong and has recruited 10 employees. He would like to seek your advice on the tax compliance obligations in Hong Kong as an employer. Required: (a) Compute the property tax liability of Philip Chan for the year of assessment 2021/22. Ignore provisional tax. Show your workings. Explanatory writing is NOT required. (9 marks) (b) Advise Philip on his obligations as an EMPLOYER under section 52 of the Inland Revenue Ordinance. (5 marks) Total: 14 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Computation of Property Tax Liability for the Year of Assessment 202122 Rental Income Monthly rent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started