Question: Problem 1 Two parties enter an interest rate swap paid in arrears on the following terms: a seven year tenor, annual payments, $100 million notional

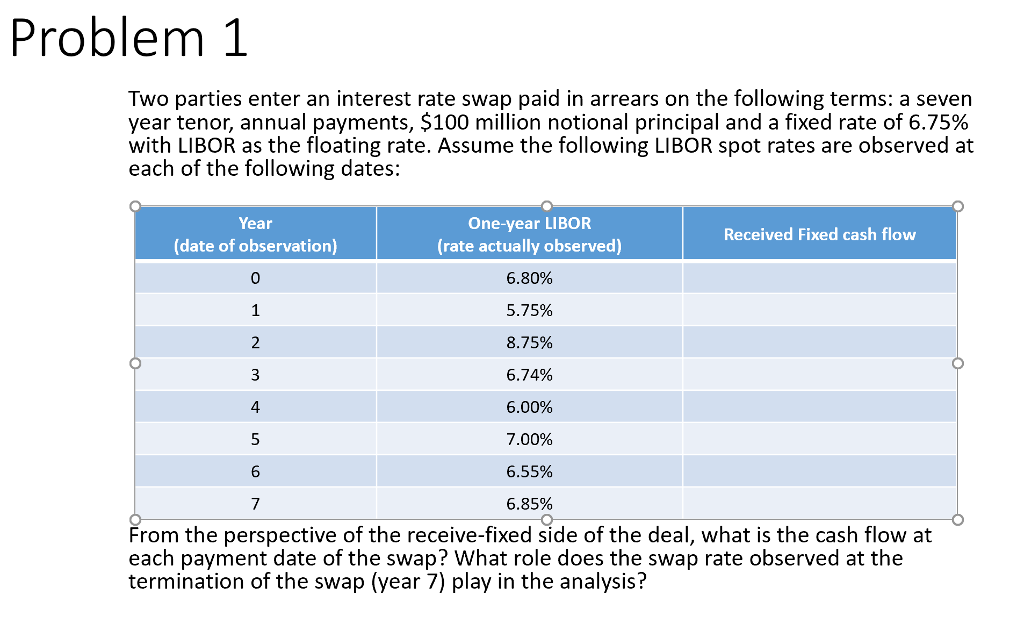

Problem 1 Two parties enter an interest rate swap paid in arrears on the following terms: a seven year tenor, annual payments, $100 million notional principal and a fixed rate of 6.75% with LIBOR as the floating rate. Assume the following LIBOR spot rates are observed at each of the following dates: One-year LIBOR (rate actually observed) 6.80% 5.75% 8.75% 6.74%. 6.00% 7.00% 6.55% 6.85% From the perspective of the receive-fixed side of the deal, what is the cash flow at Year (date of observation) 0 Received Fixed cash flow 2 4 5 6 7 each payment date of the swap? What role does the swap rate observed at the termination of the swap (year 7) play in the analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts