Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem # 3: Interdivisional Dynamics at Global Manufacturing Corp. Background: Global Manufacturing Corp. is a diversified entity with multiple business divisions. Its Electronics Division

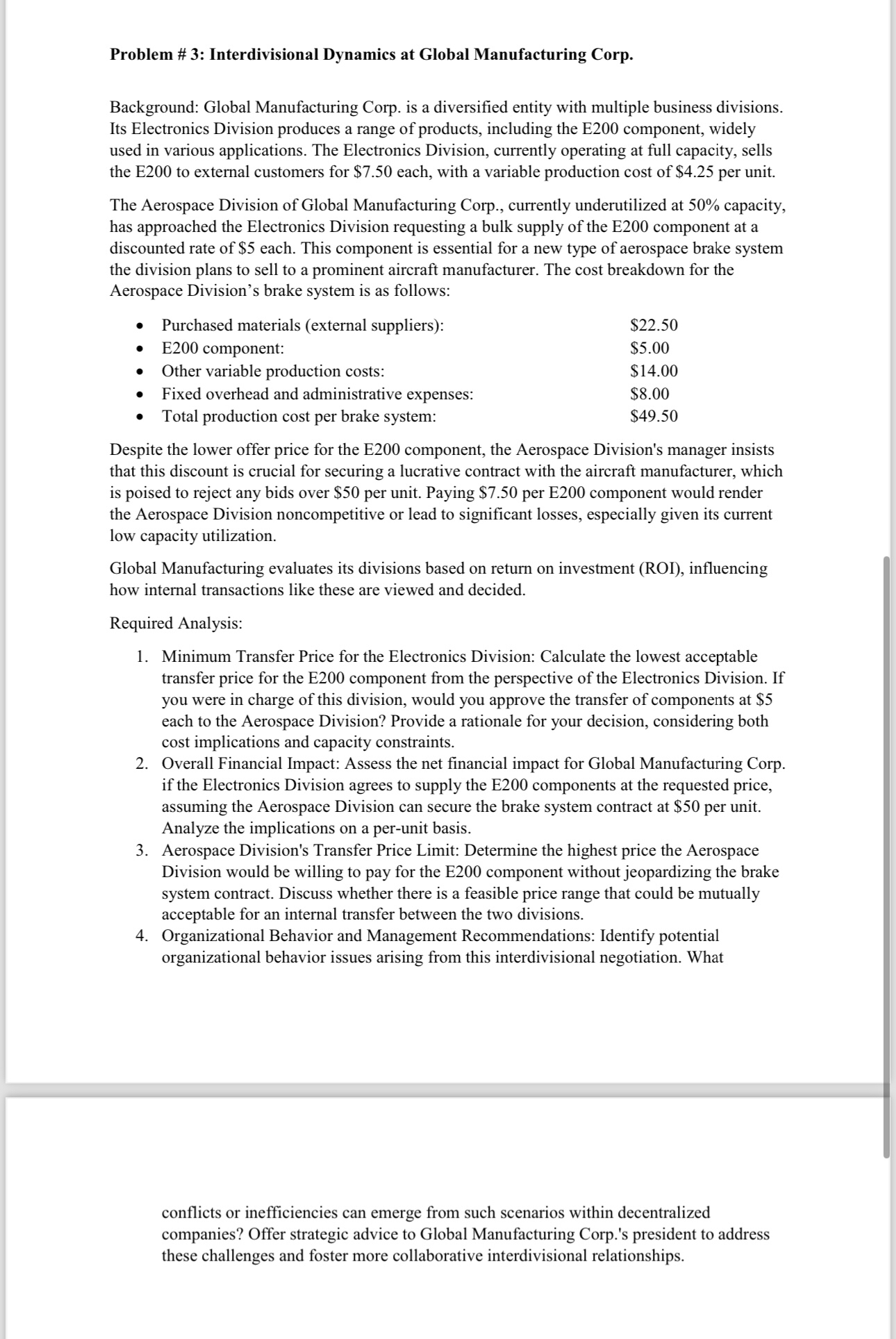

Problem # 3: Interdivisional Dynamics at Global Manufacturing Corp. Background: Global Manufacturing Corp. is a diversified entity with multiple business divisions. Its Electronics Division produces a range of products, including the E200 component, widely used in various applications. The Electronics Division, currently operating at full capacity, sells the E200 to external customers for $7.50 each, with a variable production cost of $4.25 per unit. The Aerospace Division of Global Manufacturing Corp., currently underutilized at 50% capacity, has approached the Electronics Division requesting a bulk supply of the E200 component at a discounted rate of $5 each. This component is essential for a new type of aerospace brake system the division plans to sell to a prominent aircraft manufacturer. The cost breakdown for the Aerospace Division's brake system is as follows: E200 component: Purchased materials (external suppliers): Other variable production costs: Fixed overhead and administrative expenses: Total production cost per brake system: $22.50 $5.00 $14.00 $8.00 $49.50 Despite the lower offer price for the E200 component, the Aerospace Division's manager insists that this discount is crucial for securing a lucrative contract with the aircraft manufacturer, which is poised to reject any bids over $50 per unit. Paying $7.50 per E200 component would render the Aerospace Division noncompetitive or lead to significant losses, especially given its current low capacity utilization. Global Manufacturing evaluates its divisions based on return on investment (ROI), influencing how internal transactions like these are viewed and decided. Required Analysis: 1. Minimum Transfer Price for the Electronics Division: Calculate the lowest acceptable transfer price for the E200 component from the perspective of the Electronics Division. If you were in charge of this division, would you approve the transfer of components at $5 each to the Aerospace Division? Provide a rationale for your decision, considering both cost implications and capacity constraints. 2. Overall Financial Impact: Assess the net financial impact for Global Manufacturing Corp. if the Electronics Division agrees to supply the E200 components at the requested price, assuming the Aerospace Division can secure the brake system contract at $50 per unit. Analyze the implications on a per-unit basis. 3. Aerospace Division's Transfer Price Limit: Determine the highest price the Aerospace Division would be willing to pay for the E200 component without jeopardizing the brake system contract. Discuss whether there is a feasible price range that could be mutually acceptable for an internal transfer between the two divisions. 4. Organizational Behavior and Management Recommendations: Identify potential organizational behavior issues arising from this interdivisional negotiation. What conflicts or inefficiencies can emerge from such scenarios within decentralized companies? Offer strategic advice to Global Manufacturing Corp.'s president to address these challenges and foster more collaborative interdivisional relationships.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started