Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 4 (10 points. Approximately 20 minutes) Presented below are partial Income Statements for Rider Corporation for two prior years. Rider Corporation Income Statements

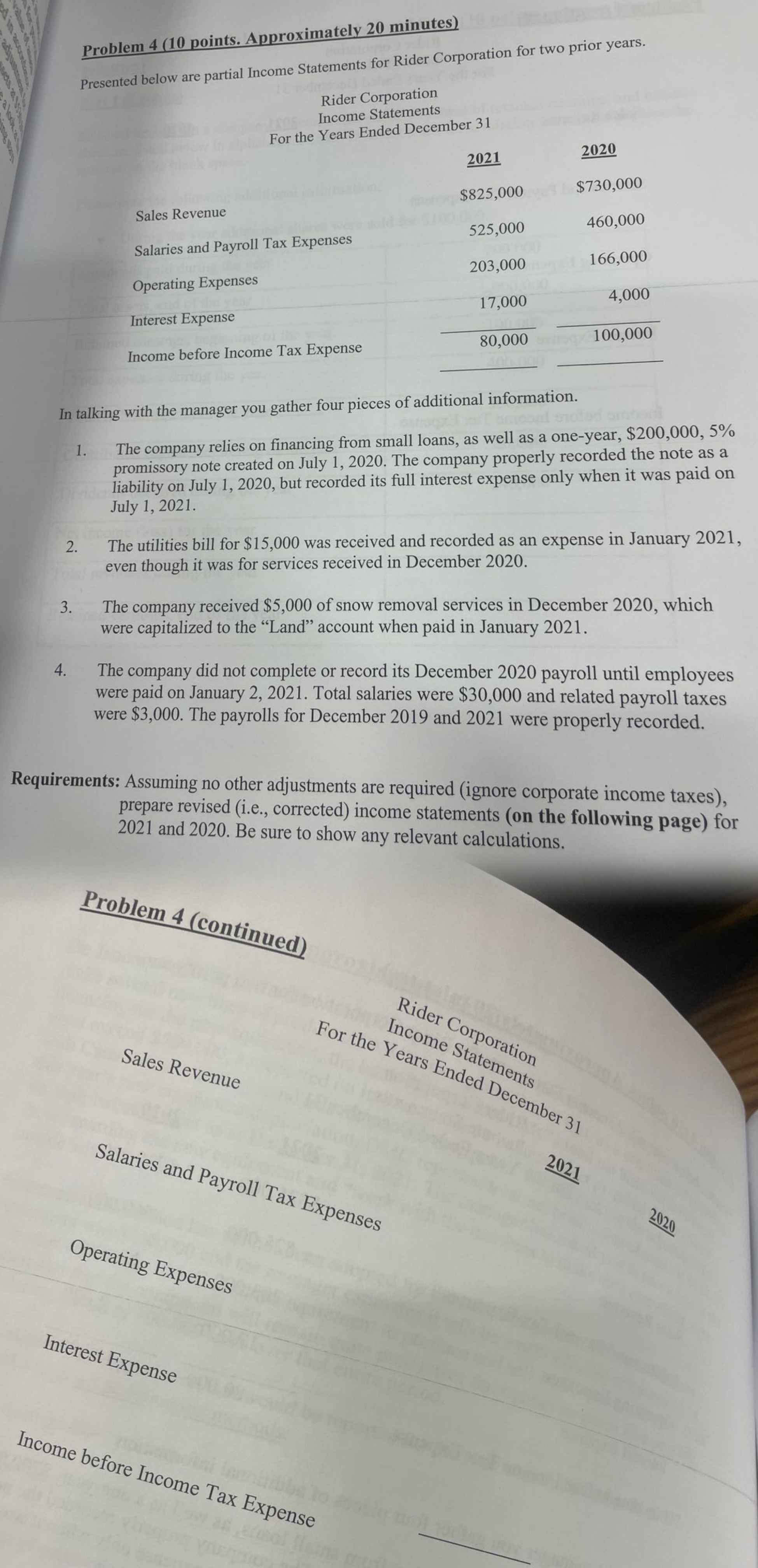

Problem 4 (10 points. Approximately 20 minutes) Presented below are partial Income Statements for Rider Corporation for two prior years. Rider Corporation Income Statements For the Years Ended December 31 2021 2020 Sales Revenue mer$825,000 $730,000 Salaries and Payroll Tax Expenses 525,000 460,000 Operating Expenses 203,000 166,000 Interest Expense 17,000 4,000 Income before Income Tax Expense 80,000 100,000 In talking with the manager you gather four pieces of additional information. 1. The company relies on financing from small loans, as well as a one-year, $200,000, 5% promissory note created on July 1, 2020. The company properly recorded the note as a liability on July 1, 2020, but recorded its full interest expense only when it was paid on July 1, 2021. 2. The utilities bill for $15,000 was received and recorded as an expense in January 2021, even though it was for services received in December 2020. 3. 4. The company received $5,000 of snow removal services in December 2020, which were capitalized to the "Land" account when paid in January 2021. The company did not complete or record its December 2020 payroll until employees were paid on January 2, 2021. Total salaries were $30,000 and related payroll taxes were $3,000. The payrolls for December 2019 and 2021 were properly recorded. Requirements: Assuming no other adjustments are required (ignore corporate income taxes), prepare revised (i.e., corrected) income statements (on the following page) for 2021 and 2020. Be sure to show any relevant calculations. Problem 4 (continued) Sales Revenue Rider Corporation Income Statements For the Years Ended December 31 Salaries and Payroll Tax Expenses Operating Expenses Interest Expense Income before Income Tax Expense 2021 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started