Question

You have a total of 10,000 to invest in three different funds - Rolls-Royce, C&J and stock exchange . The expected return and risk level

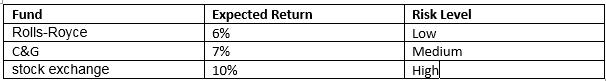

You have a total of £10,000 to invest in three different funds - Rolls-Royce, C&J and stock exchange. The expected return and risk level for each of the fund is given in the below table:

To minimize your risk across the three funds you decide to invest at least twice as much in Rolls-Royce as you invest in C&G. You also decide that as the stock exchange is considered a high-risk fund, to limit the amount you invest in this fund to £2000.

To minimize your risk across the three funds you decide to invest at least twice as much in Rolls-Royce as you invest in C&G. You also decide that as the stock exchange is considered a high-risk fund, to limit the amount you invest in this fund to £2000.

Taking account of your decisions to minimize the risk, produce a model, and determine the optimal amount to invest in each of the three funds so as to maximize the expected return?

What does your solution tell you about the problem?

Fund Expected Return Risk Level Rolls-Royce 6% Low C&G 7% Medium stock exchange 10% High

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Data Analysis And Decision Making

Authors: Christian Albright, Wayne Winston, Christopher Zappe

4th Edition

538476125, 978-0538476126

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App