Answered step by step

Verified Expert Solution

Question

1 Approved Answer

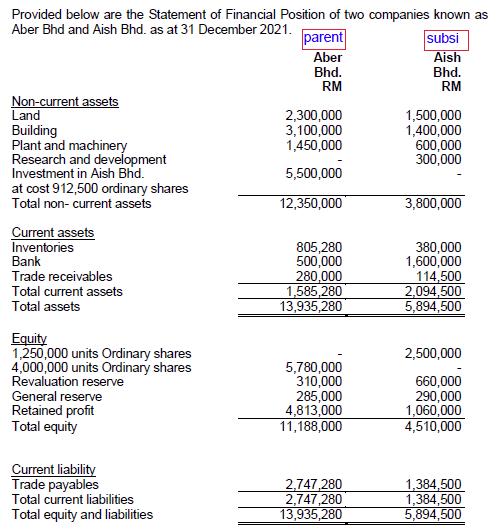

Provided below are the Statement of Financial Position of two companies known as Aber Bhd and Aish Bhd. as at 31 December 2021. Non-current

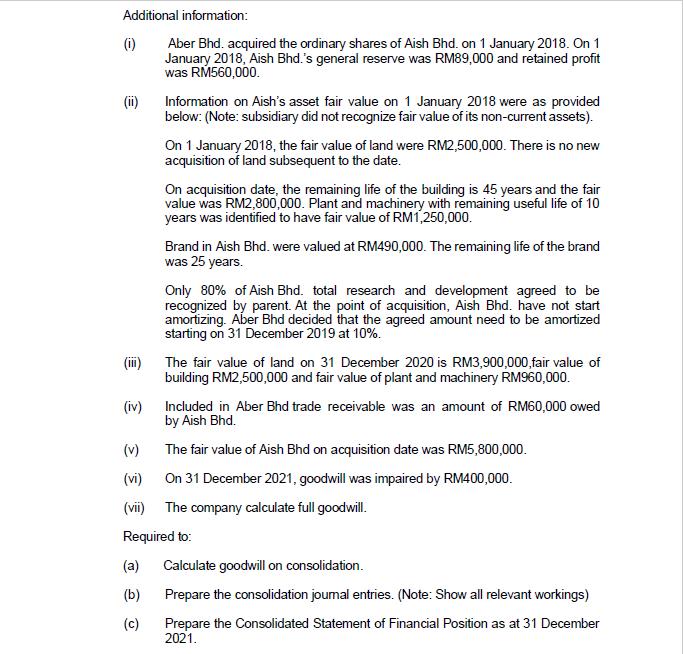

Provided below are the Statement of Financial Position of two companies known as Aber Bhd and Aish Bhd. as at 31 December 2021. Non-current assets Land Building Plant and machinery Research and development Investment in Aish Bhd. at cost 912,500 ordinary shares Total non-current assets Current assets Inventories Bank Trade receivables Total current assets Total assets Equity 1,250,000 units Ordinary shares 4,000,000 units Ordinary shares Revaluation reserve General reserve Retained profit Total equity Current liability Trade payables Total current liabilities Total equity and liabilities parent Aber Bhd. RM 2,300,000 3,100,000 1,450,000 5,500,000 12,350,000 805,280 500,000 280,000 1,585,280 13,935,280 5,780,000 310,000 285,000 4,813,000 11,188,000 2,747,280 2,747,280 13,935,280 subsi Aish Bhd. RM 1,500,000 1,400,000 600,000 300,000 3,800,000 380,000 1,600,000 114,500 2,094,500 5,894,500 2,500,000 660,000 290,000 1,060,000 4,510,000 1,384,500 1,384,500 5,894,500 Additional information: (1) Aber Bhd. acquired the ordinary shares of Aish Bhd. on 1 January 2018. On 1 January 2018, Aish Bhd.'s general reserve was RM89,000 and retained profit was RM560,000. (ii) (iii) (iv) Information on Aish's asset fair value on 1 January 2018 were as provided below: (Note: subsidiary did not recognize fair value of its non-current assets). On 1 January 2018, the fair value of land were RM2,500,000. There is no new acquisition of land subsequent to the date. On acquisition date, the remaining life of the building is 45 years and the fair value was RM2,800,000. Plant and machinery with remaining useful life of 10 years was identified to have fair value of RM1,250,000. Brand in Aish Bhd. were valued at RM490,000. The remaining life of the brand was 25 years. Only 80% of Aish Bhd. total research and development agreed to be recognized by parent. At the point of acquisition, Aish Bhd. have not start amortizing. Aber Bhd decided that the agreed amount need to be amortized starting on 31 December 2019 at 10%. The fair value of land on 31 December 2020 is RM3,900,000,fair value of building RM2,500,000 and fair value of plant and machinery RM960,000. Included in Aber Bhd trade receivable was an amount of RM60,000 owed by Aish Bhd. The fair value of Aish Bhd on acquisition date was RM5,800,000. On 31 December 2021, goodwill was impaired by RM400,000. (v) (vi) (vii) The company calculate full goodwill. Required to: (a) Calculate goodwill on consolidation. (b) Prepare the consolidation joumal entries. (Note: Show all relevant workings) (c) Prepare the Consolidated Statement of Financial Position as at 31 December 2021.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started