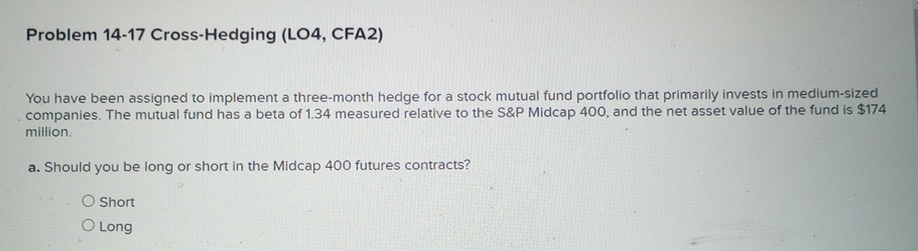

Question: Problem 1 4 - 1 7 Cross - Hedging ( LO 4 , CFA 2 ) You have been assigned to implement a three -

Problem CrossHedging LO CFA

You have been assigned to implement a threemonth hedge for a stock mutual fund portfolio that primarily invests in mediumsized

companies. The mutual fund has a beta of measured relative to the S&P Midcap and the net asset value of the fund is $

million.

a Should you be long or short in the Midcap futures contracts?

Short

Long

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock